The Malaysian High Court was informed last week that a staggering $2.4 million in stolen funds was diverted from the scandal-plagued 1Malaysia Development Bhd (1MDB) sovereign wealth fund, into the accounts of celebrity Kim Kardashian and musician Pharrell Williams, who is also men’s creative director at Louis Vuitton, through fugitive businessman Jho Low’s shell company, Good Star Ltd.

According to The Star, Richard Templeman, a financial fraud investigator, made the revelation as part of his testimony in the US$6.59 billion lawsuit brought by 1MDB against former Treasury Secretary-General Tan Sri Mohd Irwan Serigar Abdullah and former 1MDB CEO Arul Kanda Kandasamy.

Templeman told the High Court that the investigation found, by October 25, 2011, 1MDB had transferred US$1.03 billion to Good Star for the benefit of Low.

“These funds were transferred through a series of offshore companies and used for, inter alia, the personal benefit of the co-conspirators and their relatives and associates”, he detailed in his witness statement,

Templeman explained that from the billions flowing through Good Star, $2,025,000 was moved to a Suntrust Bank account under the name of Talamasca Inc. Transactions between August 11 and November 17, 2011, were noted as “part payment for music production” and “Letter of Agreement DD 3 NOV 2011 Red Spring Investments And Talamasca/Pharrell Williams.”

“I note that publicly available information links Talamasca Inc. with musician Pharrell Williams,” Templeman was quoted as saying. However, he added, “I have no further information regarding this transfer of funds.”

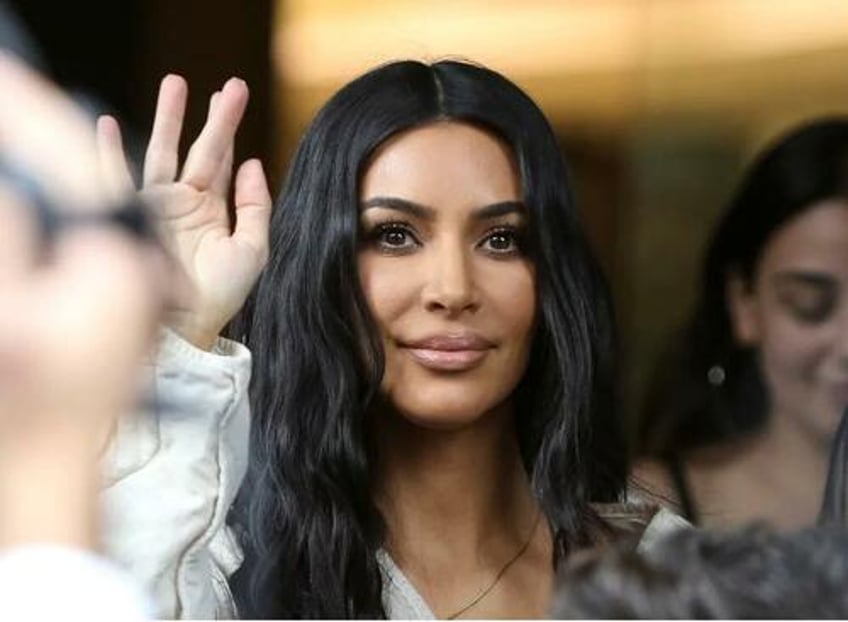

The Star also reported Templeman as revealing that further sums were paid from Good Star to various entities, including US$306,000 to reality TV star Kim Kardashian and another US$100,000 to Kardashian and her then-husband Kris Humphries.

The purpose of these transactions remains “currently unknown,” according to Templeman.

Templeman, who is a director of investigations at Kroll Advisory, oversees the ongoing probe into misappropriated funds from 1MDB and SRC International Sdn Bhd, which were channelled through liquidated companies.

In May 2021, 1MDB initiated a lawsuit against Mohd Irwan and Arul Kanda for breach of trust and conspiracy, leading to a reported $1.83 billion in losses related to an investment in 1MDB-Petrosaudi Ltd, later converted into the Brazen Sky Limited investment, which 1MDB claims is recoverable from the Bridge Global Fund.

The lawsuit also alleges that the defendants misappropriated $3.5 billion in funds paid to Aabar Investments and US$1.265 billion paid to International Petroleum Investment Company on May 9, 2017.

Furthermore, 1MDB accuses Mohd Irwan of colluding with Arul Kanda to extend an employment agreement, resulting in a RM2,905,200 payment to Arul Kanda and additional losses to the company.

As a result, 1MDB is seeking $6.59 billion in damages from both defendants and an additional RM2.9 million from Mohd Irwan related to the employment agreement extension.

The hearing will resume this afternoon before Judicial Commissioner Raja Ahmad Mohzanuddin Shah Raja Mohzan.