- APAC stocks traded with a mostly positive bias after gains on Wall St where the S&P 500 printed a fresh record high.

- European equity futures indicate a slightly lower cash open with Euro Stoxx 50 future down 0.2% after the cash market finished with gains of 0.8% on Wednesday.

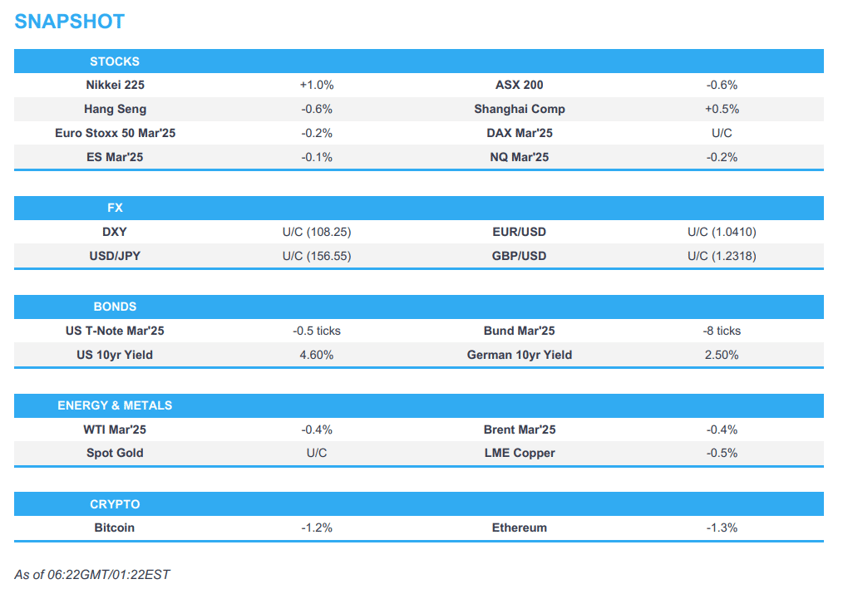

- DXY is rangebound, EUR/USD and Cable sit just above 1.04 and 1.23 respectively, JPY lacks direction ahead of the BoJ tomorrow.

- Looking ahead, highlights include US Initial Jobless Claims, Australian PMI, Japanese CPI, Canadian Retail Sales, Norges Bank & CBRT Policy Announcements, Supply from France, UK & US, SNB Chair Schlegel & US President Trump, Earnings from GE Aerospace, American Airlines, Freeport-McMoRan Copper & Gold, Elevance Health, Union Pacific Corp., Texas Instruments, CSX Corp. IG & Associated British Foods.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were predominantly bid throughout the session with SPX printing a fresh record high although the advances were led by the Nasdaq with Tech and Communication names the only sectors truly in the green with the upside in heavyweight stocks supporting the overall market. Nonetheless, tech was underpinned after US President Trump unveiled Stargate which is a USD 500bln AI infrastructure project which supported AI names like Nvidia (NVDA) and Oracle (ORCL), while Communication names were also underpinned following the recent stellar earnings report from Netflix (NFLX).

- SPX +0.61% at 6,086, NDX +1.33% at 21,853, DJIA +0.30% at 44,157, RUT -0.61% AT 2,304.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Trump said he doesn't care if Congress does one bill or two bills for reconciliation, while he stated regarding FEMA that he would rather see states take care of their own problems during a pre-recorded interview on Fox News.

- US President Trump announced Andrew F. Puzder will serve as the next US Ambassador to the EU.

- US Senate Committee will hold a confirmation hearing on January 29th for President Trump's Secretary of Commerce nominee Howard Lutnick, while US Senate Finance Chair Crapo hopes that a full Senate confirmation vote for Treasury nominee Bessent could occur next week.

- US military is preparing to send about 1,000 additional active-duty troops to the border with Mexico following Trump’s executive order, according to Reuters citing sources.

- Saudi Crown Prince MBS spoke with US President Trump on the phone and said the kingdom seeks to increase its investments and trade with the US by at least USD 600bln in the next four years, while the Saudi Crown Prince said the expected reforms under Trump's administration could create "unprecedented economic prosperity".

APAC TRADE

EQUITIES

- APAC stocks traded somewhat mixed albeit with a mostly positive bias after the gains on Wall St where the S&P 500 printed a fresh record high and the Nasdaq led amid strength in tech and communications, while outperformance was seen in mainland China after Beijing announced efforts to support the stock market in a capital markets briefing.

- ASX 200 was pressured by underperformance in miners following several quarterly production updates, with tech and telecoms the only sectors that showed some resilience.

- Nikkei 225 climbed above the 40,000 level following recent yen weakness and mostly better-than-expected trade data.

- Hang Seng and Shanghai Comp were both initially underpinned with brokerage stocks lifted after the capital markets briefing in Beijing where officials from the CSRC, financial regulator and PBoC announced efforts to boost stocks with China to direct medium and long-term funds towards market investment, while there will be at least hundreds of billions of yuan of new long-term capital for A-shares every year from state-owned insurance companies. However, the Hong Kong benchmark eventually gave back the gains..

- US equity futures (ES -0.1%, NQ -0.2%) slightly eased back following yesterday's tech- and communications-led advances.

- European equity futures indicate a slightly lower cash open with Euro Stoxx 50 future down 0.2% after the cash market finished with gains of 0.8% on Wednesday.

