By Vishwanath Tirupattur global head of Quantitative Research at Morgan Stanley

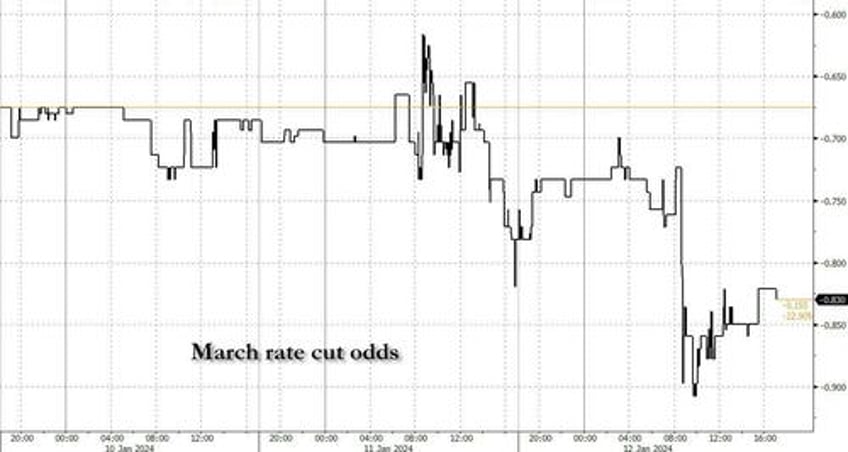

The impressive rally in US duration that began in November is continuing, while the market-implied probability of a rate cut at the March FOMC meeting hovers around 80%. Market pricing notwithstanding, our economists continue to view the June meeting as their modal expectation for the start of cuts. They see the risk of an earlier start to rate cuts skewed to May versus March. In today’s Start, we dig into recent key macro data and Fedspeak to frame our stance on the timing of Fed policy on rate cuts. Both the numbers and Fedspeak support our views.