As we move into the second half of August, this week’s center of attention for investors will be the Jackson Hole Economic Symposium that runs from Thursday evening through Saturday. The good news, as DB's Peter Sidorov writes, is that markets are approaching this in a much better mood than looked likely two weeks ago as the extreme volatility seen at the start of August seems almost a distant memory. Meanwhile, the S&P 500 is on its best 7-day run since October 2022 (+6.82%) and has moved to within 2% of its all-time high, while the VIX ended last week at 14.80, down to below 15 for the first time in over three weeks. This comes as a 50bp Fed rate cut in September is now just over 30% priced, down from being fully priced on August 5 and 55% a week ago.

The overall title at Jackson Hole this year is “Reassessing the Effectiveness and Transmission of Monetary Policy” and central bankers will surely feel more satisfied with their policy levers than the last two times they met at the Wyoming retreat. The 2022 symposium came as inflation neared double digits across many developed economies with rates markets undergoing a sharp hawkish repricing, while a higher-for-longer focus saw Treasury yields reach post-GFC highs in the run-up to the 2023 gathering, with the 10yr yield then touching 5% last October. By contrast, this year’s event comes with US PCE inflation down to 2.5%, the unemployment rate up by 0.6pp since the start of 2024 and the Fed keeping rates on hold for the past 12 months. 10yr Treasuries are back below 4% as markets are pricing 95bps of Fed rate cuts across the remaining three meetings this year and 200bps of easing by next October.

In this context, investors will be keenly watching for signals on the timing and pace of rate cuts, especially from Fed Chair Powell’s speech at 10am EST on Friday. DB's economists don’t expect him to pre-commit to any particular rate cut trajectory but to signal that the Fed has gained sufficient confidence that it will soon be appropriate to begin easing policy, with rate cuts justified by both sides of the Fed’s dual mandate. They see rate cuts as likely to be framed as dialing back restraint, leaving the exact path data dependent. With r-star uncertain and policy risks evident following the election, rate cuts beyond the first 75-125bps are more uncertain. For more, including the arguments for starting the easing cycle with 25bps vs 50bps cuts, see our economists’ full preview here.

Other scheduled Jackson Hole speakers include BoE Governor Bailey late on Friday and ECB Chief Economist Lane on Saturday. Ahead of this, we will also get the latest Fed and ECB meeting minutes on Wednesday and Thursday, respectively, which may offer some colour on the strength of the conditional September rate cut signals that both central banks sent at their July meetings. Elsewhere, tomorrow Sweden’s Riksbank is expected to deliver a second 25bps cut of its easing cycle, with markets pricing a c. 20% likelihood of a larger 50bps cut.

On the data front, this week’s main event will come with the flash August PMIs out in the US, euro area, UK and Japan on Thursday. Last month’s slippage of the US manufacturing PMI to below 50 (at 49.6) contributed to a rise in US recession fears that has since ebbed, while in the euro area activity surveys have consistently disappointed over the past two months. Another notable release will be Wednesday’s Q1 Quarterly Census of Employment and Wages (QCEW) in the US, which will provide preliminary benchmark revisions to the payrolls data.

Turning to politics, today will see the start of the US Democratic National Convention in Chicago, where masses of antifa NPCs are expected to crash the event, literally. Politics will also be in the headlines in Japan as on August 20 the LDP is due to finalize the schedule for its September leadership election.

Day-by-day calendar of events

Monday August 19

- Data: US July leading index, Japan June core machine orders

- Central banks: Fed's Waller speaks, ECB's Rehn speaks, BoC's senior loan officer survey

- Earnings: Palo Alto Networks, Estee Lauder

Tuesday August 20

Data: US August Philadelphia Fed non-manufacturing activity, China 1-yr and 5-yr loan prime rates, Germany July PPI, Italy June current account balance, ECB June current account, Eurozone June construction output, Canada July CPI, Denmark Q2 GDP

- Central banks: Fed's Barr and Bostic speak, Riksbank decision

- Earnings: Lowe's

Wednesday August 21

- Data: US Q1 Quarterly Census of Employment and Wages, UK July public finances, Japan July trade balance, Canada July industrial product price index, raw materials price index

- Central banks: FOMC meeting minutes, ECB's Panetta speaks

- Earnings: Target, TJX, Analog Devices, Snowflake, Zoom, Synopsys

- Auctions: US 20-yr Bonds ($16bn)

Thursday August 22

- Data: US, UK, Japan, Germany, France and Eurozone August PMIs, US July Chicago Fed national activity index, existing home sales, August Kansas City Fed manufacturing activity, initial jobless claims, France July retail sales, Eurozone August consumer confidence, Norway Q2 GDP

- Central banks: Fed's Jackson Hole symposium (through August 24), ECB's account of the July meeting, Q2 Euro Area negotiated wages indicator

- Earnings: Baidu, Intuit, Peloton

- Auctions: US 30-yr TIPS (reopening, $8bn)

Friday August 23

- Data: US July new home sales, August Kansas City Fed services activity, UK August GfK consumer confidence, Japan July national CPI, France August manufacturing confidence, Canada June retail sales

