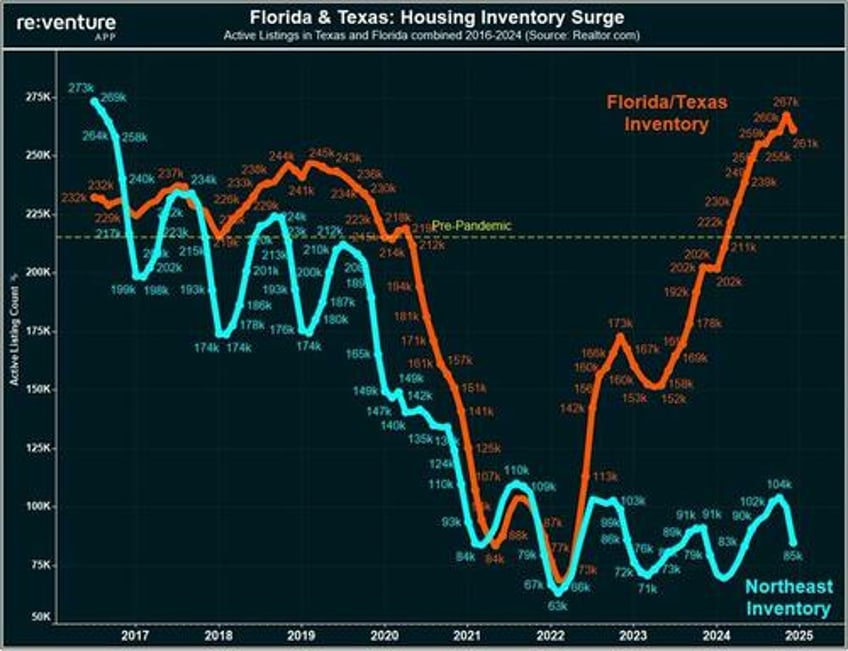

One of the wildest real estate charts we've seen in some time—aside from existing home sales plummeting to their lowest level since 1995 and new home supply reaching a 17-year high—was shared by Nick Gerli, CEO and Founder of real estate analytics firm Reventure Consulting.

"Probably my favorite housing market graph right now. Orange line is inventory levels in Florida & Texas, combined. Blue line is inventory level across entire Northeast US," Gerli wrote on X.

He continued: "In Texas and Florida, there are 261,000 active listings on the market, 207% higher than the level in the Northeast, which covers nine states. Prior to the pandemic, these regions were the same. This highlights the very bifurcated nature of this housing market. The downturn is happening in TX/FL, but we are still suffering a historic inventory shortage in the Northeast."

Focusing on the supply dynamics in Florida and Texas, Gerli outlined seven key points about boomtown areas in Sun Belt states that are rapidly losing momentum due to housing affordability challenges driven by elevated mortgage rates and high home prices:

I'm shocked at how few people actually know this in real estate circles. In my mind, it's the biggest story of the housing market. The boomtown areas during the pandemic are falling fast. While the cold weather climates that everyone left during pandemic are still appreciating.

I have some theories on why this trend is underreported. I suspect it's because many real estate outlets don't want to admit the TX/FL dominos have fallen. As those are the states with the most realtors, investors, wholesalers, and people who buy housing market-related products and services.

A huge portion of the overall revenue earned in the real estate industry is from Texas, Florida and other southern states, so admitting those markets are in a downturn is a tough thing to do. Meanwhile - the Northeast has comparatively little investor and realtor activity on a relative basis. So it's not much of a sell to talk about the outperformance.

However, what many in the real estate industry fail to realize, is that a downturn in the Sun Belt will actually be a good thing for the housing market in the long-term. Because more inventory and cheaper prices will ultimately be what draws buyers back into the market.

