Shares of Monster Beverage fell in premarket trading after the energy drink maker reported second-quarter earnings per share that fell short of the average Wall Street analyst tracked by Bloomberg. The report also revealed that drink volumes slid to their worst rate since the beginning of the virus pandemic. All of this reaffirms our view low/mid-tier consumers are continuing to pull back on spending.

"We are a blue-collar brand and our consumers are more hard-pressed than consumers in other categories," Monster Co-Chief Executive Officer Rodney C. Sacks told investors on an earnings call.

Second-quarter revenue increased at the slowest pace since Q2 2020, rising just 2.5% to $1.9 billion. This missed the average analysts' expectations tracked by Bloomberg of $2.02 billion. Sales volumes also fell short, coming in at 212 million cases in the quarter, missing the 215 million estimate.

Here's a snapshot of second-quarter earnings (courtesy of Bloomberg):

EPS 41c vs. 39c y/y, estimate 45c (Bloomberg Consensus)

Net sales $1.90 billion, +2.5% y/y, estimate $2.02 billion

Monster Energy Drinks net sales $1.74 billion, estimate $1.84 billion

Strategic Brands net sales $109.2 million, estimate $108.7 million

Alcohol Brands net sales $41.6 million, -32% y/y, estimate $66.9 million

Other net sales $7.0 million, -4.1% y/y, estimate $7.44 million

Net sales outside the United States $746.0 million, +4.3% y/y

Volume 212.19 million unit cases, +6.9% y/y, estimate 215.42 million

Average net sales per case $8.73, -3% y/y, estimate $8.91

Gross margin 53.6% vs. 52.5% y/y, estimate 53.5%

Operating margin 27.7% vs. 28.2% y/y, estimate 29%

Operating expense $492.3 million, +9.3% y/y, estimate $497 million

Shares of Monster plunged 11% in premarket trading.

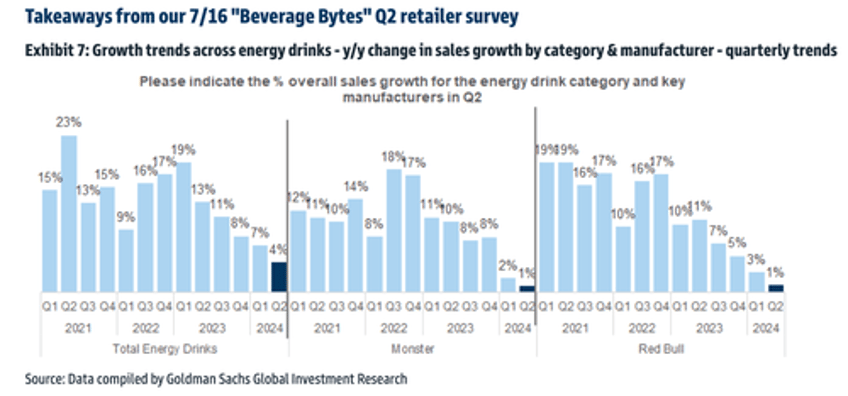

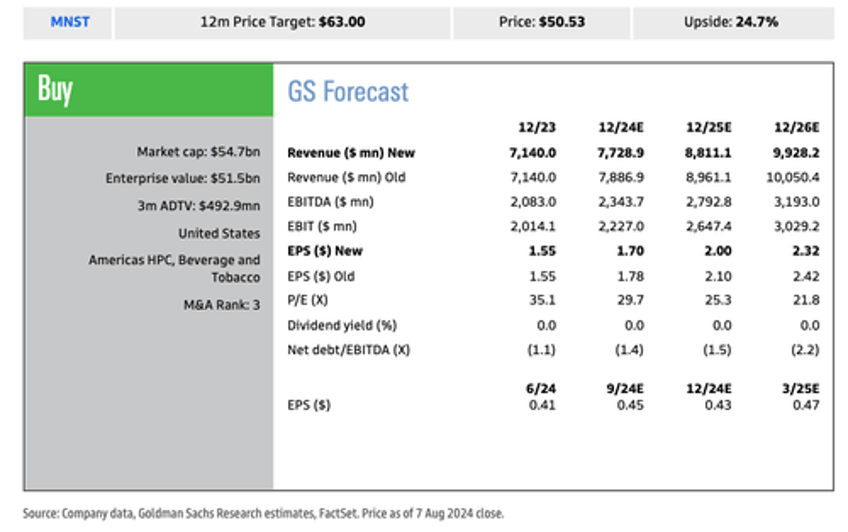

Goldman's Bonnie Herzog commented on the report, telling clients, "We maintain our Buy rating on MNST despite a disappointing Q2 that caught most by surprise."

