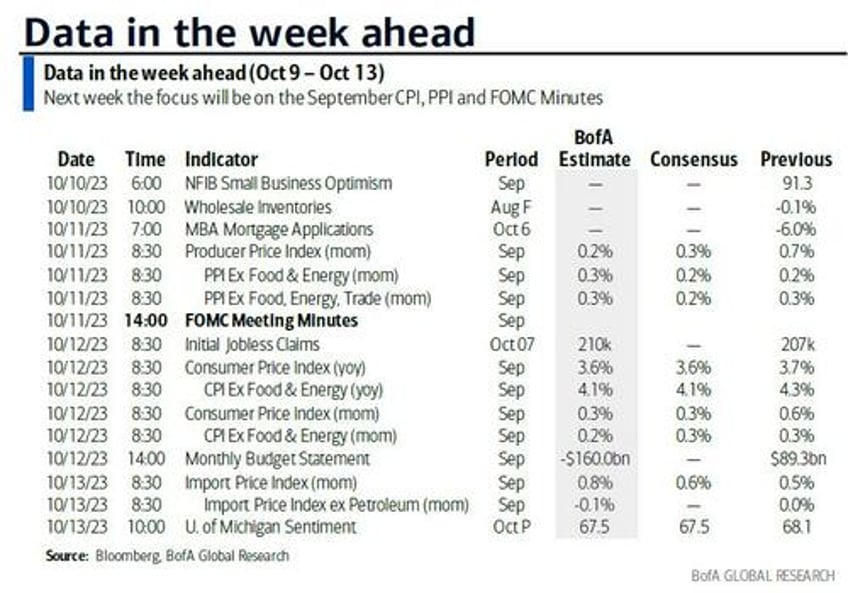

As usual in the post-payrolls event lull, it's a relatively quiet week - aside for the sudden break out of war in the middle east - as Q3 earnings season begins. Looking at the economic calendar, we have the latest US CPI (Thursday) to look forward to alongside PPI (Wednesday) as the dress rehearsal. China inflation (Friday) is also interesting as last month the country came out of deflation again.

Elsewhere, the FOMC minutes (Wednesday) and the ECB account (Thursday) from their September meetings will be of note. German industrial production (today) and UK monthly GDP (Thursday) are other key highlights and on Friday US Q3 earnings season unofficially starts with a few big US banks reporting.

US 10yr and 30yr auctions on Wednesday and Thursday could also be market-moving events for yields depending on how well they are covered.

Some more details on the two main events in the US:

- For US PPI on Wednesday, DB economists expect the headline (+0.3% forecast vs. +0.6% previously) to slightly outperform the core (+0.2% vs. +0.2%) but the healthcare and airlines components will be the most closely watched as they feed through into core PCE. The latter component has been more buoyant recently than in the CPI which is partly why PCE core services excluding housing inflation has been significantly stronger than that of the CPI core services excluding rent and medical care services. So although this is a bit in the weeds, it will matter for the Fed.

- For Thursday's CPI, DB economists note that with seasonally adjusted gas prices up almost 3% from August, they expect headline CPI (+0.26% vs. +0.63% last month) to slightly outpace core (+0.24% vs. +0.28%). This would allow core YoY CPI to drop from 4.4% to 4.0%, and headline to fall from 3.7% to 3.5%. Core goods should be soft led by used cars but this could pick up again by year-end if our models are correct.

Finally, earnings season will kick off with results from several US banks/financials on Friday, including JPMorgan, Citi, BlackRock, and Wells Fargo. Contrary to expectations for an earnings pullback, DB strategists think we'll see a fresh high for S&P 500 earnings. They also note that 80% of time the market rallies during earnings season, and by an average of 2%. The extent of this typically depends on performance and positioning going into it. Going into this season, we've had a notable pull-back and investors are now underweight (see their positioning report here) which leaves our strategists fairly optimistic. We will see if the macro world supports that view in the next few weeks.

Here is a day-by-day calendar of events

Monday October 9

- Data: Germany August industrial production

- Central banks: Fed's Barr, Logan and Jefferson speak, ECB's Centeno speaks, BoE's Mann speaks

Tuesday October 10

- Data: US September NFIB small business optimism, NY Fed 1-yr inflation expectations, August wholesale trade sales, Japan September Economy Watchers Survey, August trade balance, current account balance, Italy August industrial production

- Central banks: Fed's Bostic, Waller, Kashkari, Perli and Daly speak, ECB's Villeroy speaks, BoE minutes of financial policy meeting

- Earnings: PepsiCo

Wednesday October 11

- Data: US September PPI, Japan September machine tool orders, Canada August building permits

- Central banks: FOMC meeting minutes, Fed's Bowman, Collins and Bostic speak, ECB Consumer Expectations Survey, ECB's Klaas and de Cos speak

Thursday October 12

- Data: US September CPI, monthly budget statement, initial jobless claims, UK August monthly GDP, trade balance, industrial production, index of services, construction output, Japan September PPI, bank lending, August core machine orders, Germany August current account balance

- Central banks: Fed's Bostic and Collins speak, ECB's account of September meeting, ECB's Villeroy, Holzmann, Knot, Vujcic, Vasle and Panetta speak, BoJ's Noguchi speaks, BoE's credit conditions survey, BoE's Pill speaks

- Earnings: Walgreens Boots Alliance, Domino's Pizza

Friday October 13

- Data: US October University of Michigan survey, September import and export price indices, China September CPI, PPI, trade balance, Japan September M2, M3, Eurozone August industrial production, Canada September existing home sales

- Central banks: Fed's Harker speaks, ECB's Lagarde and Nagel speak, BoE's Bailey and Cunliffe speak

- Earnings: JPMorgan Chase, Wells Fargo, Citigroup, BlackRock, UnitedHealth

* * *

Finally, turning to just the US, Goldman writes that the key economic data releases this week are the PPI report on Wednesday and the CPI report on Thursday. The minutes from the September FOMC meeting will be released on Wednesday. There are several speaking engagements by Fed officials scheduled this week, including Fed presidents Logan, Bostic, Kashkari, Daly, Collins, and Harker and Fed governors Barr, Jefferson, Waller, and Bowman.

