- APAC stocks were mixed amid the holiday-thinned conditions and as participants braced for this week's central bank announcements including from the FOMC, BoE and BoJ.

- Chinese house prices further deteriorated, while the latest Chinese Industrial Production and Retail Sales also disappointed.

- After last week's late dovish Fed repricing, odds of a 50bps cut sit at 59% vs. 41% chance of a 25bps reduction.

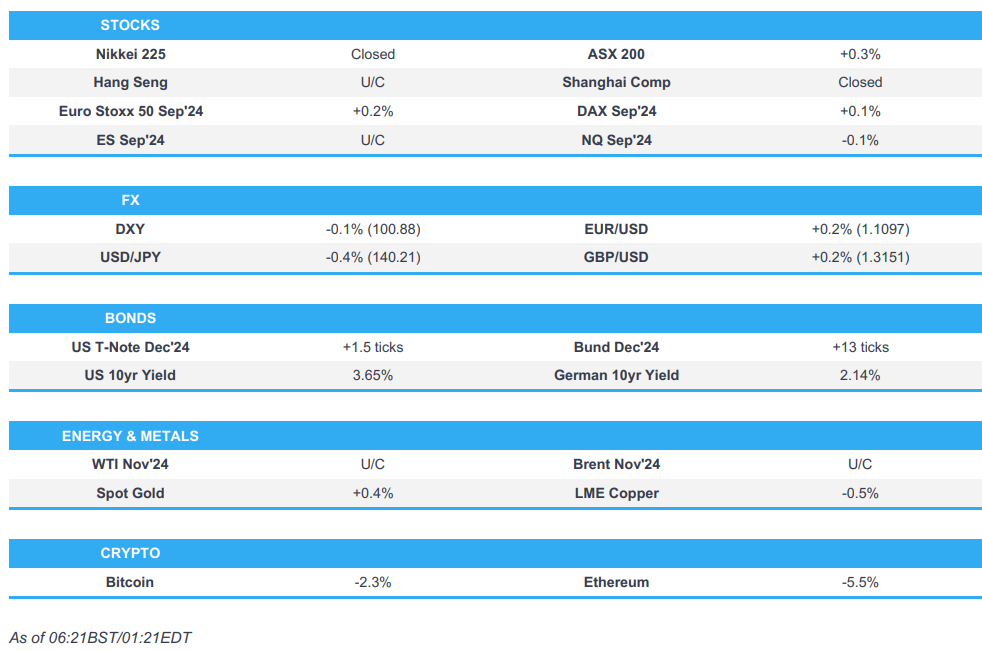

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.2% after the cash market closed higher by 0.6% on Friday.

- DXY is on the backfoot and back below the 101 mark, EUR/USD sits around the 1.11 level, JPY is the biggest gainer vs. the USD.

- Looking ahead, highlights include EZ Labour Costs/Wages, NY Fed Manufacturing, Canadian Manufacturing Sales, ECB Survey of Monetary Analysts, Comments from ECB’s de Guindos & Lane.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were bid throughout Friday's session with outperformance in the small caps Russell 2k and all sectors closed in the green with Utilities, Communication and Materials the best performers although Health Care, Real Estate and Financials lagged, while T-Notes bull steepened as traders increased bets for a 50bp rate cut at the upcoming Fed meeting with money markets pricing the decision at a near coin toss.

- SPX +0.54% at 5,626, NDX +0.47% at 19,515, DJIA +0.72% at 41,394, RUT +2.49% at 2,182.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Multiple shots were fired near former President Trump’s golf course in West Palm Beach and the Secret Service reportedly opened fire at a suspected person with a weapon while Trump was golfing, according to law enforcement sources cited by AP. Trump’s campaign said the former President is safe following a shooting in his vicinity, while Trump said he will never give up and nothing will stop him. Furthermore, the FBI said it is investigating what appears to be an assassination attempt and a Palm Beach law enforcement official said the suspect was arrested and that they found an AK-47 type weapon.

- Goldman Sachs still sees 25bps of Fed easing this week and for each remaining meeting this year, while JPMorgan reiterated its call for a 50bp Fed rate cut in September.

- WSJ opinion piece by Greg Ip noted that the Fed's rate decision this week looks more difficult than it should be and the real question isn’t how much to cut, but where rates ought to be, while it added that the answer is much lower which argues for a half-point cut.

APAC TRADE

EQUITIES

- APAC stocks were mixed amid the holiday-thinned conditions with many key markets in the region closed and as participants braced for this week's central bank announcements including from the FOMC, BoE and BoJ.

- ASX 200 mildly gained as real estate and financials led the advances across most sectors aside from defensives.

- Hang Seng was dragged lower amid the absence of mainland participants and with underperformance seen in property developers after Chinese house prices further deteriorated, while the latest Chinese Industrial Production and Retail Sales also disappointed.

- US equity futures (ES +0.1%) took a breather after rallying on Friday as markets priced increased odds for an incoming 50bps Fed rate cut.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.2% after the cash market closed higher by 0.6% on Friday.

FX

- DXY dipped below 101.00 ahead of the FOMC and as participants second-guessed the magnitude of a looming Fed rate cut.

- EUR/USD edged mild gains and eventually retested the 1.1100 level which has provided some resistance.

- GBP/USD was slightly firmer although further upside was limited with a BoE meeting also scheduled later this week.

- USD/JPY remained subdued after last week's retreat and with Japanese participants away for Respect for the Aged Day.

- Antipodeans were initially rangebound following the disappointing data releases from China, but later took advantage of the softer buck.

- Bank of Canada Governor Macklem opened the door to increasing the pace of rate cuts as growth fears mount, according to FT.