- Central banks: Fed's Powell speaks (10:00 EST), ECB consumer expectations survey, BoE's Bailey speaks

* * *

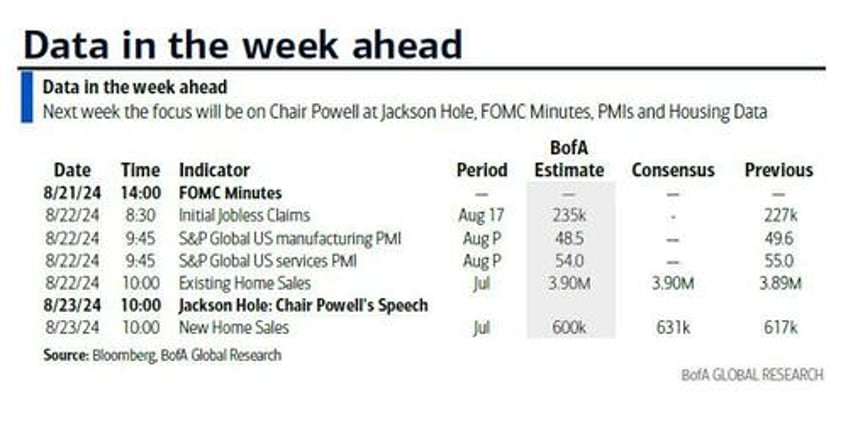

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the jobless claims and existing home sales reports on Thursday. The minutes from the July FOMC meeting will be released on Wednesday. There are several speaking engagements from Fed officials this week, including Governor Waller, President Bostic, and Chair Powell, who will deliver the keynote address on Friday at the Jackson Hole Economic Policy Symposium.

Monday, August 19

- 09:15 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will deliver welcoming remarks at the 2024 Summer Workshop on Money, Banking, Payments, and Finance at the Fed. Speech text is expected. On July 17, Waller said, "I believe current data are consistent with achieving a soft landing, and I will be looking for data over the next couple months to buttress this view. So, while I don’t believe we have reached our final destination, I do believe we are getting closer to the time when a cut in the policy rate is warranted."

Tuesday, August 20

- 01:35 PM Atlanta Fed Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will speak in a fireside chat about innovating for inclusion at the Atlanta Fed's Payment Inclusion Forum. A Q&A is expected. On August 15, Bostic said, "Now that inflation is coming into range, we have to look at the other side of the mandate, and there, we’ve seen the unemployment rate rise considerably off of its lows. But it does have me thinking about what the appropriate timing is, and so I’m open to something happening in terms of us moving before the fourth quarter...Waiting does bring risk, and that’s why we have to be extra vigilant on this. Because our policies act with a lag in both directions, we can’t really afford to be late. We have to act as soon as possible."

- 02:45 PM Fed Vice Chair for Supervision Michael Barr speaks: Fed Vice Chair for Supervision Michael Barr will speak on cybersecurity. A Q&A is expected.

Wednesday, August 21

- 10:00 AM BLS releases preliminary annual payrolls benchmark revision: The Bureau of Labor Statistics (BLS) will publish a preliminary estimate of the benchmark revision to the level of nonfarm payrolls for March 2024. The final benchmark revision will be issued and incorporated into nonfarm payrolls alongside the January 2025 employment report in February 2025. Based on the Quarterly Census of Employment and Wages (QCEW)—the key source data for the annual benchmark revision—a large downward revision seems likely; we estimate on the order of 600k-1mn (or a 50-85k downward revision to monthly payroll growth over April 2023-March 2024). However, we believe next week’s estimate will likely revise payroll growth down by 400-600k too much, as discussed in greater detail here.

- 02:00 PM FOMC meeting minutes, July 30-31 meeting: The FOMC kept the target range for the federal funds rate unchanged at its July meeting, and the FOMC’s message was largely in line with expectations. Powell confirmed that the FOMC has moved closer to a cut and that a cut will be on the table in September if the inflation data cooperate, and his comments suggest the bar is not very high.

Thursday, August 22

- 08:30 AM Initial jobless claims, week ended August 17 (GS 220k, consensus 231k, last 227k): Continuing jobless claims, week ended August 10 (consensus 1,860k, last 1,864k)

- 09:45 AM S&P Global US manufacturing PMI, August preliminary (consensus 49.8, last 49.6): S&P Global US services PMI, August preliminary (consensus 54.0, last 55.0)

- 10:00 AM Existing home sales, July (GS +2.6%, consensus +1.0%, last -5.4%)

- 11:00 AM Kansas City Fed manufacturing index, August (last -13)

- 08:00 PM Jackson Hole agenda and paper titles likely released: The Jackson Hole program is expected to be posted here, with the paper titles or panel topics and speaker names. Full text of the papers and speeches will be posted to the website at the time each event is scheduled to begin.

Friday, August 23

- 10:00 AM New home sales, July (GS 610k, consensus 624k, last 617k)

- 10:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will speak on the economic outlook at the 2024 Jackson Hole Economic Policy Symposium. Speech text is expected. In past years, the event has been livestreamed by the Kansas City Fed here.

Source: DB, Goldman