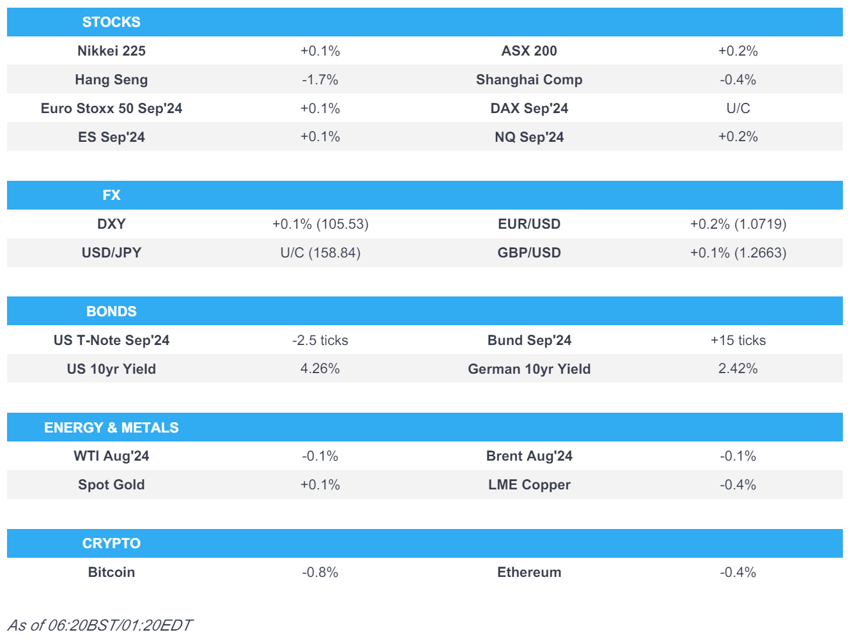

- APAC stocks were mostly rangebound with sentiment subdued after the lacklustre handover from Wall St where tech underperformed, and risk appetite was sapped.

- DXY took a breather but held on to the prior day's spoils after strengthening on firmer yields despite soft data; USD/JPY briefly rose above 159.00.

- 10-year UST futures remained lacklustre after weakening yesterday; Bund futures were kept afloat after rebounding from support near the 132.00 level.

- European equity futures indicate a flat/slightly firmer open with Euro Stoxx 50 futures +0.1% after the cash market closed higher by 1.3% on Thursday.

- Looking ahead, highlights include French, German, UK, EZ, US Manufacturing & Services PMI, US & Canadian Retail Sales, ECB’s Schnabel, and quad-witching.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were predominantly lower on Thursday with the downside led by the Nasdaq amid weakness in AI-darling Nvidia (NVDA) which eased back from all-time highs and failed to hold on to its status as the most valuable company by market cap despite initially gaining pre-market. As such, tech was the worst-performing sector although most industries finished in the green, while participants also digested soft data releases in which US Housing Starts, Building Permits, headline Philly Fed, and Initial Jobless Claims all missed forecasts.

- SPX -0.25% at 5,473, NDX -0.79% at 19,752, DJIA +0.77% at 39,135, RUT -0.39% at 2,017.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Barkin (voter) urged for clearer inflation signals before cutting rates and said data is to determine further moves after the initial rate cut, while he added the Fed is well-positioned and has the necessary firepower for the job.

- Fed's Goolsbee (non-voter) repeated that they can cut if they see more good inflation reports.

- US Treasury Secretary Yellen said it is necessary that the US contain deficits and President Biden's budget is full of proposals to do exactly that, while she added that President Biden would protect tax benefits received by families making USD 400k or less.

APAC TRADE

EQUITIES

- APAC stocks were mostly rangebound with sentiment subdued after the lacklustre handover from Wall St where tech underperformed and risk appetite was sapped as participants reflected on higher yields and soft data releases ahead of quad-witching.

- ASX 200 was rangebound with upside restricted after weak Australian flash PMI data including a steeper contraction in manufacturing.

- Nikkei 225 traded indecisively after softer-than-expected National CPI data and weakening PMIs.

- Hang Seng and Shanghai Comp. were pressured with underperformance in Hong Kong as the local benchmark dipped beneath 18,000 amid losses in property and tech, while the mainland conformed to the glum mood amid ongoing trade-related headwinds with Canada also preparing a tariffs plan on Chinese electric vehicles.

- US equity futures lacked conviction following the recent uninspired performance heading into the witching hour.

- European equity futures indicate a flat/slightly firmer open with Euro Stoxx 50 futures +0.1% after the cash market closed higher by 1.3% on Thursday.

FX

- DXY took a breather but held on to the prior day's spoils after strengthening on firmer yields despite soft data.

- EUR/USD attempted to partially nurse some of its recent losses with a rebound from support at the 1.0700 level.

- GBP/USD languishes around yesterday's trough following an unwinding of hawkish bets post-BoE meeting.

- USD/JPY briefly extended on recent advances and momentarily rose above 159.00, while the pair was unmoved by the inclusion of Japan and others to the US monitoring list for FX practices citing large bilateral trade and current account surpluses.

- Antipodeans eked mild but with upside capped amid the quiet mood across FX and the uninspiring risk appetite.

- PBoC set USD/CNY mid-point at 7.1196 vs exp. 7.2698 (prev. 7.1192).

