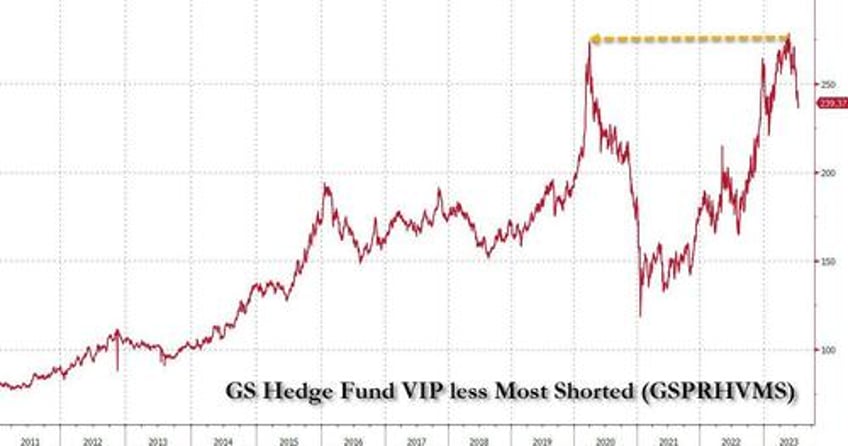

Two weeks ago, we were the first to point out something deeply concerning: while the Biden admin was poundings its chest, pointing to the surging S&P500 (not to mention seasonally-adjusted jobs and GDP numbers) which is just 5% from all time highs and at levels not seen in over a year, an index that was a proxy of hedge fund exposure (long the hedge fund VIP basket of companies and short the most popular shorts) had just suffered staggering losses after reaching a level that was identical to the pre-Covid crash.

Coming at a time when, contrary to what one would assume is pervasive euphoria as a result of the surge in the S&P, L/S managers "had experienced 9 consecutive days of negative alpha, the longest period since Jan 2017" and July was on course "to be the worst month in terms of alpha since May last year"...