America's anti-obesity craze, courtesy of GLP-1-based weight-loss drugs such as Wegovy and Mounjaro made by Novo Nordisk and Eli Lilly, continues to gain momentum as yet another Wall Street bank loses faith in obese consumers.

Wall Street is losing faith in Fat Americans.

— zerohedge (@zerohedge) October 30, 2023

Truist Securities downgraded Krispy Kreme saying it has a difficult time recommending the stock until the impact of GLP-1 weight-loss drugs becomes more apparent.

On Monday, Truist Securities downgraded doughnut chain Krispy Kreme Inc. from "buy" to "hold" and slashed the price target from $20 to $13, citing GLP-1 trends.

Analysts led by Bill Chappell told investors:

"We believe the stocks will be stuck in a holding pattern at best with strong potential for additional multiple contraction as the initial impact of GLP-1 use becomes more apparent. To be clear, we have NO IDEA what the impact of GLP-1s will be on overall food consumption, but we believe it is way too early in the cycle for anyone to have an accurate estimate."

Chappell said he needs more evidence to gauge the overall GLP-1 impacts on overall food consumption. He noted if GLP-1 impacts worked through Krispy Kreme and its peers in the third quarter - there would be enough data to forecast 2024-25 trends.

Chappell warned that GLP-1 overhang will weigh shares down for the next six to 12 months, "if not longer."

He added:

"We believe the stocks will be stuck in a holding pattern at best with strong potential for additional multiple contraction as the initial impact of GLP-1 use becomes more apparent."

Shares of Krispy Kreme fell as much as 3.6% in early New York trade, but most losses were recovered by early afternoon. Shares are up 24% on the year but remain around record lows.

Another problem for the doughnut chain is that top-line growth resulted from increased pricing during Covid. According to Chappell, this trend will "only feed into the GLP-1 narrative as pricing benefits recede and overall sales growth decelerates in the next few quarters."

We told readers 2.5 months ago about the emerging "food revolution" as the food industrial-complex has been too lazy to adapt to the shifting winds of an increasing number of Americans using GLP-1 drugs.

In late July, a shift occurred as investors started to offload companies with potential downstream risks related to obesity drugs, as indicated by the Goldman Sachs Global HLC GLP Risk index. Concurrently, investors piled into Goldman's GLP-1 Obesity drug basket to capitalize on slimming down Americans.

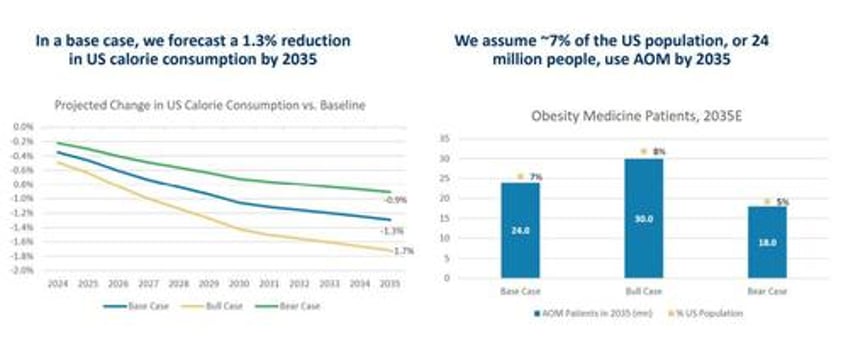

A recent Morgan Stanley presentation (available to pro subs) found the most bull case for the GLP-1 drugs could result in a 1.7% reduction (vs baseline) in calories consumed by Americans.

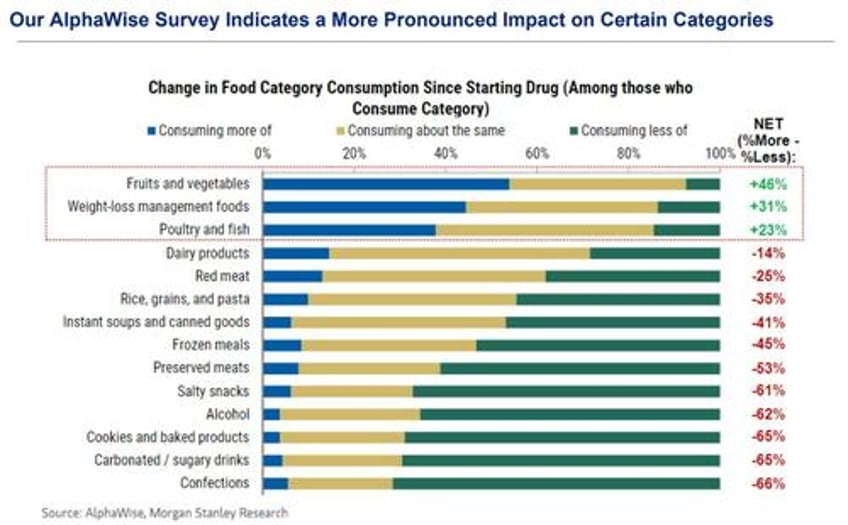

Not surprisingly, MS found a more pronounced impact on certain food categories among those on the weight-loss drugs.

