Despite a soaring stock market, money-market funds saw $16.7BN of inflows last week, to a new record high of $6.018 TN in assets under management as yields rose this week after Powell poured cold water on rate-cut hopes.

Source: Bloomberg

But, but, but, 'money on the sidelines' and stuff?

In a breakdown for the week to Feb. 7, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.89 trillion, a $3.71 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets rise to $1 trillion, a $12.4 billion increase.

Institutional funds saw inflows ($3.1BN) for the 2nd straight week, and Retail funds continued their unbroken streak of inflows...

Source: Bloomberg

After a sizable $47BN decline the prior week, The Fed's balance sheet expanded by $1.2BN last week...

Source: Bloomberg

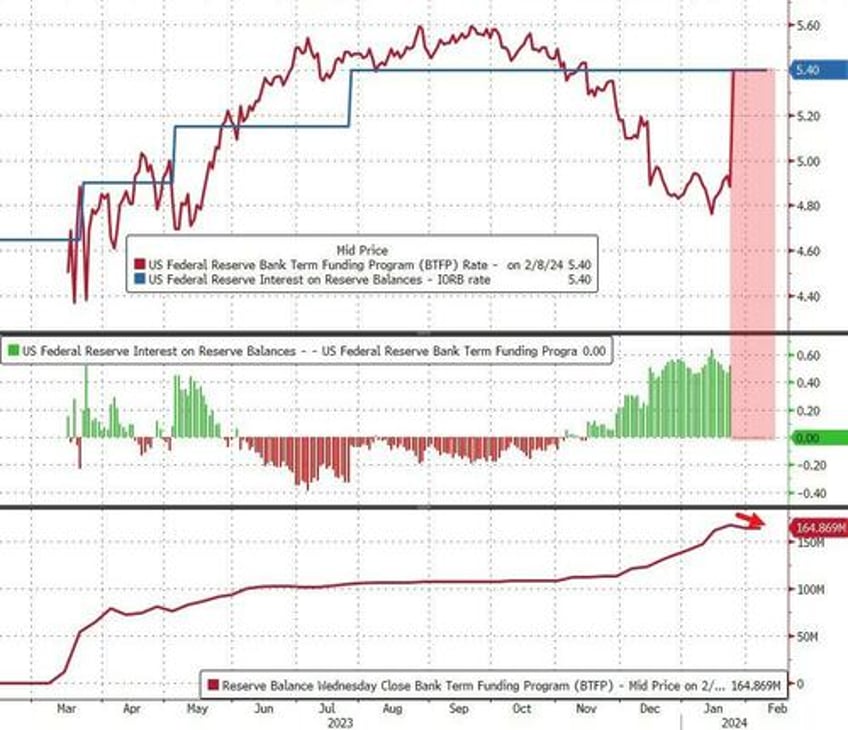

With the Fed's free-money arb now done and dusted (red rectangle below), The Fed's bank bailout facility declined a tiny $369 Million, hovering above $165BN still...

Source: Bloomberg

The Fed's Reverse Repo facility saw further liquidity drawn down, on target for a March meeting with the x-axis...

Source: Bloomberg

Bank reserves at The Fed rose on the week but US equity market cap remains notably decoupled still...

Source: Bloomberg

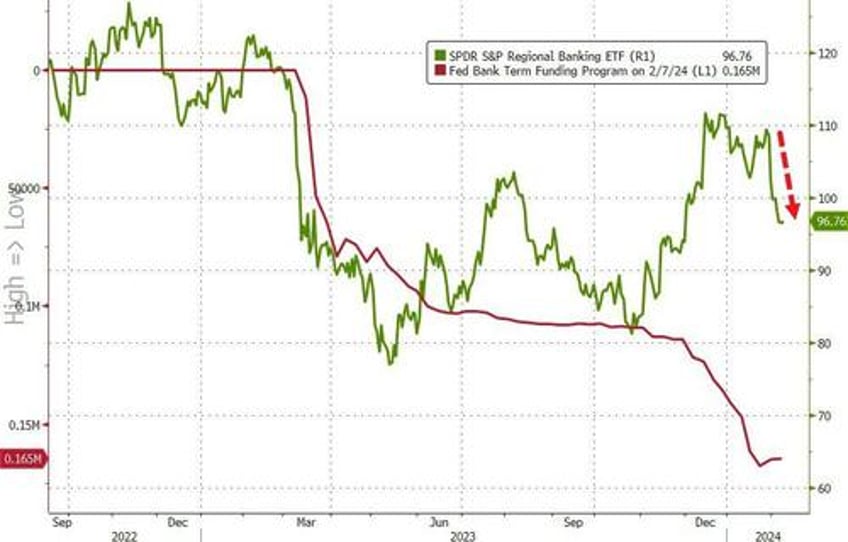

Meanwhile, the market is increasingly convinced now that the economy is awesome (cough govt debt cough) and that 'we don't need no stinking rate-cuts' to keep the dream alive. We shall see what reality has to say about that in March when the BTFP facility expires and banks need to find $165BN in funding...(of course, they have up to one year to figure it out as the loans were 1Y terms, but most of the big jump in BTFP usage was at the start).

And remember those assets will be worth... less...

Reminder, bonds are trading higher in yield, lower in price, since the SVB crisis (which means what for the banks holdings?)