"Expectations heading into MNST's Q2 print had pulled back, the result of a slowdown in US energy drink category growth recently, which mgmt acknowledged at their recent shareholder meeting, weighed largely by pressured c-store traffic levels and some reduction in consumer spending," Herzog said.

She continued, "That said, MNST's Q2 topline growth of +2.5% y/y (vs our/cons ests of +8.9%) was even worse than feared, dragged in part by unfavorable FX headwinds - with FX neutral sales growth of +6.1% (+7.4% ex-alcohol brands). While US sales were pressured as expected, up just 1.3%, the big surprise was international sales which were up only 4.3% (although up 13.7% ex f/x) as the energy drink category in certain European countries saw a slowdown."

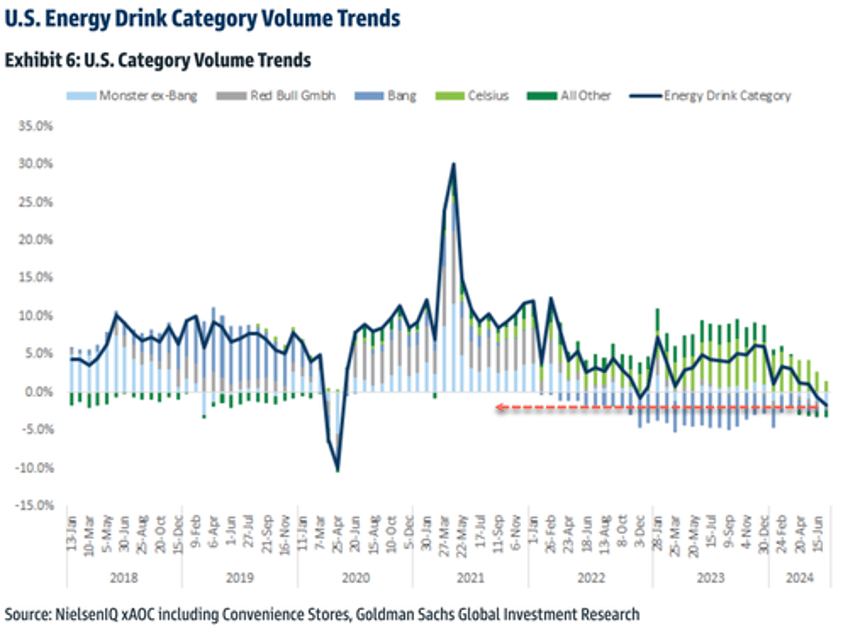

Volume trends across the entire US energy drink industry have turned negative, signaling that cash-strapped consumers are pulling back after a series of price hikes. These volume trends are at their lowest levels since the early Covid lockdowns.

Sales growth trends for energy drinks appear to have slowed a couple of quarters after Jerome Powell & company began raising interest rates in early 2022. Elevated inflation and high interest rates financially crushed working-poor and middle-class households.

Herzog lowered Monster's 12-month price target to $63 versus the prior target of $66 "based on an equal-weighted P/E of 31.5x and EV/EBITDA of 23.0x, both on our FY25 estimates (both unchanged)," adding that estimates and price targets could change based on deteriorating C-store traffic and weakness in sales.

Here's what other Wall Street analysts are saying about the downturn in the energy drink market (courtesy of Bloomberg):

Jefferies (buy)

- The quarter was worse than feared, analyst Kaumil Gajrawala says

- "The plan to increase prices in the US by 5% seems at odds with a slowing category and consumer weakness"

- PT lowered to $60 from $61

Citi (buy)

- As analyst Filippo Falorni had expected, the results were "very soft," though the magnitude was worse than anticipated

- International sales were well below Falorni's forecast, impacted by shipment weakness in EMEA

- "We continue to see near-term downside given the scanner data weakness, but remain Buy rated on a 12-month basis as we believe the US category slowdown is more cyclical than secular"

- PT cut to $54 from $60

Piper Sandler (neutral)

- Near-term headwinds are growing as global growth slows, analyst Michael Lavery writes

- Notes US energy drink category momentum has slowed; however, Monster is still going through with a price hike in the US, pointing to rebounds in categories momentum in other markets that have previously weathered slowdowns of their own

- "While we agree with this thinking, it is unclear how long any such rebound may take to materialize"

- PT cut to $46 from $59

Bloomberg Intelligence

- "US energy-drink sales are under pressure from a more price- conscious consumer and tougher category competition than in prior periods," analyst Kenneth Shea writes

The downturn in the energy drink market is another ominous sign that the consumer slowdown is gaining momentum ahead of the presidential election. It underscores how failed Bidenomics has been detrimental to the working poor and middle class.