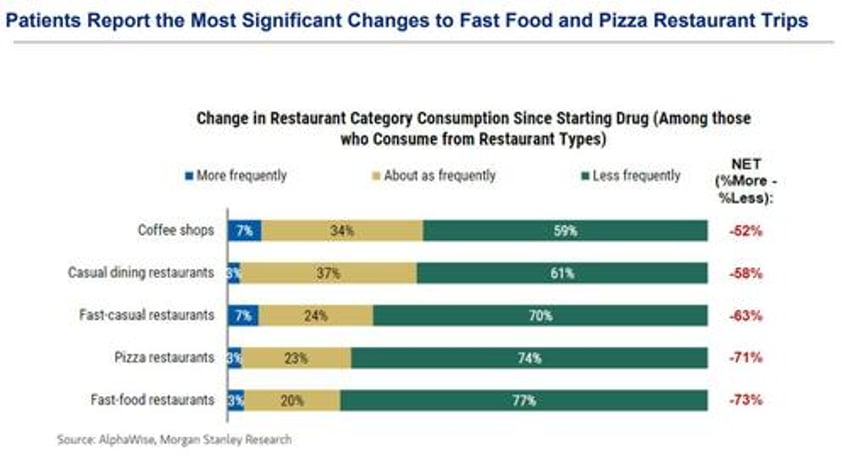

Also, the biggest losers appear to be fast food and pizza restaurants...

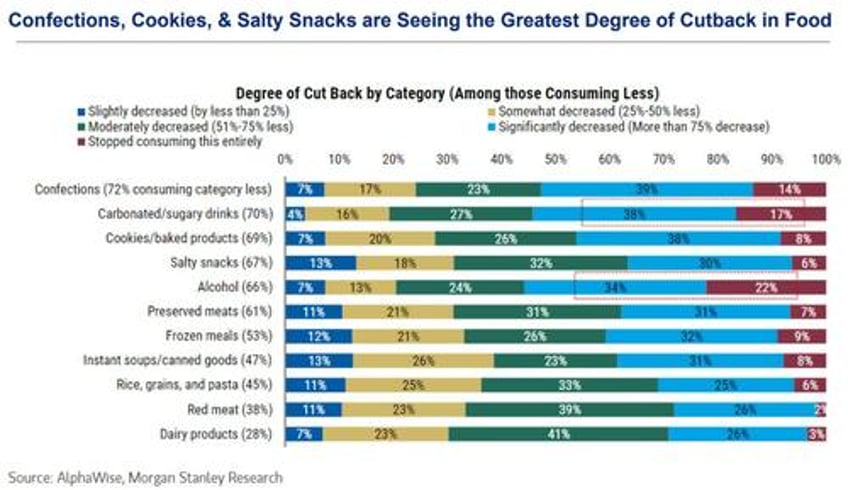

... confections, cookies, and salty snacks...

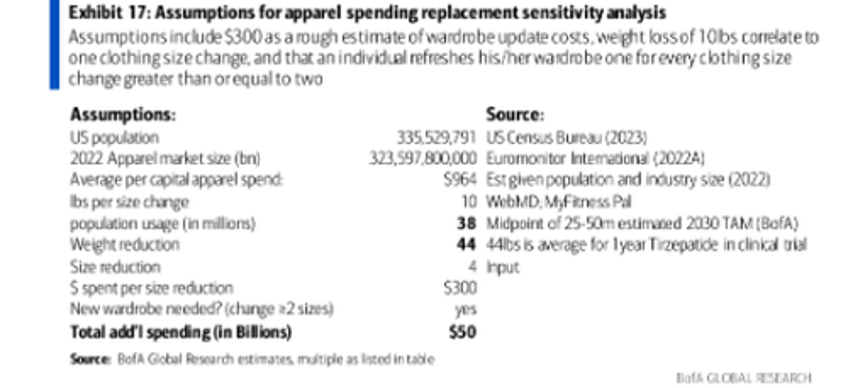

Expanding on MS' report is Bank of America analyst Geoff Meacham (available to pro subs), who reveals the downstream effects of the obesity drug will impact the apparel industry as "eventual weight loss in the broader population could spur a wardrobe replacement cycle."

Meacham said that an adoption rate of 38 million individuals using weight-loss drugs (midpoint of BofA's estimated 2030 TAM) combined with the assumption of buying new clothing could result in $50 billion of new apparel spending.

Walmart has already voiced concern about seeing an impact on shopping demand from people taking the diabetes drug Ozempic, Wegovy, and other appetite-suppressing medications.

Banks are still evaluating the downstream effects of GLP-1 impacts that could be more clear in the next several quarters.