On Feb 3, Trump's new Treasury Secretary, Scott Bessent, said “within the next 12 months, we are going to monetize the asset side of the US balance sheet”. These comments - which were in the context of US government funding for a new sovereign wealth fund - prompted the FT's Gillian Tett to suggest that rising speculation of gold revaluation may be behind the surge in gold, to wit: "currently, [US gold stocks] are valued at just $42 an ounce in national accounts. But knowledgeable observers reckon that if these were marked at current values — $2,800 an ounce — this could inject $800bn into the Treasury General Account, via a repurchase agreement. That might reduce the need to issue quite so many Treasury bonds this year" (technically yes, practically - considering the US government spends over $7 trillion each year, the "benefit" would be equivalent to... less than 2 months of spending).

In any case, so pervasive is the panic across Wall Street that gold may suddenly be revalued by a factor of ~70, that none other than BofA's heaviest of Fed plumbing hitter, former NY Fed staffer Mark Cabana was looped in to opine on whether or not the Treasury may indeed shock the world by letting gold "float."

As Cabana writes in "US asset monetization & gold re-marking" (available to pro subscribers), while he admits that he doesn't know the details of Bessent’s plan yet, they could include non-traditional UST funding options.

Below we excerpt from his note, along with some of our thoughts on the matter.

US government balance sheet: not your standard T-table

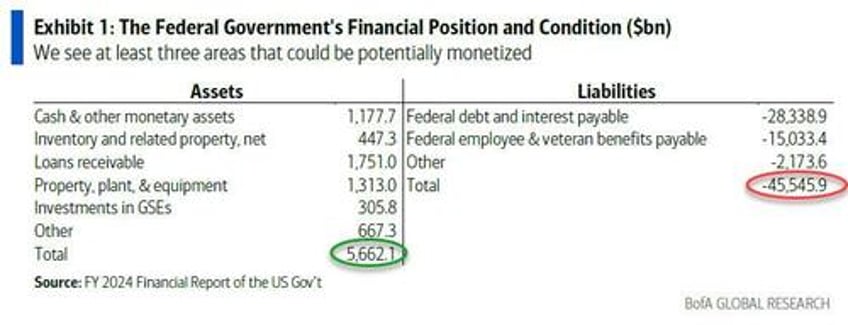

The balance sheets of governments are unique: they don’t always look like corporates or households. As shown in the first chart, the US federal government has a significant gap between the total published size of its assets ($5.7tn) and liabilities ($45.5tn).

The US Treasury states “the balance sheet does not include the financial value of the government’s sovereign powers to tax, regulate commerce, or set monetary policy or the value of nonoperational resources of the government, such as national and natural resources, for which the government is a steward.” As Cabana notes, "taxation & stewardship value presumably close the large asset liability gap, a feature unique to governments." Or, as a cynic might say, that's a lot of value assigned to superpower and reserve currency status.

Three potential areas of US asset monetization

To better understand Bessent’s comment on monetizing US assets, Cabana focuses on balance sheet items that could potentially be revalued or sold to seed the sovereign wealth fund (SWF) or fund any other gov’t priority. There are at least three areas that could be potentially monetized:

- PP&E

- Agency investments (Fannie / Freddie)

- Gold and silver.

The BofA strategist places relatively low odds of monetization for any assets. However, the bank's clients have asked for an explainer given the potential large impact (esp on gold). Here are the details:

PP&E assets: most standard but least impactful

Plant, property, & equipment (PP&E) totals over $1.3tn in US gov’t assets. PP&E is mostly comprised of tangible assets including land. The Dept of Defense (DoD) holds approximately 64.7% of the gov’ts total PP&E, which excludes land and rights of 22.8mn acreage. The US gov’t could potentially “monetize” PP&E but it's unlikely given national security implications / DoD presence + the need to involve Congress in revenue generating dispositions. In PP&E sales, the US gov’t would swap PP&E assets for cash or ultimate investments in other gov’t priorities.

Selling assets does not raise funding for other projects unless the net effect reduces deficits, i.e. total outlays decrease relative to revenues. It is not clear if revenue from selling a property or plant would exceed the new costs from seeking a private replacement for that property or plant. The CBO would likely need to score such dispositions to get a read on whether it is a deficit reduction or not.

Fannie & Freddie: government share could be monetized

Selling shares in Fannie Mae and Freddie Mac is another way to monetize US assets. The US currently owns a stake in gov’t sponsored enterprises (GSEs) that at end FY ’24 valued $339b in gross investments of primarily senior preferred stock. It is possible that Fannie / Freddie are privatized (to Bill Ackman's delight) to raise capital, though the mortgage guarantee is a challenging issue. It would take over 12 months to privatize Fannie & Freddie which seems at odds with the timing in Bessent’s comments.

