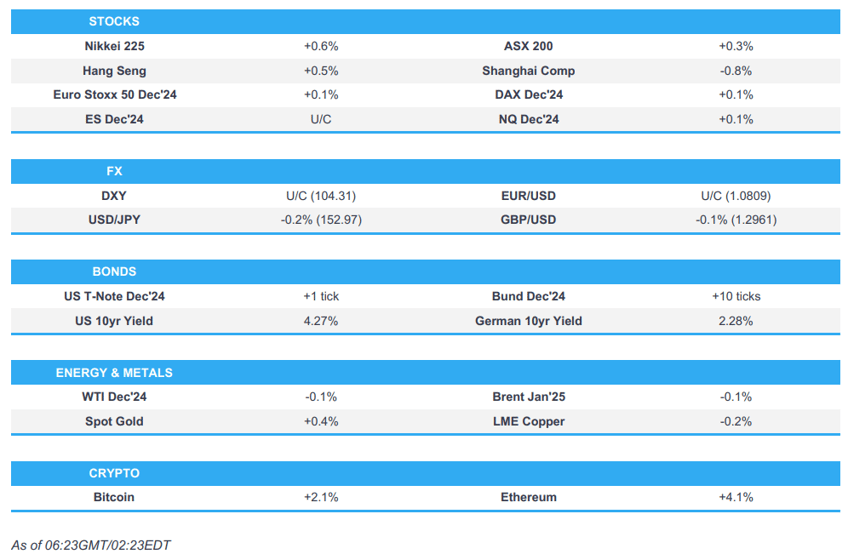

- APAC stocks were ultimately mixed alongside a lack of fresh catalysts heading into this week's key data releases.

- European equity futures are indicative of a marginally positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed higher by 0.5% on Monday.

- In FX, DXY is steady, JPY is attempting to claw back recent losses, antipodeans marginally lag, EUR/USD remains on a 1.08 handle.

- The Israeli cabinet decided there could be another response against Iran soon, according to Channel 13.

- Looking ahead, highlights include US Advance Goods Trade Balance, Wholesale Inventories, US Consumer Confidence, JOLTS, BoC Governor Macklem & Rogers, Supply from UK, Germany & US.

- Earnings from McDonald's, Pfizer, PayPal, D.R. Horton, Phillips 66, Royal Caribbean, MSCI, Corning, Sysco, Alphabet, Visa, AMD, Stryker, Chubb, Mondelez, Chipotle, EA, Snap, ASM International, Saint Gobain, Ferrovial, Santander, Novartis, Clariant, BP, Pearson, Deutsche Lufthansa, Covestro & OMV.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks predominantly closed in the green with outperformance in small caps, while the Nasdaq gave up its early gains as tech sold off. Most industries gained with financials leading the advances although Tech and Energy lagged and were the only sectors to close lower with the latter weighed on by tumbling crude prices in the aftermath of Israel's response to Iran which was seen as 'moderate' as it only focused on military targets and avoided oil or nuclear facilities.

- SPX +0.27% at 5,824, NDX unch. at 20,351, DJIA +0.65% at 42,388, RUT +1.63% at 2,244.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Treasury Financing Estimates showed US Treasury expects to borrow USD 546bln (prev. 740bln Q/Q) in Q4, assuming end of December cash balance of USD 700bln (prev. USD 850bln Q/Q), while the borrowing estimate is USD 19bln lower than the Q4 estimate announced in July 2024. Furthermore, it expects to borrow USD 823bln in Q1 2025, assuming an end-March cash balance of USD 850bln (Goldman Sachs expected USD 753bln, assuming a quarter-end cash balance of USD 750bln).

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed despite the initial tailwinds following the mostly positive handover from Wall St, with gains in the region capped and some markets were choppy owing to a lack of fresh catalysts heading into this week's key data releases.

- ASX 200 was led by strength in gold stocks after the precious metal extended on advances, while sentiment was also supported by M&A activity with Myer to acquire apparel brands from Premier Investments.

