After last week's epic central bank/payrolls/QRA/earnings juggernaut, there's not a lot of US data this week, as is usually the case immediately post payrolls, but as DB's Jim Reid notes, the highlight could be the annual BLS revisions to the seasonal factors for CPI on Friday. Both Waller (pre FOMC blackout) and Powell (at the FOMC) noted that these are an important landmark to get past before potential rate cuts can be better calibrated. Last year, these revisions lowered H1 inflation and increased H2 which changed the momentum profile of inflation.

Before we get there, today we get the services ISM (53.4. consensus 52.0, with the prices paid component soaring to 64.0) which negatively surprised a month ago (at 50.6 and below all estimates), with the employment series the lowest since July 2020 (down from 50.7 to 43.3). That clearly was completely at odds with payrolls on Friday, so today's much stronger prints are a return to normalcy. Also anomalous has been the recent creep higher in initial jobless claims of late with continuous claims only having been higher for one week since November 2021. So another number to watch.

Today's Fed Senior Loan Officer's survey (SLOOS) should also be very important, but very tight bank lending in recent quarters hasn't so far translated into reduced activity as it has done in the past. Reid admits that he doesn't know why this is the case. It's possible that excess savings or cash are still high enough in the economy that business and consumers don't need much access to what would be very tight bank lending. This wouldn't be able to carry on forever so the survey results today are still important to see if banks are becoming less restrictive after some improvements last quarter. You can find the other US data in the diary at the end.

Outside the US, China inflation numbers on Thursday are worth watching. Current estimates on Bloomberg suggest the CPI is expected to fall further into negative territory from -0.3% YoY in December to -0.5% YoY in January. The PPI is seen marginally edging higher but staying in negative territory (-2.6% vs -2.7% YoY in December). The Chinese CSI index closed at 5-yr lows on Friday so marching to a very different beat to the US at the moment.

In Europe, the focus will be on economic activity in Germany with indicators due including industrial production (Wednesday), factory orders (tomorrow) and the trade balance (today). There will also be industrial production (Friday) and retail sales for Italy (Wednesday) and trade balance data for France (Wednesday). From the ECB, investors will keep an eye on the consumer expectations survey (CES) on Tuesday and the economic bulletin will be due on Thursday.

Elsewhere earnings season soldiers on but after the mega caps from last week, the main highlights this week, which we detail in the calendar at the end, are not going to move the macro needle.

Day-by-day calendar of events

Monday February 5

- Data: US January ISM services, China January Caixin services PMI, UK January official reserves changes, new car registrations, Japan December labor cash earnings, household spending, Italy January services PMI, Germany December trade balance, Eurozone December PPI, Canada January services PMI

- Central banks: Fed SLOOS, Fed's Bostic speaks

- Earnings: McDonald's, Caterpillar, Vertex, NXP Semiconductors, Estee Lauder, Palantir Technologies

- Other: OECD interim economic outlook

Tuesday February 6

- Data: UK January construction PMI, Italy January manufacturing confidence, economic sentiment, consumer confidence index, Germany January construction PMI, December factory orders, Eurozone December retail sales, Canada December building permits

- Central banks: Fed's Mester, Kashkari and Collins speak, ECB consumer expectations survey, BoE's asset purchase facility report, RBA decision

- Earnings: Eli Lilly, Toyota, Linde, Amgen, BP, Gilead Sciences, Fiserv, KKR, Nintendo, Chipotle, Carrier Global, Ford, Spotify, Centene

- Auctions: US 3-yr Note ($54bn)

Wednesday February 7

- Data: US December trade balance, consumer credit, China January foreign reserves, Japan January bank lending, December trade balance, leading index, coincident index, current account balance, Italy December retail sales, Germany December industrial production, France Q4 private sector payrolls, December trade balance, current account balance, Canada December international merchandise trade

- Central banks: Fed's Harker, Kugler, Collins, Bowman and Barkin speak, BoE's Breeden speaks

- Earnings: Alibaba, Walt Disney, TotalEnergies, Uber, CVS, Equinor, Vinci, ARM, PayPal, McKesson, O'Reilly, Hilton, Vestas, Roblox, Orsted, Carlsberg, Pandora, Siemens Energy, Ares