Re-marking gold: most impactful... but low probability for now

Wall Street - and everyone else - is mostly focused on the possibility of re-marking gold to monetize US assets. It is unclear if the Treasury Secretary can unilaterally re-mark gold. Below is what we know.

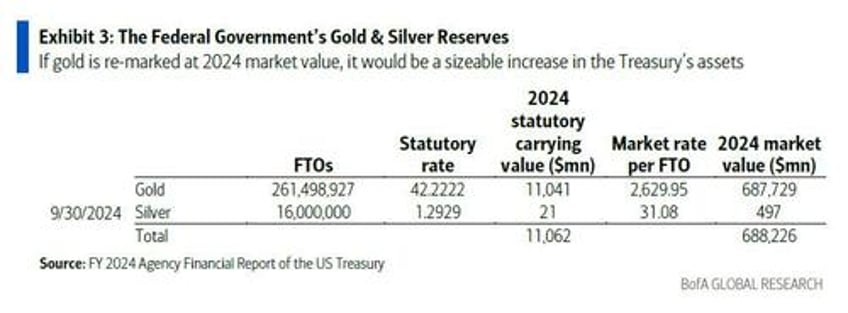

The latest US gov’t financial statement reflects holdings of $11.1bn in gold and silver (Exhibit 3).

This is based on a static value of $42.22 per fine troy ounce (FTO) as established by law & set in 1973 when Nixon cut the final loose threads linking the US dollar with gold. This gold value is referred to as the “statutory rate”. If Treasury remarked their gold, according to the most recent Treasury Agency Financial Report, the 2024 market value would be $688b. This would mean a $677b increase in Treasury’s assets.

There are a number of technical considerations around US gold holdings, including:

- US Treasury owns the gold & holdings are partially offset by a Treasury liability for gold certificates issued to the Federal Reserve at the statutory rate

- the value of the gold certificates is credited to the Treasury’s cash balance (TGA)

- the statutory rate gold value is set by law 31 USC 5117 though there is a clause that states “With the approval of the President, the Secretary may prescribe regulations the Secretary considers necessary to carry out this section.”

Current law defines the gold certificate value & it is unclear how much influence the UST Secretary has on potential gold re-marking value.

US gold re-marking would have implications for both the Treasury & Fed balance sheets.

US Treasury: assets would rise by the value of the gold re-marking & liabilities would rise by the size of gold certificates issued to the Fed.

Federal Reserve: assets would rise by value of gold certificates & liabilities would rise by a crediting of cash in the Treasury cash balance (Exhibit 4). And here is the punchline: the Fed balance sheet impact would look like QE though no open market purchases would be required & Fed liability growth would initially be in TGA.

In other words, the best of all words: a QE-like operation, one which see the Fed quietly funnel almost $700 billion in cash to the Treasury... but without actually doing a thing!

On net, a gold re-marking would increase the size of both Treasury & Fed balance sheets + allow for TGA to be used for Treasury priorities (i.e. SWF, pay down debt, fund deficit, etc). Meanwhile, the Fed and Treasury magically conjure some $700 billion out of thing air to be spent on whatever, all because the Treasury agrees that the fair value of gold is... the fair value of gold.

Needless to say, a gold re-marking would be seen by the market as unorthodox, if not completely unexpected. US gold has not been re-marked for decades likely to guard against (1) volatility of Treasury & Fed balance sheets (2) concerns over fiscal & monetary authority independence.

According to Cabana, a gold re-marking could cause TGA to be paid down in ways that stoke macro activity, risk inflation, & add excess cash into the banking system (higher TGA would eventually move to higher Fed reserves or ON RRP balances). In essence, gold re-marking would ease both fiscal & monetary policy (all else equal).

Indeed, just like a QE but without the actual QE.

The BofA strategist's conclusion is that gold re-marking is possible (and certainly likely after Bessent's comments), but has legal questions, "may not be well received by the market since it would amount to an easing of fiscal & monetary policies + erosion of fiscal / monetary independence" (yup, QE under any other name...). And, not unironically, the revaluation of gold will also send the price of gold (not to mention bitcoin and anything else that may also be subsequently remonetized) soaring.

As such, BofA places low odds of US asset monetization until Bessent provides more credible detail on how he will “monetize the asset side of the US balance sheet." We, however, having realized that Trump moves very fast and breaks everything in his path, are confident that the odds of a gold revaluation are surging, and are a big part of why gold is trading just shy of $3000...

For more, including what the rates market impact of a gold re-marking would be across the entire complex, read the full note available to pro subscribers in the usual place.