- Nikkei 225 recouped opening losses and extended higher amid recent currency weakness and lower unemployment.

- Hang Seng and Shanghai Comp traded mixed with the former underpinned by tech strength and as participants reflected on earnings releases, while the mainland index swung between gains and losses as EV and child-related policy initiatives were counterbalanced by frictions after the US issued final rules to curb US investments in AI, semis and other tech sectors in China.

- US equity futures were contained as participants awaited a slew of upcoming key data releases and earnings results.

- European equity futures are indicative of a marginally positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed higher by 0.5% on Monday.

FX

- DXY was uneventful as newsflow from the US remained quiet ahead of this week's slew of key data releases stateside including JOLTS, GDP, Core PCE & NFP, while the US election and the latest Fed meeting are scheduled for the following week.

- EUR/USD traded sideways after its recent reclaim of the 1.0800 status but with little catalysts for a further upward boost.

- GBP/USD lacked conviction after having recently eased back from resistance at the 1.3000 level.

- USD/JPY faded some of the post-election advances and briefly reverted to the sub-153.00 territory.

- Antipodeans were lacklustre amid a quiet calendar, mixed risk appetite and an overall uneventful mood in the FX space.

FIXED INCOME

- 10yr UST futures were little changed after the prior day's flimsy mood and with prices not helped by soft 2yr and 5yr auctions, while the Treasury financing estimates failed to impact markets as the attention turns to upcoming data and a 7yr auction.

- Bund futures sat above the 133.00 level following yesterday's rebound with further upside contained ahead of a Bobl auction.

- 10yr JGB futures struggled for direction amid the ongoing political uncertainty in Japan and after data showed a surprise decline in Japan's Unemployment Rate, while the mostly stronger results from the 2yr JGB auction failed to inspire a bid.

COMMODITIES

- Crude futures attempted to nurse some of the losses after slumping by more than 5% the prior day in reaction to Israel's moderate response to Iran although the recovery gradually waned after WTI hit resistance at the USD 68.00/bbl level.

- US DoE announced a new solicitation for up to 3mln bbls of oil for delivery to the Strategic Petroleum Reserve from April 2025 through to May 2025.

- Spot gold edged higher and looked to retest last week's all-time highs but then stalled in choppy trade.

- Copper futures were subdued after recent indecision and with prices not helped by the tentative risk sentiment.

CRYPTO

- Bitcoin advanced overnight following a return above the USD 70k level for the first time since June and briefly reclaimed the USD 71k level before paring some of the gains.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Ishiba is said to seek a partial coalition with the DPP. In relevant news, Japanese DPP head Tamaki said they will push the government towards policies that increase take-home pay and want to enact at least one or two of their policies, while he favours an extra budget to respond to the aftermath of the Noto earthquake. Tamaki said they have not heard from the LDP about a partial coalition and are exchanging information with the LDP, CDP and Ishin, while he waits for the LDP response on a possible coalition but declined to join the LDP-Komeito ruling coalition and does not understand what a partial coalition would mean. Furthermore, Tamaki said the BoJ should avoid big policy change for now with real wages at a standstill and can review monetary policy if there is certainty that wage growth will exceed 4% at next year’s wage negotiations, according to Reuters and Nikkei.

- Auto and tech industry groups asked the US Commerce Department for more time before implementing Chinese software and hardware restrictions, while it was also reported that the Mexican government noted the Biden administration's proposed connected car rules could disrupt the auto supply chain from China.

- UK is reportedly open to restarting China trade talks, according to POLITICO.

DATA RECAP

- Japanese Unemployment Rate (Sep) 2.4% vs. Exp. 2.5% (Prev. 2.5%)

- Japanese Jobs/Applicants Ratio (Sep) 1.24 vs. Exp. 1.23 (Prev. 1.23)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said they have not received an offer to release 4 hostages in exchange for a 48-hour ceasefire in Gaza, according to Asharq News. It was separately reported that Israeli PM Netanyahu is waiting to see who will succeed President Biden before committing to a diplomatic path, according to NYT.

