By Sam Bourgi of CreditNews,

Housing is becoming an exclusively upper-class privilege in a growing number of cities.

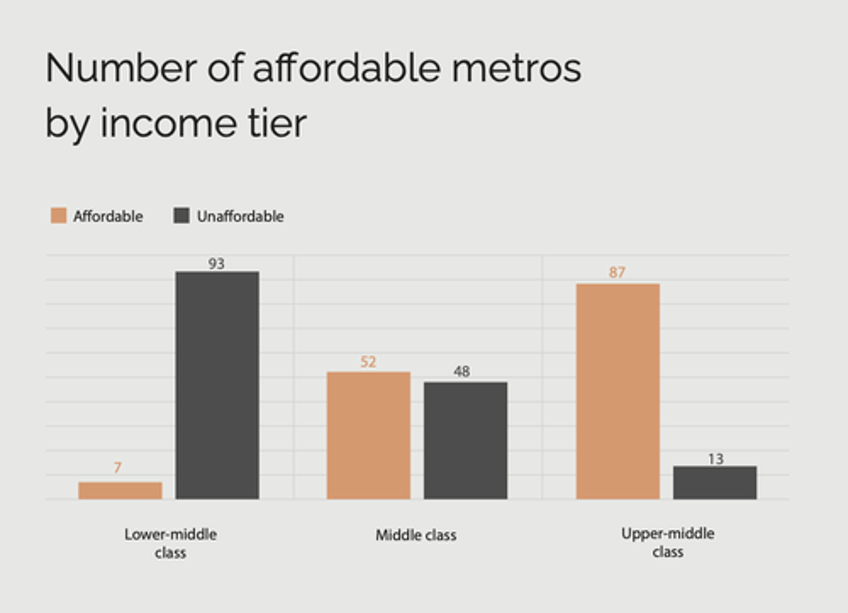

According to a new study by Creditnews Research, in 2024, middle-class households could afford to buy an average home in just 52 of the country’s 100 largest metros.

Just five years earlier, they could afford a home in 91 of the top 100 metros.

The situation is far worse for lower middle-class households, as they can only afford a home in seven of the largest 100 metros.

In total, 41 out of the 100 metros require a gross annual income of $100,000 or more to qualify for an average home. In 13 metros, an average income of more than $155,000 is needed.

In those cities, even the upper-middle class doesn’t qualify for an average home.

The study determined affordability by looking at how much income households need to earn to afford a down payment, mortgage payment, and related fees for an average home.

A home is considered affordable if monthly housing and mortgage costs don’t exceed 28% of a household’s gross income.

“There’s no two ways about it: Housing affordability has worsened significantly since Covid,” the report said. Since the pandemic, 39 of the most populous metros have fallen below the affordability threshold.

As expected, the most affordable areas for the middle class are located in the Midwest, Rust Belt, and parts of Texas, while the West Coast, Tri-State Area, and Hawaii are largely out of reach.

Affording a home is no longer a guarantee for the middle class

Being considered “middle class” doesn’t carry the same significance as it did just a few years ago.

“In the past, if you were middle class, it was almost assumed you would become a homeowner,” said Ali Wolf, chief economist of Zonda, a housing market research firm.

“Today, the aspiration is still there, but it is a lot more difficult. You have to be wealthy or lucky.”

That's all thanks to a “perfect storm” of elevated mortgage rates, sky-high home prices, and a lack of inventory, making housing more unaffordable.

The result is that middle-income buyers, or those with an annual income of up to $75,000, could only afford about one-quarter of listings on the market last year.

According to Nadia Evangelou, the director of real estate research at the National Association of Realtors, “Middle-income buyers face the largest shortage of homes among all income groups, making it even harder for them to build wealth through homeownership.”

Mortgage rates creep closer to 7%

After falling between November and January, mortgage rates are creeping back up.

According to Freddie Mac, 30-year fixed-rate mortgages reached 6.88% in the week of April 11 and at some point climbed well above 7%.

“As mortgage rates increase, it’s never good news for the housing market, especially when more sellers are in the mix,” said HousingWire lead analyst Logan Mohtashami.

“We saw a bounce in demand early in the year as rates fell. However, just like last year, when mortgage rates headed higher, it limits sales growth.”

The reversal seems to be driven by a surprise spike in inflation, which has come out higher than expected for four consecutive months

“For homebuyers, the latest CPI report means mortgage rates will stay higher for longer because it makes the Fed unlikely to cut interest rates in the next few months,” said Chen Zaho, Redfin’s economic research lead.

“Housing costs are likely to continue going up for the near future, but persistently high mortgage rates and rising supply could cool home-price growth by the end of the year, taking some pressure off costs.”