FX

- DXY traded rangebound following yesterday's indecisive performance and with a very quiet data calendar for the US so far this week as participants mull over the recent tariff rhetoric from President Trump, while his pre-taped interview on Fox News did little to sway the buck with participants awaiting his address to the World Economic Forum, as well as Initial Jobless Claims data.

- EUR/USD was ultimately flat and tested 1.0400 to the downside after gradually pulling back from yesterday's peak, while there were recent comments from ECB's Holzmann who said it would be better to wait a bit longer on rate cuts although he can be persuaded on a cut if there are good arguments.

- GBP/USD kept to within a narrow range just above 1.2300 with price action contained amid light pertinent catalysts.

- USD/JPY lacked firm direction after advancing yesterday despite expectations of a looming rate hike for tomorrow's BoJ policy announcement, while mostly better-than-expected Japanese trade data did little to spur a reaction in the Japanese currency.

- Antipodeans were little changed amid a quiet calendar and somewhat mixed risk appetite during Asia-Pac trade.

- PBoC set USD/CNY mid-point at 7.1708 vs exp. 7.2826 (prev. 7.1696).

FIXED INCOME

- 10yr UST futures languished around the prior day's trough after retreating amid upside in yields and recent Trump tariff rhetoric, but with a floor seen following a strong 20yr auction stateside.

- Bund futures lacked demand following recent whipsawing and failures to sustain the 132.00 status.

- 10yr JGB futures were subdued amid an enhanced liquidity auction and with the BoJ kickstarting its two-day policy meeting.

COMMODITIES

- Crude futures were lacklustre after yesterday's flimsy performance amid dollar fluctuations and recent Trump tariff rhetoric, while the delayed private sector inventory data was bearish with a surprise build in headline crude stockpiles.

- Private inventory data (bbls): Crude +1.0mln (exp. -1.2mln), Distillate +1.9mln (exp. -0.0mln), Gasoline +3.2mln (exp. +2.3mln), Cushing +0.5mln.

- Port Houston announced that all facilities would resume normal operations on January 23rd.

- North Dakota oil output is estimated to be down about 70-100k BPD due to extreme cold and related operations challenges although it is anticipated that the majority of the lost production will return within the next 3-6 days, according to the state pipeline authority.

- Spot gold traded rangebound and took a breather after recently advancing to its highest level in almost three months.

- Copper futures remained subdued and failed to benefit from the mostly positive risk sentiment.

CRYPTO

- Bitcoin was on the back foot throughout the session and dipped beneath the USD 102k level.

NOTABLE ASIA-PAC HEADLINES

- China CSRC chief said China will direct medium and long-term funds towards market investment and there will be at least hundreds of billions of yuan of new long-term capital for A-shares every year from state-owned insurance companies, while a pilot scheme of insurers buying stocks is to be implemented in H1 2025 with scales of at least CNY 100bln. Furthermore, public funds are to increase A-share holdings by at least 10% annually over the next 3 years and China will guide fund companies to buy their own equity funds using some of their profits.

- China's financial regulator vice head said they will encourage major state insurers to use 30% of their newly generated premium incomes for stock investment, while a PBoC official said they will expand the scope and increase the scale of liquidity tools to fund share purchases at the proper time.

DATA RECAP

- Japanese Trade Balance Total Yen (Dec) 130.9B vs. Exp. -53.0B (Prev. -110.3B)

- Japanese Exports YY (Dec) 2.8% vs. Exp. 2.3% (Prev. 3.8%)

- Japanese Imports YY (Dec) 1.8% vs. Exp. 2.6% (Prev. -3.8%)

- South Korean GDP QQ (Q4 A) 0.1% vs. Exp. 0.2% (Prev. 0.1%)

- South Korean GDP YY (Q4 A) 1.2% vs. Exp. 1.4% (Prev. 1.5%)

GEOPOLITICS

MIDDLE EAST

- US Secretary of State Rubio spoke to Israeli PM Netanyahu and conveyed that he looks forward to addressing threats posed by Iran.

- White House designated Yemen's Houthi movement as a foreign terrorist organisation and said the policy of the US is to cooperate with regional partners to eliminate Houthis' capabilities and operations.

RUSSIA-UKRAINE

- Military administration in Zaporizhia reported 4 explosions in the city of Zaporizhia in southeastern Ukraine due to Russian missile shelling, according to Al Jazeera.

- Russia's deputy UN envoy said in response to US President Trump's remarks on Ukraine, that it is not merely the question of ending the war and it is about addressing the root causes of the Ukrainian crisis, while they have to see what Trump thinks a deal means and said that Trump has the power to stop malicious US policy in Ukraine.

OTHER NEWS

- US Secretary of State Rubio spoke to Venezuela's Edmundo González Urrutia and María Corina Machado on Wednesday, while he reaffirmed US support for the restoration of democracy in Venezuela and the immediate release of all political prisoners. Rubio also spoke with South Korean Foreign Minister Cho held a phone call and stated that the US-South Korea alliance is the linchpin of regional peace and security. Furthermore, he spoke to the Philippines Secretary of Foreign Affairs about China's dangerous and destabilising actions in the South China Sea.

EU/UK

NOTABLE HEADLINES

- ECB's Holzmann said inflation gauges are still very strong and there is a danger of cutting rates and then hiking again, while he added it would be better to wait a bit longer on rate cuts although he can be persuaded on a cut if there are good arguments.

- EU's Sefcovic says a pan-European customs area is something the bloc would consider as part of a "reset" discussion with the UK; BBC's understanding is that the gov't has begun consultations on joining the Pan-Euro-Mediterranean Convention.