FIXED INCOME

- 10yr UST futures traded little changed as money markets pointed to a near-coin flip between a 25bps or 50bps rate cut by the Fed and with overnight treasury cash trade is shut owing to the holiday closure in Tokyo.

- Bund futures kept within a relatively tight range amid a lack of pertinent drivers.

COMMODITIES

- Crude futures were little changed after Friday's pullback and as output shut-in at the Gulf of Mexico gradually returned post-Francine.

- Almost a fifth of US Gulf of Mexico crude oil production remained offline and nearly 28% of natural gas production was shut-in in the aftermath of Francine on Sunday, according to the US offshore energy regulator cited by Reuters.

- BP (BP/ LN) is restarting operations at its Castrol lubricants facility in Port Allen, Louisiana after determining conditions are safe to return and Shell (SHEL LN) is ramping up production at Perdido following the resolution of downstream issues, according to Reuters.

- Chevron (CVX) said its US Gulf of Mexico Jack/St Malo and Big Foot platforms are producing at reduced rates due to onshore gas plant disruption, while it continues to return workers and restore oil production at the US Gulf of Mexico Anchor and Tahiti platforms shut-in by Francine with initial assessments showed that neither the Anchor nor Tahiti platforms suffered significant damage, according to Reuters.

- Spot gold marginally extended on all-time highs ahead of this week's widely expected Fed rate cut.

- Copper futures suffered mild losses after disappointing Chinese data and with its largest buyer on a 4-day weekend although prices are off intraday lows.

CRYPTO

- Bitcoin was pressured and steadily retreated to beneath the USD 59,000 level.

NOTABLE ASIA-PAC HEADLINES

- China is strongly dissatisfied with and firmly opposes the US locking in tariff hikes on Chinese imports. Furthermore, China urges the US to immediately correct its ‘wrongdoings’ and lift all tariffs imposed on Chinese goods, while China will take necessary measures to firmly safeguard the interests of Chinese firms, according to MOFCOM.

- China Stats Bureau spokesperson said China will step up macro policy adjustments, while they expect a mild rebound in the consumer price index and for quickening bond issuance and policy initiatives to support China’s investment growth.

DATA RECAP

- Chinese Industrial Output YY (Aug) 4.5% vs. Exp. 4.8% (Prev. 5.1%)

- Chinese Retail Sales YY (Aug) 2.1% vs. Exp. 2.5% (Prev. 2.7%)

- Chinese Urban Investment YTD YY (Aug) 3.4% vs. Exp. 3.5% (Prev. 3.6%)

- Chinese House Prices YY (Aug) -5.3% (Prev. -5.0%)

GEOPOLITICS

MIDDLE EAST

- Sirens sounded in Avivim in the Upper Galilee to warn of rocket launches, according to Al Jazeera.

- Yemen’s Houthis claimed responsibility for a missile attack on central Israel and stated that a Yemeni missile reached Israel after 20 missiles failed to intercept it. There were separate reports that Israel’s military announced sirens were set off by a missile which crossed into the country from the east and fell in an open area but caused no casualties.

- Israeli PM Netanyahu said Yemen’s Houthis should know that they will exact a heavy price for every attempt to harm Israel and noted that a missile fired from Yemen most likely fragmented in mid-air, while he also said the current situation in northern Israel will not continue.

OTHER

- Russia’s Medvedev said Russia already has formal grounds to use nuclear weapons but has so far chosen not to do so, while their patience has its limits and their response might come in non-nuclear form.

- Russia’s Deputy Foreign Minister said Moscow is aware that the West decided on whether to allow Ukraine to strike deep within Russia and that Moscow should use other means since verbal warnings to the West against escalation are not working, according to TASS.

- G7 Foreign Ministers condemned in the strongest terms Iran’s export and Russia’s procurement of Iranian ballistic missiles, while they called for Iran to immediately cease all support to Russia’s illegal war against Ukraine and halt such transfers of ballistic missiles, according to Reuters.

- Ukrainian President Zelensky said Ukraine brought home 103 POWs from Russia in a second swap in two days and noted the incursion into Kursk helped bring about a prisoner exchange with Russia.

- Ukrainian spy chief Budanov said North Korea’s artillery supplies to Russia are a major problem and have a visible battlefield impact. Budanov said that Russia has ramped up production of Iskander ballistic missiles and guided bombs, as well as commented that Russia expects to face recruitment problems in the summer of 2025.

- US National Security Adviser Sullivan said long-range weapons permission is the subject of intense consultations among allies and that fighting around Ukraine’s Pokrovsk is of unique concern, while the US is preparing to present a substantial Ukraine aid package this month.

- US military member was detained in Venezuela and it was also reported that two additional US citizens were detained, according to a State Department spokesperson cited by Reuters.

- Russian and Chinese warships practiced missile and artillery firing in the Sea of Japan as part of Ocean-2024 drills, according to RIA.

- China’s military said the transit of two German warships in the Taiwan Strait increased security risks and sent a wrong signal. China’s military also stated that Chinese troops are always on high alert and ready to counter all threats and provocations.

- China’s Coast Guard said Philippine vessel 9701 withdrew from the Sabina Shoal on September 14th which ‘illegally’ stayed there for nearly five months, while it added that China took measures against the Philippine vessel in accordance with the law and the Philippines’ repeated attempts to organise supple replenishment to the vessel had all failed. However, the Philippines said it would send another vessel to immediately takeover from the vessel in the disputed Spratlys.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves was advised by a group of leading economists that cutting public investment in the UK would damage the foundations of the economy, according to FT.

- ECB's Makhlouf said on Friday that the ECB is not pre-committing to a particular rate path.

DATA RECAP

- UK Rightmove House Price Index MM (Sep) 0.8% (Prev. -1.5%)

- UK Rightmove House Price Index YY (Sep) 1.2% (Prev. 0.8%)