Submitted by QTR's Fringe Finance

The bad news is that it has taken decades to expose the rot that has been making its way through Ivy League institutions in our country.

The good news is that with such glaring examples as the multiple university presidents who humiliated themselves in front of Congress talking about the response to the Israel-Palestine conflict on their campuses, it is now impossible for even the most lobotomized groupthinkers to ignore said rot.

Bill Ackman has personified the awakening of many. Ackman, a Jewish Harvard alum who leans left, has obviously had enough, openly and publicly waging war not only against Harvard and its former President Claudine Gay, but also against wider diversity, equity, and inclusion (“DEI”) policies that have threaded their way through both universities and corporate America.

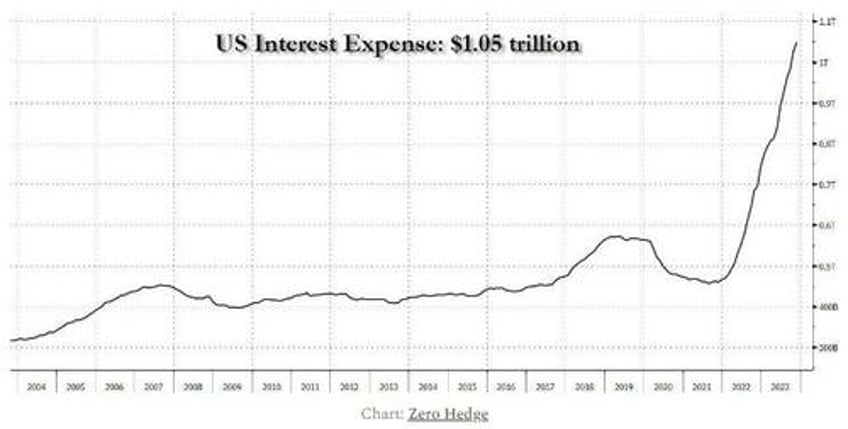

While I commend Ackman's crusade and think he will be on the right side of history, there’s one string I’m sure he won’t pull on: the fact that the universities that have been revealed as pseudo-intellectual circle-jerks, generating little to nothing of value, are the very same institutions that have validated, solidified and legitimized the monetary theory governing how our central bank policies take shape in the United States. You know, the ones that have led us here:

Chart: Zero Hedge

At this point, almost everybody knows that the United States is in a far more precarious fiscal position than it has been at any time in recent history.

And I’m sure there will be plenty of time to play the blame game when demand for US treasuries dries up. But it sure would be interesting to examine the theory of who to blame right now, before the storm hits, wouldn’t it?

There are generally two schools of thought in the world of monetary policy. The first is that central banking and the ability to print new money out of thin air, despite it only being backed by confidence, is some type of well thought out, esoteric solution to the economic "problem" of markets having downward cycles. At the same time, this theory of money also allows us to avoid our debt responsibilities, enrich the world's wealthiest people, bail out bad actors on Wall Street, and generally socialize the losses of whomever the government deems worthy. In other words, it’s the school of thought that we have somehow engineered an academic hack that allows us to usurp and manipulate the natural laws of free markets and economies, sold to the public as a key to leading us towards Utopia.

The second school of economic thought, to quote the parlance of Vincent LaGuardia Gambini, is that everything in the first school of economic thought is “bullshit".

“Everything that guy just said in that last paragraph is bullshit. Thank you.”

It’s obvious which of these two camps I’m in: I simply believe that the system can’t continue the way that it operates today forever. To me, it appears to be a mathematical impossibility. And as I’ve mentioned many times in previous articles and podcasts, the especially nefarious thing about the first school of thought is that its consequences manifest in the background, cloaked by a global misunderstanding of how the system works and acceptance by the commonfolk — the construction workers, teachers, truck drivers, waiters and small business owners — who are too busy actually generating productivity to fact-check whether or not Jerome Powell is really Bernie Madoff in an intricate disguise.

TODAY ONLY: 50% OFF ALL SUBSCRIPTIONS: Subscribe and get 50% off and no price hikes for as long as you wish to be a subscriber.

Despite the fact that adoption of Bitcoin is shoehorning in an understanding of monetary policy that may not have existed otherwise with a younger generation, it still may be years before the moms and pops understand how monetary policy works. By the time they do, it’ll be because it’s too late, and we’ve crossed the point of no return. Even after it happens, many will not believe that the United States has defaulted on its obligations because the disaster will likely take place as a “soft default” — a situation where the country winds up technically meeting all of its financial obligations, but does so via rampant money printing that eventually erodes the purchasing power of the US dollar and causes extreme inflation.