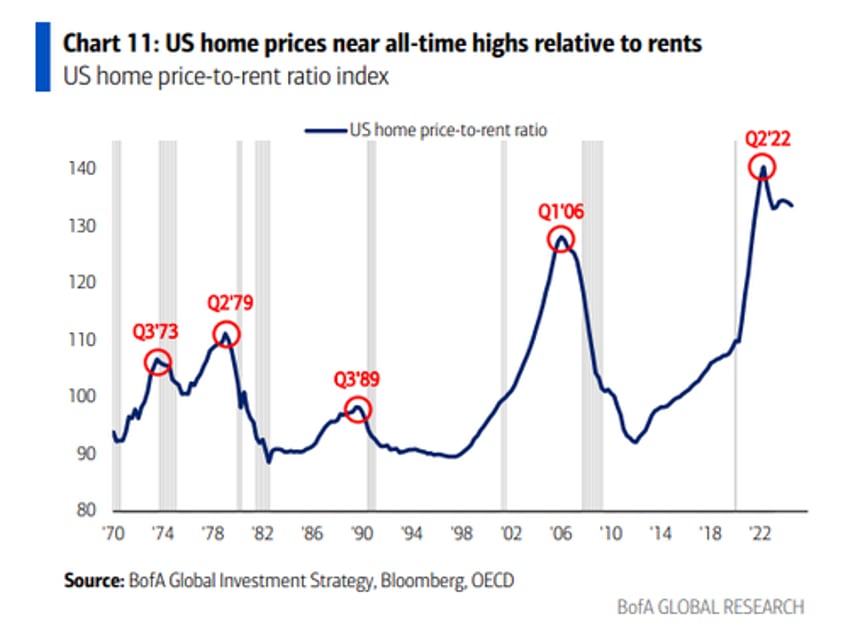

The level of home sale transactions today is comically low, and almost hard to fathom. 2024 had 4.06M existing sales. The worst performance of any where since 1995. Adjusted for the number of houses in America, this was the worst year for demand in 42 years.

The reason demand is so low is because home PRICES are too high. Not that mortgage rates are too high.

And so that's it. Prices need to drop to bring buyers back in. Very simple. However, for prices to drop, inventory levels need to go up enough to force sellers into meaningful price reductions. In South and Texas/Florida more specifically, that's happening. In Northeast, it's not. Too few homes for sale means high competition and even bidding wars, still.

Gerli told X users to visit the Reventure App for more details on the current state of the US housing industry.

8) At Reventure App, we make inventroy data for every ZIP code in America publicly available so users can understand the trends in their market for free.

— Nick Gerli (@nickgerli1) January 27, 2025

Head there right now, type in your ZIP code, and see how the inventory trends look. This will give you a good first…

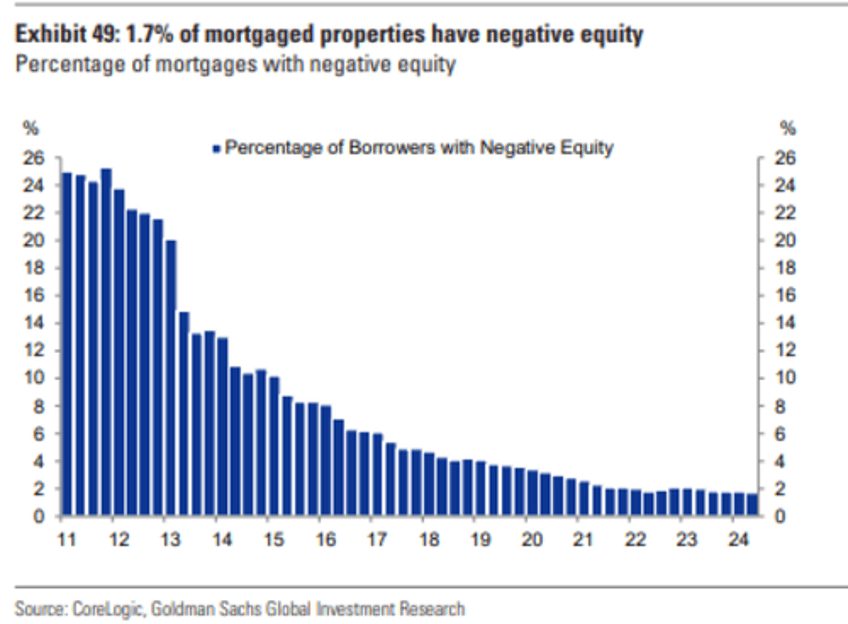

Meanwhile...

And this.

The key takeaway is that home prices in these boomtown areas must return to affordable levels to attract buyers. Florida and Texas are the two markets to watch for the most volatility, driven by extremely elevated inventory levels.