Money market funds saw significant inflows for the third straight week (+$24.9BN) pushing total assets under management to a new record high of $6.24TN, despite the rebound in stocks...

Source: Bloomberg

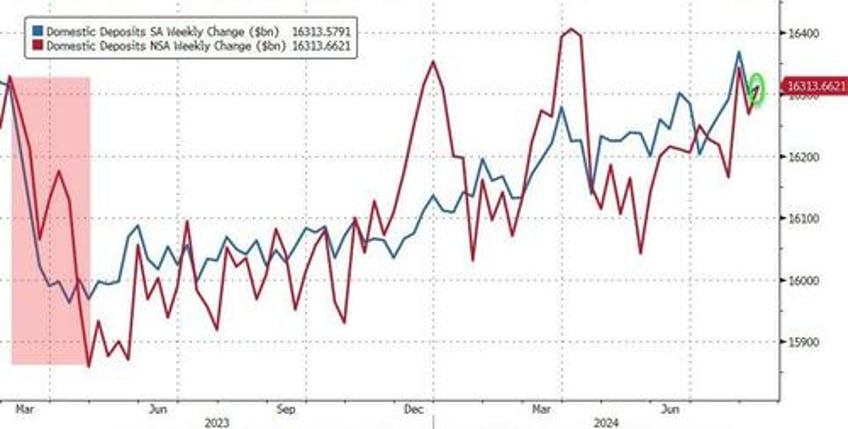

As both retail and institutional MM funds saw inflows, US bank deposits (on a seasonally-adjusted basis) rebounded from last week's big decline with $36.3BN in inflows in the week-ending 8/14...

Source: Bloomberg

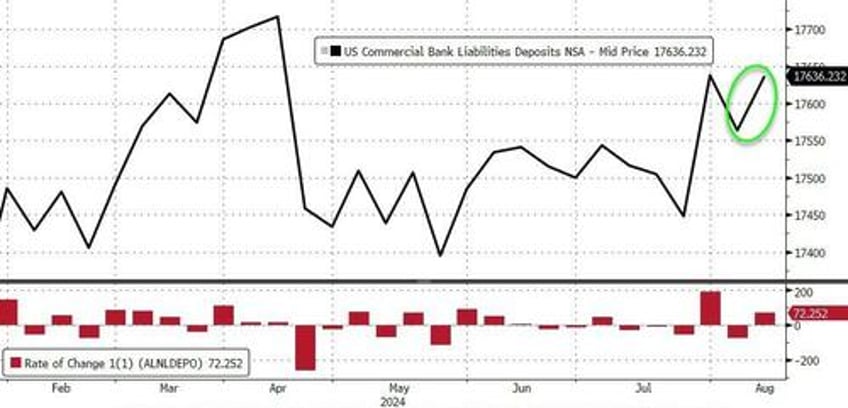

Also, on a non-seasonally-adjusted basis, US bank deposits surged $72.3BN, erasing all of the prior week's declines...

Source: Bloomberg

Particularly interesting is the fact that since the March 2023 SVB collapse in deposits, this week has now seen both SA and NSA deposits perfectly back in line...

Source: Bloomberg

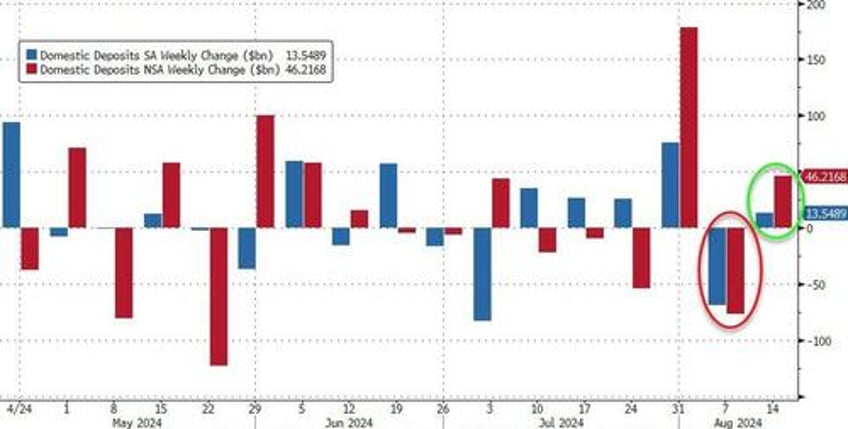

Excluding foreign deposits (which saw major inflows), US banks inflows were not enough to offset last week's outflows (SA +$13.5BN vs -$68.5BN and NSA +$46.2BN vs -$76.1BN). On an NSA basis, the inflows were almost entirely in large banks (+$45.7BN) and on an SA basis, small banks saw $5BN outflows (large banks +$18.5BN)

Source: Bloomberg

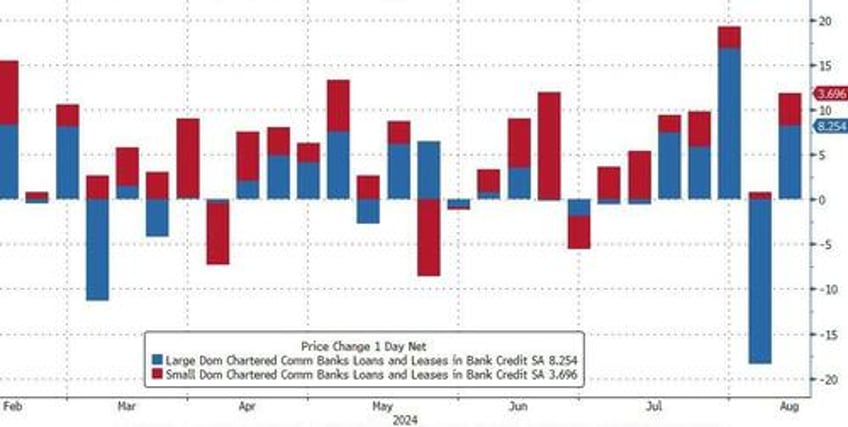

On the other side of the ledger, loan volumes rebounded in the week-ending 8/14 - after shrinking dramatically the prior week...

Source: Bloomberg

Finally, US equity market capitalization rebounded strongly this week, despite negligible change in bank reserves held at The Fed...

Source: Bloomberg

Of course, now that Powell has pivoted, we suspect these inflow trends will shift (as rates decline)... unless, of course, the typical post-Jackson-Hole plunge prompts derisking.