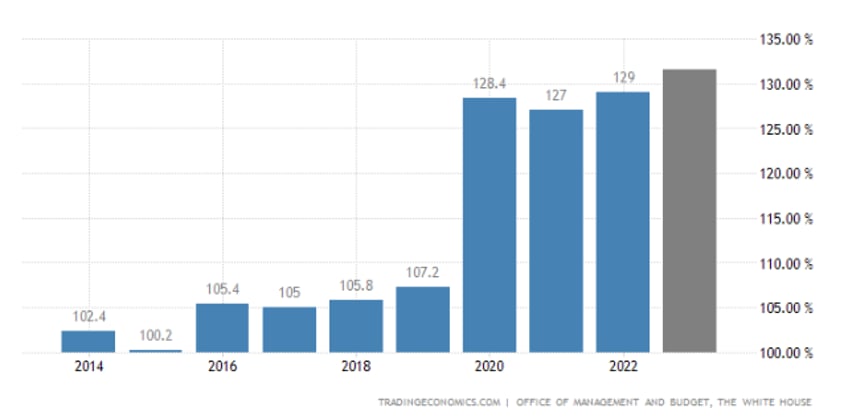

But with our debt to GDP over 120% and interest on the national debt totaling $1 trillion+ – with the Treasury planning to sell nearly twice as much in bonds next year as it did this year – we are quickly accelerating into uncharted, unprecedented, and what I believe to be extremely dangerous territory for our country and its currency.

Gross debt to GDP

Last night, JP Morgan called the U.S.’s $34 trillion in debt a ‘boiling frog’ situation. Another way of saying this is that the U.S. appears to simply have descended into a debt spiral that it won’t be able to legitimately make its way out of. As such, the consequences for money printing over the next decade will likely be the most pronounced that they’ve ever been: an even further widening of the inequality gap, prices moving significantly higher, and the middle and lower class disproportionately bearing the burden and suffering a lower quality of life while the powers that be offer them a $1/hour minimum wage hike and a $500 ‘stimulus’ check as some type of stick consolation prize hush money.

My guess is when this becomes too evident to ignore even to many on the left – just as the comments multiple university presidents made before Congress were - that there is going to be a hell of a lot of finger-pointing to go around. And let me be the first to spoil the party for everybody ahead of time: most of the blame can be placed squarely on academia, which continues to give sustenance to the egregiously toxic ideas that have warped our way of thinking about economics and finance.

Paul Krugman once joked back in 2008 or 2009 that he had a lot of sympathy for Ben Bernanke because they both went to Princeton together. I saved the quote years ago but can’t remember the source, so you have to take me on my word on this one:

“I am entirely sympathetic to the efforts of the Fed, this is a very hard time. But you should know that I am biased, because before he was promoted, Ben Bernanke was the Chairman of the Princeton economics department.” - Paul Krugman

This is a simple example that demonstrates exactly what I’m talking about.

Ben Bernanke failed to see the subprime mortgage crisis when it was waving its schlong directly in front of his face. Rather than Krugman rightfully criticizing his counterpart with whom he shares some dorky Ivy League-crested jacket, he instead chose to give him accolades and “sympathy” simply because they both went to Princeton. The academic world loves both of these “geniuses” and can’t get enough of them – hell, they’ve both even won Nobel prizes. And that wasn’t enough fluffing for Krugman: he took to the New York Times to exclaim his delight on Bernanke sharing the prize with him.

“Fortunately, by then Bernanke was chair of the Federal Reserve,” Krugman gushed about the 2008 housing crisis that Bernanke failed to predict. “He understood what was going on, and the Fed stepped in on an immense scale to prop up the financial system.”

Janet Yellen, our our extraordinarily incompetent Treasury Secretary who is personally overseeing pornographic amounts of spending and can’t figure out why a ratings agency would downgrade the U.S. despite our inability to acknowledge, let alone pay back, debt — and who incorrectly predicted that inflation would be transitory weeks after predicting we wouldn’t see another financial crisis in her lifetime, is a graduate of Yale and Brown, and has worked at Harvard.

The Federal Reserve as a whole, which has also been unable to correctly predict inflation and still doesn’t have any idea what the normalized rate of interest should be, employs hundreds of economists with PhDs, many from Ivy League schools.

My prediction is that Jerome Powell is at some point soon about to oversee one of the sharpest declines in the economy and stock market in US history. If I’m right, and that happens, they’re either going to let the economy (1) descend into a deflationary depression or they are going to (2) print tens of trillions of dollars to “fix” it. Either way, just remember that right now the Fed and its hundreds of PhDs are telling you that a soft landing is imminent, and that they are winning, or have won, the fight against inflation. Hell, they’re already talking about rate cuts for next year.

Keeping in mind that…

the subprime housing crisis went exactly the opposite of how Ben Bernanke predicted when he said “subprime is contained”

the Fed caved after hiking rates just ~2% when the market crashed in December 2018

the Fed has often described inflation as a “mystery” despite it being one of the sole key economic concepts they are required to understand

the Fed has often admitted they don’t know what normal interest rates should be, despite being in charge of them

the Fed incorrectly predicted inflation as transitory after overseeing one of the largest expansions of the money supply in history

…maybe when it all goes horribly wrong, people will finally stop and think about the role academia — the sole consistency behind all the decision makers pulling the monetary policy strings — has played in making monetary theory the can of silly string it has become today.

And so, it’s all fun and well to beat up on DEI hires for plagiarism, but the economy and monetary policy are going to show us that the rot in academia goes far deeper – and will have extraordinarily more profound consequences when the shit hits the fan.

Because when the economy and the US dollar don’t wind up doing what our central bank relies on them to do to further 50 years of flawed policy, the problems we’re going to face as a result of these continued economic academic circle jerks are going to make the recent Congressional hearing about the Israel-Palestine protests look like a Caribbean cruise.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. Contributor posts and curated content are posted either with the author’s permission or under a Creative Commons license. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.