- Auctions: US 10-yr Note ($42bn)

Thursday February 8

- Data: US December wholesale trade sales, initial jobless claims, China January CPI, PPI, UK January RICS house price balance, Japan January Economy Watchers survey, M2, M3

- Central banks: Fed's Barkin speaks, ECB's economic bulletin, Wunsch, Lane speak, BoE's Mann speaks

- Earnings: L'Oreal, AstraZeneca, Siemens, S&P Global, ConocoPhillips, Unilever, SoftBank, Apollo, Kering, Kenvue, Hershey, AP Moller - Maersk, Take-Two Interactive, Neste, Pinterest, ArcelorMittal

- Auctions: US 30-yr Bond ($25bn)

Friday February 9

- Data: Italy December industrial production, France Q4 wages, Canada January jobs report

- Central banks: ECB's Cipellone and Nagel speak

- Earnings: PepsiCo, Hermes, Tokyo Electron, Blue Owl

* * *

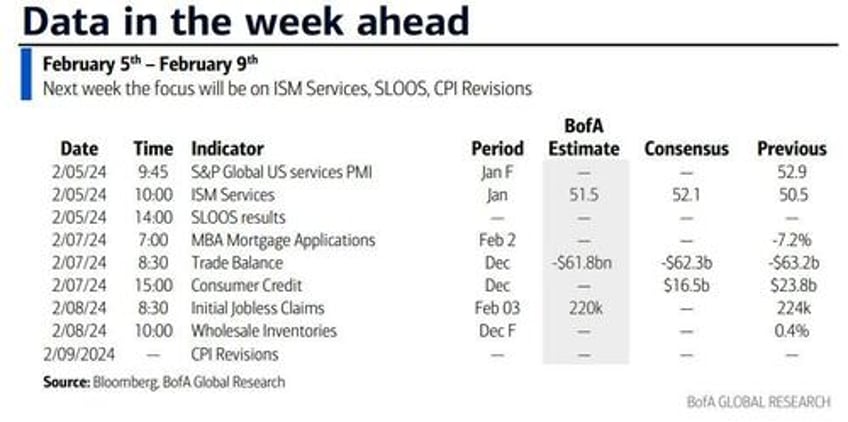

Finally, looking at just the US, the key economic data release this week is the ISM services report on Monday. There are several speaking engagements from Fed officials this week.

Monday, February 5

- 09:45 AM S&P Global US services PMI, January final (consensus 52.9, last 52.9)

- 10:00 AM ISM services index, January (GS 52.3, consensus 52.0, last 50.5): We estimate that the ISM services index rebounded 1.8pt to 52.3 in January. Our non-manufacturing survey tracker edged up 0.6pt to 52.8, and the collapse in the ISM services employment gauge in December is inconsistent with the strong job growth and low layoff rates in that month and in January. We also see seasonality as a positive factor this month.

- 10:00 AM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will be interviewed on Bloomberg Television. On February 2nd, following the release of the January employment report, President Goolsbee noted that “the continued strength of the labor market, if [it] continues, would lessen my worry that the job market side of our mandate is deteriorating.” That being said, President Goolsbee stressed that a strong employment report wouldn’t necessarily lead the Fed to delay cutting the fed funds rate because strong hiring was taking place in the context of “positive supply shocks working their way through the system.” President Goolsbee also observed that the decline in weekly hours suggests that the underlying pace of wage growth “wasn’t as strong as that headline [average hourly earnings] number suggested.”

- 02:00 PM Senior Loan Officer Opinion Survey, banks tightening C&I loans for large and middle-market firms, 2023Q4 (last 33.9)

- 02:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will deliver welcoming remarks at an event on the economic returns of education and training. Text is expected. On January 18th, President Bostic noted that he had “incorporated the unexpected progress on inflation and economic activity into my outlook, and thus moved up my projected time to begin normalizing the fed funds rate to the third quarter of this year from the fourth quarter.” President Bostic cautioned that “premature rate cuts could unleash a surge in demand that could initiate upward pressure on prices… [but] if we continue to see a further accumulation of downside surprises in the data, it’s possible for me to get comfortable enough to advocate for normalization sooner than the third quarter.”

Tuesday, February 6

- There are no major economic data releases scheduled.

