Instead of the woke Baltimore Mayor Brandon Scott utilizing his precious time by going on corporate media's leftists Joy Reid's MSNBC show and asserting that white conservatives "should be afraid" of the consequences of calling him the 'DEI Mayor,' perhaps the unseasoned youngster who over-promised about fixing imploding Baltimore City (after fifty years of a Democratic-controlled City Hall) should realize the local economy is on the cusp of meltdown and potential negative credit risk event following the bridge collapse and resulting paralyzed port.

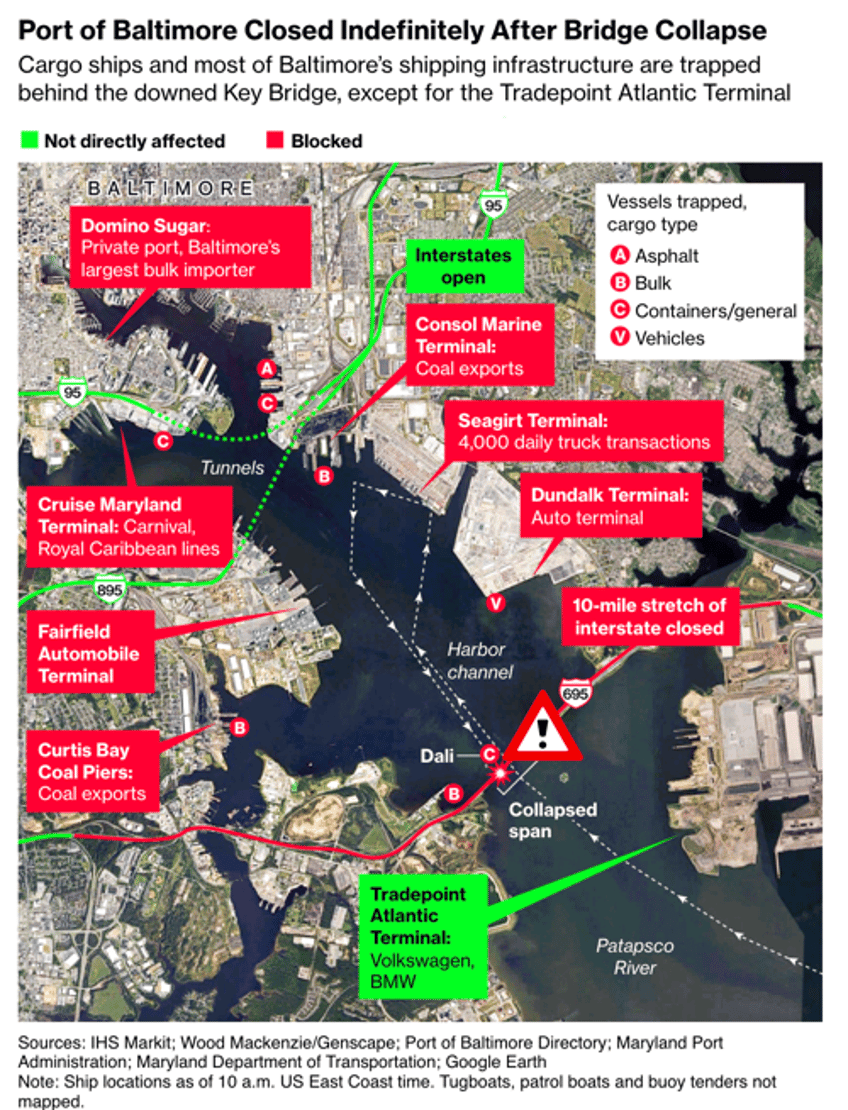

The Port of Baltimore is a significant economic driver for the city of Baltimore and the state of Maryland, and an extended closure will spread like cancer through the local economy as snarled supply chains will result in job losses, lower warehouse activity, and tax revenue loss for the government.

"I would say the Port of Baltimore is the leading economic driver for the region in Baltimore," Anirban Basu, chairman and CEO of Baltimore-based Sage Policy Group Inc., told FreightWaves.

Basu said, "One could argue that the leading driver is Johns Hopkins. It's a difficult comparison, because you're talking about two very different fields of endeavor. But the Baltimore region has been one of the nation's underperformers in recent years. In the Baltimore region, we have had to clawback the jobs lost early during the pandemic."

Cargo to the paralyzed Port of Baltimore will be diverted to other US East Coast ports. Scott Cowan, president of the International Longshoremen's Association Baltimore local chapter, warned that thousands of port jobs could soon vanish.

On Thursday morning, Moody's published a note that said a prolonged closure of the port would ripple through the local economy and could spark negative credit risk events for the city and state:

The bridge collapse threatens to disrupt aspects of the State of Maryland (Aaa stable) and City of Baltimore (Aa2 stable) economies. The suspension of shipping traffic to the Port of Baltimore will likely divert cargo to other East Coast ports, which may affect jobs and tax revenue. The accident also has the potential to hurt the transportation and warehousing sector, though that accounts for a small share of state GDP.

More from Moody's about the credit fallout that could soon hit Baltimore:

In recent years, the state and Baltimore County (Aaa stable) have provided incentives and worked with developers to facilitate the redevelopment of Sparrows Point, a more than 3,000-acre contaminated industrial site once home to a Bethlehem Steel plant. Over the last nine years, Sparrows Point has seen almost $2 billion of private investment resulting in the development of 14 million square feet of warehousing and distribution facilities. With the Key Bridge providing the only direct access route between Sparrows Point and Baltimore/Washington International Thurgood Marshall Airport, further development at Sparrows Point could be delayed.

There is no timetable for how long salvage crews will take to remove the massive bridge blocking the harbor's only entry and exit. Some figures are six weeks, while others are several months. Shippers diverting operations to other East Coast ports will also hit warehousing and trucking businesses in the area.

We have described to readers for years that Baltimore has been trending down. It's only in a downward trend when a shock forms that the real troubles begin materializing. And that shock started this week. Sorry, Scott. It's not a race thing like you describe on MSNBC—you're just an inexperienced leader. The persistent crime chaos and failed progressive policies are evidence of this. It's time for new leadership.