- Israeli Defence Minister Gallant said the Israeli forces' targeting of Iranian radars and air defence systems will help Israel if it decides to launch a new attack on Iran. Furthermore, he stated the recent Israeli attack led to a change in the balance of power with Iran and that Iran is no longer able to produce weapons and defend itself as in the past.

- Israel’s Channel 13 reported that following the UAV strike on PM Netanyahu's residence last week, the cabinet decided there could be another response against Iran soon and noted that two days after their repentance operation and the IDF attack on Iran, the working assumption in the security establishment is that there will be an Iranian response. However, the report added that it seems Tehran has not yet decided whether and how to attack, while the security establishment assessment is that Iran is not interested in acting immediately.

- Iranian representative to the UN Security Council said Israel and its US backer bear responsibility for the dangerous escalation in the region and most of the bombs that Israel drops on civilians are made by the United States. Iran's envoy added the US government is complicit in the Israeli aggression and will be punished for its action, while they reserve the right to respond to Israeli aggression at a time of their choosing.

- It was initially reported that Israel seeks a deal with Lebanon in exchange for measures to prevent the rearmament of Hezbollah and to cancel the expansion of the ground operation in exchange for a sea, land and air embargo on Lebanon, while it aims for a 60-day ceasefire during which the details of a full agreement will be reached, according to Al Jazeera citing Israel Channel 12. However, Israel PM Netanyahu's office denied holding consultations with Washington to prevent expanding fighting in Lebanon for 60 days and said there is no retreat from fighting in Lebanon before ensuring Hezbollah's exit from the south, according to Al Arabiya.

- Yedioth Ahronoth reported ongoing talks for a settlement in Lebanon are at an advanced stage with US envoy Hochstein leading these efforts and plans to visit Israel and Lebanon. Western sources said Hezbollah agreed to separate the Lebanon file from Gaza and Hezbollah got the green light from Iran to retreat to northern Litani, while the new proposal includes the deployment of the Lebanese army in the south and begins with a 60-day cessation of hostilities by Israel and Hezbollah, according to Sky News Arabia.

- Senior member of the Gaza abductees' deal negotiating team resigned due to a lack of progress on the deal, according to Israel Broadcasting Corporation cited by Sky News Arabia.

- CIA Director floated a 28-day Gaza ceasefire and hostage deal in Doha, according to Axios. It was also reported that the CIA Director and Qatari PM are starting to develop the idea of a partial agreement in the Gaza Strip, while Israel agreed to a temporary ceasefire, but Hamas wants a halt that leads to irreversible Israeli steps, according to Axios and Al Jazeera.

- Israel’s parliament passed a bill to ban the UNRWA from operating inside of Israel.

- UN Secretary-General Guterres said if Israel's laws on UNRWA are implemented, it could have devastating consequences for Palestine refugees in occupied Palestinian territory which is unacceptable, while he added there is no alternative to the UNRWA and it is indispensable.

OTHER

- North Korea is ready for another military satellite launch thanks to Russia's technological support, according to Yonhap citing South Korea's spy agency. Furthermore, the report noted that North Korea sent 4,000 workers to Russia this year, while certain high-ranking military officials and troops deployed to Russia might move to the frontline.

- Pentagon reportedly suffers from a shortage of air defense missiles due to growing demand and fears running out of interceptor missile stockpile, while the shortage jeopardises US interests in the Pacific, according to WSJ

EU/UK

NOTABLE HEADLINES

- ECB's de Guindos said the price outlook is surrounded by substantial risks and inflation is to decline to the target next year. De Guindos reiterated official ECB rate guidance and noted that domestic inflation remains high through moderating, while he added that risks to the growth outlook are elevated and tilted to the downside.

DATA RECAP

- UK BRC Shop Price Index YY (Oct) -0.8% vs Exp. -0.5% (Prev. -0.6%)