By Vishwanath Tirapattur, head of global head of Quantitative Research at Morgan Stanley

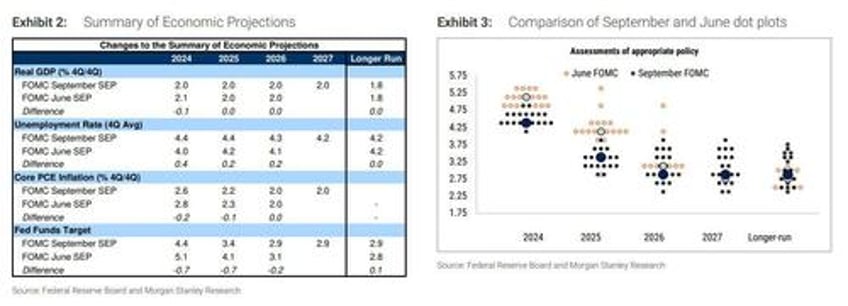

Finally, we have a decision. The months of shifting narratives about if and when the Fed would cut policy rates and, more recently, whether by 25bp or 50bp, are over. On Wednesday, the Fed kicked off the cutting cycle, lowering the policy rate by 50bp. While it still sees the economy as healthy and the labor market as solid, Chair Powell noted that it was time to recalibrate policy: inflation risks have come down while risks to the labor market have risen. At the press conference, he made it clear that the 50bp cut signals (1) the Fed's commitment to stay ahead of the curve (or at least not fall behind it) and (2) confidence in the Fed's progress on moving inflation toward the 2% goal. He further emphasized the FOMC's commitment to being data-dependent and nimble.