Inflation is back on the radar this week after yesterday's release of PCE in the US. It showed a modest fall from the prior month in the headline print (but under the surface the picture was more worrying), lending credence to the bigger picture signal of inflation pressures building again. Emblematic of how unpriced assets are for this likelihood, volatility in gold and silver and other metals is near decade lows.

Given how recently inflation was at generational highs, it is remarkable how complacent the market has become that the inflation problem is over. Normally after an inflation shock, there is a risk premium built into prices that persists for many years. It took a long time, and the brutal rate rises of Paul Volcker followed by the delphic utterances of Alan Greenspan, to finally convince the market to bring term premium back to the pre-Great Inflation levels of the 1960s.

Today, the fixing-swaps market foresees that CPI will return towards 2% CPI by the second half of this year. There is no risk premium for inflation built into yields, and money markets have a significant bias towards expecting lower not higher rates.

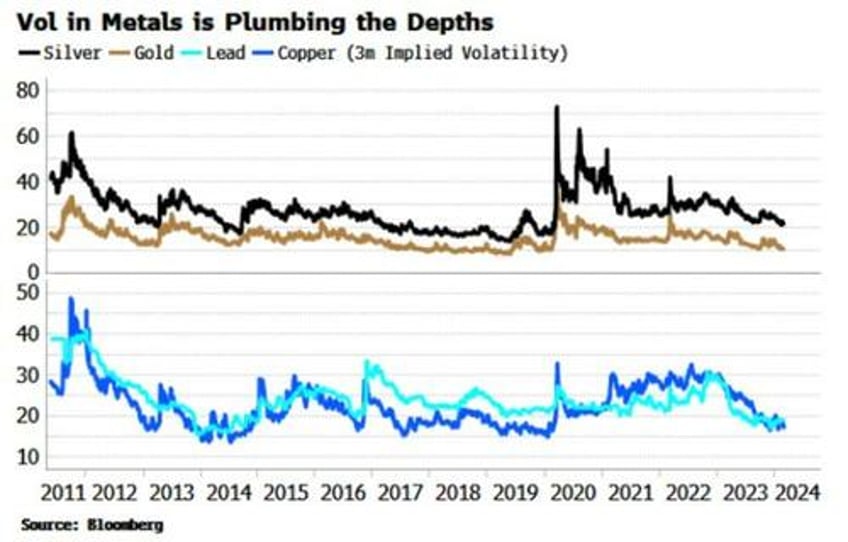

On top of that, commodity volatility is becalmed. Commodities and other real assets have historically performed well in in inflation regimes, with their volatility rising too. But implied vol in several commodities, especially metals and notably gold and silver, is preternaturally low.

This is not reflective of a market expecting a return of inflation, or indeed pricing much probability of it happening at all. No asset class, in fact, looks ready for an inflation redux.

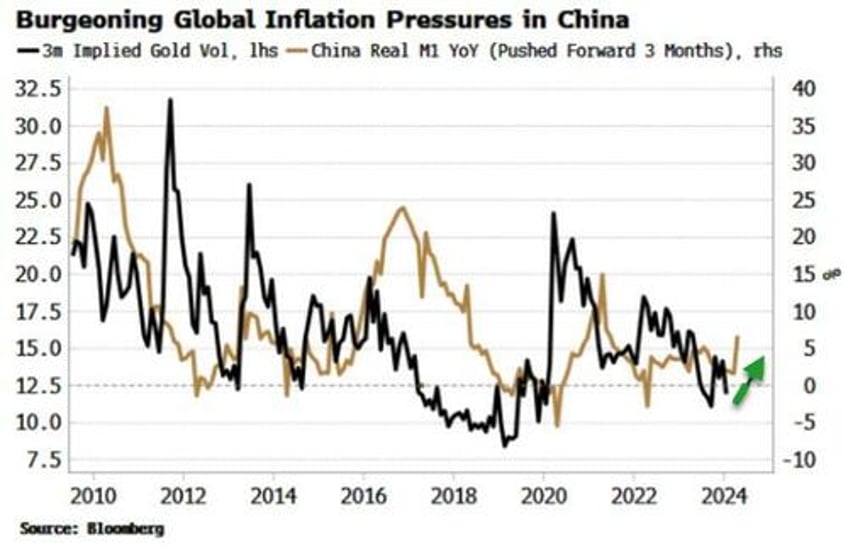

One of the biggest drivers of US disinflation over the last two years has not been domestic monetary policy, but deflation in China. Yet, very slowly, leading indicators of activity and inflation are beginning to pick up in China as layers of fiscal and monetary stimulus start to bite.

A sign that China will soon be contributing positively to global and US price pressures again -- and cause a repricing in markets -- can be seen in the nascent rise in real narrow money (M1) growth, which has led gold volatility in recent years.