- US Treasury semi-annual currency report found that no major US trading partner manipulated their currency to gain unfair trade advantage in four quarters through December 2023, while the monitoring list of trading partners whose currency practices 'merit' close attention includes China, Japan, Malaysia, Singapore, Taiwan, Vietnam, and Germany. Furthermore, it stated that Japan, Taiwan, Vietnam, and Germany are on the monitoring list due to a significant bilateral US trade surplus and material global account surplus.

FIXED INCOME

- 10-year UST futures remained lacklustre after weakening yesterday despite the mostly soft US data releases and with demand hampered ahead of next week's supply, as well as month and quarter-end.

- Bund futures were kept afloat after rebounding from support near the 132.00 level as participants await PMI data.

- 10-year JGB futures continued to trickle lower amid the absence of additional BoJ purchases and despite softer-than-expected inflation and weaker flash PMI data from Japan.

COMMODITIES

- Crude futures were uneventful overnight but held on to most of the prior day's mild gains after marginally bullish inventory data.

- Spot gold took a breather after the recent ascent north of the USD 2,350/oz level.

- Copper futures pulled back from yesterday's advances with demand sapped by the subdued risk tone.

CRYPTO

- Bitcoin traded marginally lower after hitting resistance around the USD 65,000 level.

NOTABLE ASIA-PAC HEADLINES

- Canada is reportedly preparing a tariffs plan on Chinese electric vehicles, according to Bloomberg.

- ByteDance and TikTok urged the US Court of Appeals to block the law that would compel divestiture or impose a ban on the app in the US by January 19th, according to a court filing. It was separately reported that the US DoJ is to file a consumer protection lawsuit against TikTok later this year on behalf of the FTC but drops claims that TikTok misled consumers, according to Bloomberg.

- Japanese PM Kishida is to resume utility and maintain gasoline subsidies, according to FNN. It was separately reported that Japan's government is in final preparations to adopt additional steps to ease the burden of higher electricity and gas prices, according to NHK.

- Japan's Chief Cabinet Secretary Hayashi said the inclusion to the US monitoring list does not mean that Japan's foreign exchange policy is a problem, while he added that stable forex levels are desirable and it is important that forex rates reflect fundamentals.

DATA RECAP

- Japanese National CPI YY (May) 2.8% vs. Exp. 2.9% (Prev. 2.5%)

- Japanese National CPI Ex. Fresh Food YY (May) 2.5% vs. Exp. 2.6% (Prev. 2.2%)

- Japanese National CPI Ex. Fresh Food & Energy YY (May) 2.1% vs. Exp. 2.2% (Prev. 2.4%)

- Japanese JibunBK Manufacturing PMI Flash SA (Jun) 50.1 (Prev. 50.4)

- Japanese JibunBK Services PMI Flash SA (Jun) 49.8 (Prev. 53.8)

- Australian Judo Bank Composite PMI Flash (Jun) 50.6 (Prev. 52.1)

- Australian Judo Bank Manufacturing PMI Flash (Jun) 47.5 (Prev. 49.7)

- Australian Judo Bank Services PMI Flash (Jun) 51.0 (Prev. 52.5)

GEOPOLITICAL

MIDDLE EAST

- Israel will reportedly step up attempts to assassinate Hamas leaders in a bid to force Hamas to accept the ceasefire deal, according to a senior Israeli official cited by The Times.

- US Secretary of State Blinken underscored the importance of avoiding further escalation in Lebanon and reaching a diplomatic resolution in the meeting with Israeli officials, while he emphasised the need to take additional steps to surge humanitarian aid into Gaza and plan for post-conflict governance, security, and reconstruction, according to the State Department.

- American officials said we are entering a very dangerous stage between Lebanon and Israel and something may happen without warning, according to Asharq News. It was also reported that Israel informed Washington of its intention to transfer equipment from southern Gaza to the northern front in preparation for a possible attack on Hezbollah.

OTHER

- UK is reportedly at loggerheads with the US and Germany over Ukraine joining NATO as the US and Germany have derailed a European plan to grant Ukraine an “irreversible” path to NATO membership and instead support offering Ukraine a lighter commitment to membership of the military alliance, according to The Telegraph.

- Russian President Putin said Russia is ready to start talks on a settlement of the Ukrainian conflict even as early as tomorrow but all parties should study its peace proposals and it is up to them when they bother to do it, while he added Russia never rejected the idea of negotiations and that the Ukrainian side has forbidden itself to negotiate, according to TASS.

- Russian President Putin said Russia is thinking about changes to its nuclear doctrine and does not rule out supplies of high-precision weapons to North Korea, according to Russian press. Possible changes are related to lowering the threshold for the use of nuclear weapons in the West but it was noted that there is no need for a Russian pre-emptive nuclear strike and it expects that cooperation with North Korea will be a deterrent factor. Furthermore, it was stated that Seoul's supply of weapons to Kyiv would be a mistake and that South Korea should not worry about agreements between Russia and North Korea, while it was said that NATO is moving to Asia, creating a security threat to Russia.

- Japan imposed sanctions against China-based companies in connection to the Ukraine war with sanctions placed on China-based Yilufa Electronics and Shenzhen 5G High-Tech Innovation Co.

- South Korean military fired warning shots after North Korean soldiers crossed the border on Thursday, according to Yonhap.

EU/UK

- UK Conservative MPs have accused the BoE of making a "political decision" after deciding to hold rates, according to The Telegraph.

DATA RECAP

- UK GfK Consumer Confidence (Jun) -14.0 vs. Exp. -16.0 (Prev. -17.0)