Department store chain Macy's missed analysts' estimates for its quarterly revenue and lowered its outlook for sales for the full year, citing "more discriminating consumer and heightened promotional environment relative to its prior expectations."

The department store operator said Wednesday in a statement that sales in the second quarter through Aug. 3 fell 3.8% to $4.9 billion, missing the Goldman Sachs consensus of $5.10/$5.06 billion.

"In the second quarter, we began to see the customer become even more discerning," CEO Tony Spring said in an interview, as quoted by Bloomberg.

Spring continued, "We did not see any material change in our traffic. We did see a change in conversion, and that to us really means people were either distracted, or they were even more cautious than we had seen previously."

A team of Goldman analysts led by Brooke Roach and Evan Dorschne wrote in a note to clients that their first take on Macy's earnings was "Weaker comp trends and cautious revenue outlook overshadows better 2Q margin delivery."

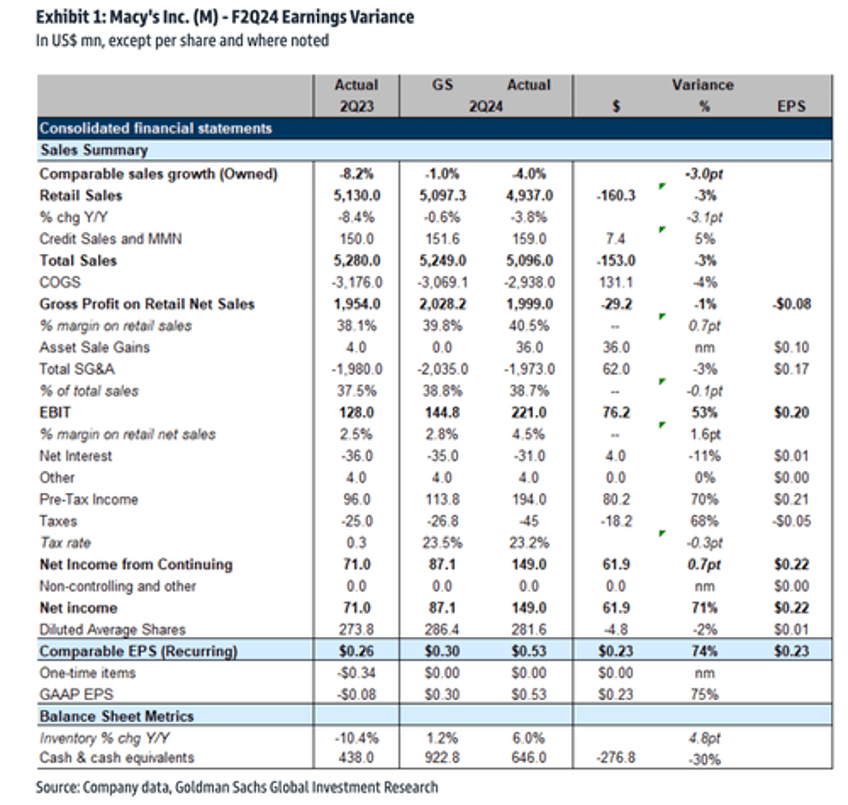

Here's the analysts' detailed breakdown of second-quarter results:

M reported F2Q24 EPS of $0.53, ahead of GS/FactSet consensus of $0.30 with the beat driven by better margins. Despite the beat, sales fell notably light of expectations in the quarter, with retail sales of $4.94bn well below GS/consensus at $5.10/$5.06bn, driven by a sequential slowdown in owned reported comps which decelerated to -4.0% vs. GS/FactSet consensus of -1.0%/-0.9%. This softer sales trend was offset by better profitability with gross margin as a % of retail sales at 40.5% (above GS/consensus 39.8%/40.1%), and SG&A as a percent of total sales at 38.7% (below GS/consensus at 38.8%/38.9%). Inventories were reported +6.0% Y/Y, compared to our expectation of +1.2% Y/Y.

After the weaker-than-expected quarter, attributed to a cautious consumer, Macy's lowered its annual outlook on sales for the fiscal year to between $22.1 and $22.4 billion, compared with the previous forecast (as of May 31) of between $22.9 billion and $22.3 billion.

