Meme stock guru Keith Gill went from sticking it to Wall Street hedge funds shorting GameStop to front-running retail, which he knows will unleash buying power with every social media post. A report from The Wall Street Journal on Monday explained that ETrade, the online brokerage Gill trades from, has had enough of his stock-pumping shenanigans. Now, the Massachusetts securities regulator is getting involved as unwanted attention swarms the social media stonk influencer, also known as "Roaring Kitty."

Reuters reports that Massachusetts Secretary of State Bill Galvin, the state's top securities regulator, is investigating Gill's stock trading activities.

Gill resurfaced early in May with posts on various social media platforms, including X, which triggered a short squeeze on GME. The multi-day pump, trapping many retail traders at the top, ended with a dump. Around the time of the first pump, GameStop executives slammed the market with an offering of 45 million shares, allowing the company to raise $933 million. This was a major red flag.

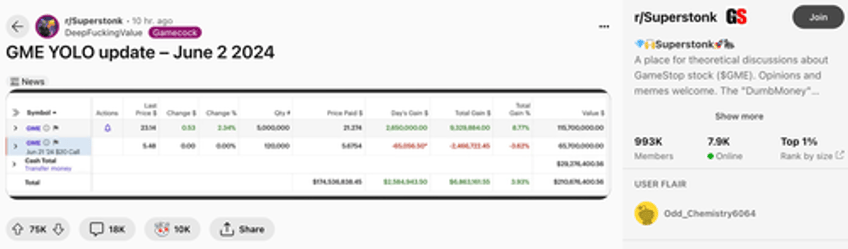

The beginning of the second pump first surfaced on Sunday evening when Gill posted an image of his ETrade account, showing GME stock valued at $115.7 million, $65.7 million in GME short-term options, and $29 million in cash.

Gill's GameStop June 21 call options at a strike price of $20 show the retail trader's time horizon was relatively short - just enough time to capitalize on a pump.

The Massachusetts securities regulator had no other information about the investigation. This shows that Gill has attracted unwanted attention to his stock-pumping.

Shares of GME are lower by 5.5% around lunchtime, trading around the midpoint of the $26 handle. Most of the second pump gains have been evaporated.

"Roaring Kitty went from being one of the little guys sticking it to Wall Street… …to front running multi million dollar trades that he knows his retail army will pump up by 80-100% after decides to tweet," X user itquidity said.

Roaring Kitty went from being one of the little guys sticking it to Wall Street…

— litquidity (@litcapital) June 3, 2024

…to front running multi million dollar trades that he knows his retail army will pump up by 80-100% after decides to tweet pic.twitter.com/HX6505a1Me

X user The Real Fly said, "Roaring Kitty is showing equity of nearly $200m in $GME. He is truly exceptional. My guess he parlayed the $45m he made from last gambit into the stock before the memes from $12-15, kicked it out over $50 and made 4x min on his equity. He's likely sitting on $300m and this is his dip buy basis."

Roaring Kitty is showing equity of nearly $200m in $GME. He is truly exceptional. My guess he parlayed the $45m he made from last gambit into the stock before the memes from $12-15, kicked it out over $50 and made 4x min on his equity. He’s likely sitting on $300m and this is his… pic.twitter.com/oOZ61om81T

— The_Real_Fly (@The_Real_Fly) June 3, 2024

"What made Keith Gill aka Kitty interesting initially was his authenticity. He shared a detailed investment thesis and put his money where his mouth was, which combined with a high short interest and a restless country and boom.. investing history. This time it feels different. Now, with $GME, he posts with a large account and a significant near-term option position, appearing more like manipulation without a solid thesis. Considering the stock is now 2,000% higher than his initial video almost 4 years ago. We believe someone is backing Gill—there's no way he made this size trade alone. His reported finances don't support t his trade. Investors will see through this roaring Icarus," Citron Research wrote on X.

What made Keith Gill aka Kitty interesting initially was his authenticity. He shared a detailed investment thesis and put his money where his mouth was, which combined with a high short interest and a restless country and boom.. investing history. This time it feels different…

— Citron Research (@CitronResearch) June 3, 2024

Meanwhile...

Imagine being such a beta cucked platform like e*trade that you want to ban RoaringKitty, the person responsible for making your platform relevant to millennials and probably the best piece of organic marketing you could ask for. They should offer him a referral code instead.

— Autism Capital 🧩 (@AutismCapital) June 4, 2024

Some on X say...

Retail isn't causing those pumps and either is he

— Sith_ball-sakius 🇺🇸🏴☠️ (@chucks_gas_Bsak) June 4, 2024

It's cute you think retail is behind the pump and not something larger.

— J Lutz (@Kemi_013) June 3, 2024