- 12:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will deliver a speech on the economic outlook in Columbus, Ohio. Text and Q&A are expected. On January 11th, President Mester said that “March is probably too early in my estimation for a rate decline because I think we need to see some more evidence. … I think the December CPI report just shows there is more work to do, and that work is going to take restrictive monetary policy.”

- 01:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a moderated Q&A at a luncheon hosted by Greater Mankato Growth. Audience Q&A is expected.

- 02:00 PM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will deliver opening remarks at the second day of a Fed conference on "Uneven Outcomes in the Labor Market." Text is expected.

- 07:00 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will deliver a speech on the Fed's role in the economy at the Rowan Institute for Public Policy & Citizenship in Glassboro, New Jersey. Text and Q&A are expected. On December 20th, President Harker argued that it was “important that we start to move rates down,” adding that “we don't have to do it too fast, we're not going to do it right away, it's going to take some time.”

Wednesday, February 7

- 08:30 AM Trade balance, December, (GS -$61.7bn, consensus -$62.2bn, last -$63.2bn)

- 11:00 AM Fed Governor Kugler speaks: Fed Governor Adrianna Kugler will speak about the economic outlook at an event hosted by the Brookings Institution. Text and Q&A are expected. This will be Governor Kugler's first speech since joining the Fed Board.

- 11:30 AM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will speak at an event hosted by the Boston Economic Club. Text and audience Q&A are expected.

- 12:30 PM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will take part in a conversation on the economic outlook at the Economic Club of Washington, D.C. Q&A is expected. In an interview on CNN on January 22nd, President Barkin argued that the FOMC had to “focus on what’s happening on demand and whether that’s either helping your efforts to bring inflation in line or working against you, and then I think you make the call when you get to the meeting.” President Barkin did not rule out a March cut, noting that he did not “have any particular objection to normalizing rates when it’s the right time.”

- 02:00 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will deliver a speech on entrepreneurship and small businesses. Text is expected. On February 2nd, Governor Bowman noted that the recent progress on inflation was “encouraging,” and that her “baseline outlook is that inflation will decline further with the policy rate held at the current level.” Governor Bowman said that, as inflation came down, “it will eventually become appropriate to gradually lower our policy rate to prevent monetary policy from becoming overly restrictive.” That being said, Governor Bowman also stressed that she would “remain cautious in my approach to considering future changes in the stance of policy,” noting that "reducing our policy rate too soon could result in requiring further future policy rate increases to return inflation to 2 percent in the longer run.”

Thursday, February 8

- 08:30 AM Initial jobless claims, week ended February 3 (GS 220k, consensus 220k, last 224k): Continuing jobless claims, week ended January 27 (GS 1,855k, consensus 1,870k, last 1,898k)

- 08:30 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will be interviewed on Bloomberg Television.

- 12:05 PM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will speak at the Economic Club of New York. Text and audience and media Q&A are expected.

Friday, February 9

- 08:30 AM CPI Annual Revisions: The BLS will release updated seasonal factors that have been recalculated to reflect price movements from 2023. The annual revisions tend to cause monthly inflation readings to be revised toward the annual average. In other words, higher inflation readings for the year tend to be revised lower and lower readings tend to be revised higher. On average over the last decade, about 20% of the relative strength of a month’s initial core inflation vintage has been revised away in its first annual revision. With inflation pressures easing over 2023, monthly core CPI was 0.06pp below the annual average in the second half of 2023. As a result, if the revisions are in line with the historically average 20%, monthly core CPI inflation would be revised roughly 0.01pp higher on average in 2023H2. We expect revisions to core PCE inflation in the same direction for 2023Q4 (prior quarters are not revised until the BEA’s annual revisions later this year) but smaller in magnitude, because only some of the PCE components use the CPI seasonal factors.

- 01:30 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will speak at the 14th Annual Tarrant County Transportation Summit in Hurst, Texas. On January 6th, President Logan noted that if the FOMC doesn’t “maintain sufficiently tight financial conditions, there is a risk that inflation will pick back up and reverse the progress we’ve made,” and that “in light of the easing in financial conditions in recent months, we shouldn’t take the possibility of another rate increase off the table just yet.”

Source: DB, Goldman,BofA