Goldman's Roach and Dorschne added more color to the dismal outlook:

On the forward outlook, M reaffirmed its FY EPS guidance of $2.55-$2.90, vs. GS/consensus at $2.85/$2.78. However, management took a much more cautious tone on the consumer, pointing to a more discriminating consumer and a heightened promotional environment vs. prior expectations. As a result, management now expects comps (owned + licensed) at -2.0% to -0.5% (vs. -1.0% to +1.5% prior), and net sales are now guided at $22.1bn-$22.4bn (vs. $22.3bn-$22.9bn prior), indicating -4.3% to -3.0% Y/Y declines (vs. -3.4% to -0.8% prior), which compares to GS/consensus at -1.2%/-2.4%. For 3Q, management expects EPS at -$0.04 to $0.01 vs. GS/consensus at $0.07/$0.01.

The analysts noted, "This is a disappointing result for Macy's and a sharp cut to the company's forecast for sales and comp trends for the full year."

CEO Spring warned in the interview that "it will be a more rocky remainder of the year" for the consumer.

The retailer decided to increase product discounting to counter the slowdown in discretionary spending.

"We are leaning into every available expense stream" that doesn't erode customers' shopping experience, Spring said, adding, "We are trying to make sure that our cost of operations, our packaging, our delivery expense, our costs for paper and shopping bags" are decreasing.

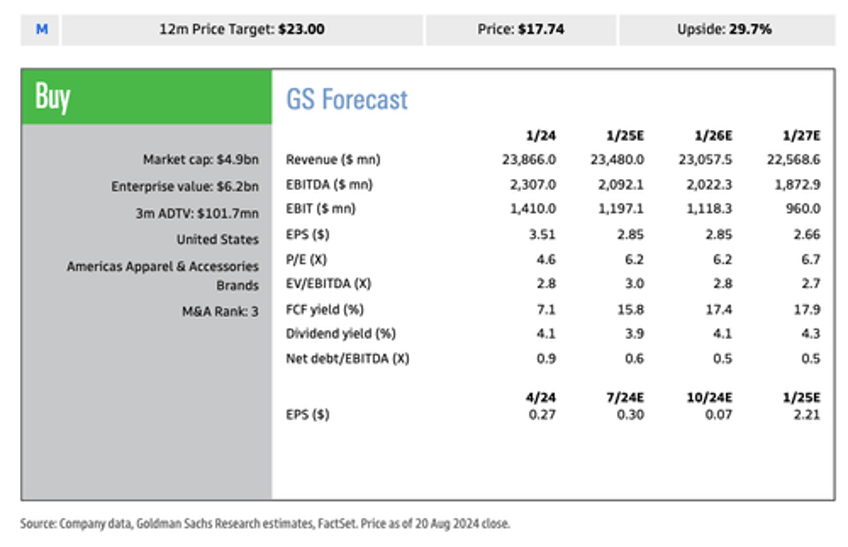

Goldman analysts concluded, "We are Buy rated on M. Our 12-month price target of $23 is based on 3.85x Q5-Q8 EV/EBITDA and includes a $1 per share contribution value from M's real estate."

Shares of Macy's are down more than 13% in the early US cash session...

...extending a multi-year trend lower...

Separately, Target beat Wall Street's earnings and revenue expectations, yet issued a cautious note on the consumer and gave a mixed outlook because of uncertainty surrounding discretionary spending in the months ahead.

Goldamn's consumer specialist, Scott Feiler, provided clients with commentary surrounding the latest and most important earnings from big box retailers, noting consumer weakness will still be a theme through year-end:

The big debate post WMT's beat and better than expected consumer commentary last week was whether they were just taking a lot of share, or if in fact they truly thought the consumer was stable. Post WMT's huge comp beat and comment that general merchandise flipped positive, expectations for TGT's comp moved from the +1% range to the +1.5% range. They hit the very high-end of the recent expectations (+2%) and importantly, beat margins by 90 bps, which they did not do last quarter. Is this an all clear in consumer? I would argue it is not, given that they are now talking to the low-end of the prior FY comp guide (probably some conservatism), despite this beat. However, it will certainly be good enough for TGT at this valuation and a little bit more of a relief for the space, even if not an all-clear (Macy's revenue miss and cut this morning).

What's clear with Home Depot and Lowe's executives is that home improvement trends remain under pressure. McDonald's and Disney have warned about waning consumer spending. And travel companies have warned about a slowdown. The theme building is that low/mid-tier consumers are under pressure in the era of failed Bidenomics.