Monday, October 9

- 09:00 AM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will speak on the US outlook and monetary policy at the National Association of Business Economics annual meeting in Dallas. Speech text and Q&A with audience are expected.

- 09:15 AM Fed Vice Chair for Supervision Barr (FOMC voter) speaks: Fed Vice Chair for Supervision Michael Barr will speak at the American Bankers Association annual convention. Speech text and Q&A with moderator are expected.

- 01:30 PM Fed Vice Chair Jefferson (FOMC voter) speaks: Fed Vice Chair Philip Jefferson will give a luncheon address at the National Association for Business Economics conference in Dallas. Speech text and Q&A with moderator and audience are expected.

Tuesday, October 10

- 06:00 AM NFIB small business optimism, September (consensus 91.0, last 91.3)

- 09:30 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will take part in a moderated conversation with the American Bankers Association chief policy officer Naomi Camper at the ABA’s annual convention. President Bostic will discuss the outlook for the US economy. The talk will be livestreamed.

- 10:00 AM Wholesale inventories, August final (consensus -0.1%, last -0.1%)

- 11:00 AM New York Fed 1-year inflation expectations, September (last 3.63%)

- 01:00 PM Fed Governor Waller (FOMC voter) speaks: Fed Governor Christopher Waller will deliver the keynote address at a monetary policy conference hosted by George Mason University.

- 03:00 PM Minneapolis Fed President Kashkari (FOMC voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a town hall hosted by Minot State University. A moderated Q&A is expected.

- 06:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will discuss current economic challenges faced by young Americans and opportunities to foster economic resilience at a town hall event hosted by the Chicago Council on Global Affairs. A moderated Q&A is expected. The talk will be livestreamed.

Wednesday, October 11

- 04:15 AM Fed Governor Bowman (FOMC voter) speaks: Fed Governor Michelle Bowman will speak on a panel at the Marrakech Economic Festival during the World Bank-IMF meetings in Morocco. Speech text and moderated Q&A are expected.

- 08:30 AM PPI final demand, September (GS +0.3%, consensus +0.3%, last +0.7%); PPI ex-food and energy, September (GS +0.2%, consensus +0.2%, last +0.2%); PPI ex-food, energy, and trade, September (GS +0.2%, consensus +0.2%, last +0.3%)

- 10:15 AM Fed Governor Waller (FOMC voter) speaks: Fed Governor Christopher Waller will hold a fireside chat at the E2 Summit in Park City, Utah. A moderated Q&A is expected. The talk will be livestreamed on YouTube.

- 12:15 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak about economic conditions at the Metro Atlanta Chamber’s ATLeaders lunch. A Q&A with audience is expected.

- 02:00 PM FOMC meeting minutes, September 19-20 meeting

- 04:30 PM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will deliver the 2023 Goldman Lecture in Economics at Wellesley College. Speech text and Q&A with audience are expected.

Thursday, October 12

- 08:30 AM CPI (mom), September (GS +0.30%, consensus +0.3%, last +0.6%); Core CPI (mom), September (GS +0.22%, consensus +0.3%, last +0.3%); CPI (yoy), September (GS +3.55%, consensus +3.6%, last +3.7%); Core CPI (yoy), September (GS +3.98%, consensus +4.1%, last +4.3%): We estimate a 0.22% increase in September core CPI (mom sa), which would lower the year-on-year rate by three tenths to 3.98%. Our forecast reflects a decline in auto prices (used -2.3%, new -0.1%, mom sa) reflecting the summer declines in used car auction prices and the further rebound in new car inventories and incentives. We also assume a 3% pullback in airfares on softer post-Labor Day demand. However, we expect another strong gain in car insurance rates (we assume +1.7%), as carriers continue to offset higher repair and replacement costs. We forecast shelter inflation to remain roughly at its current pace (we estimate +0.48% for rent and +0.45% for OER). We estimate a 0.30% rise in headline CPI, reflecting higher energy (+1.25%) and food (+0.3%) prices.

- 08:30 AM Initial jobless claims, week ended October 7 (GS 205k, consensus 210k, last 204k); Continuing jobless claims, week ended September 30 (GS 1,700k, last 1,664k)

- 01:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will deliver welcoming remarks to the National Agriculture Conference at the Atlanta Fed.

- 04:00 PM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will speak at the 22nd Annual Regional and Community Bankers Conference hosted by the Boston Fed. President Collins will share her perspectives on the economy. Speech text and moderated Q&A are expected.

Friday, October 13

- 08:30 AM Import price index (mom), September (consensus +0.6%, last +0.5%): Export price index (mom), September (consensus +0.5%, last +1.3%)

- 09:00 AM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will speak on the 2023 economic outlook in a virtual event with the Delaware State Chamber of Commerce. Speech text and Q&A with audience are expected.

- 10:00 AM University of Michigan consumer sentiment, October preliminary (GS 66.0, consensus 65.7, last 66.0): University of Michigan 5-10-year inflation expectations, October preliminary (GS 3.0%, consensus 2.9%, last 2.8%)

Source: DB, Goldman, BofA