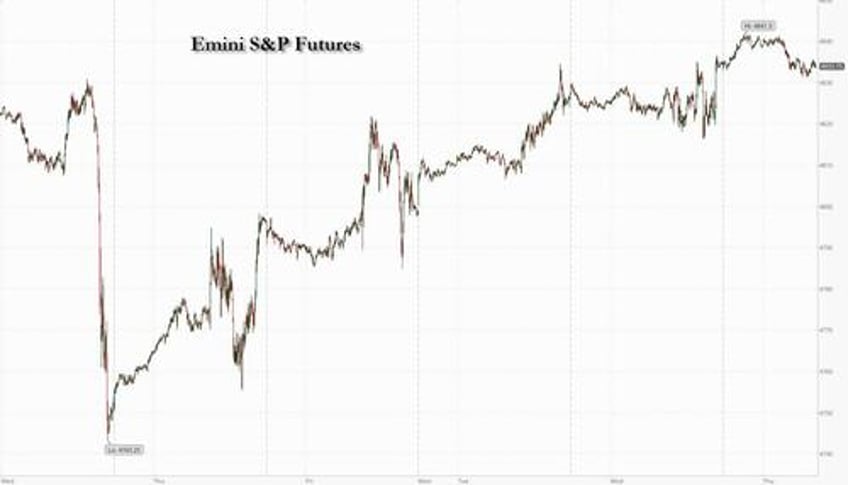

The relentless Santa rally can't stop, won't stop, and while S&P futures swung between modest gains and losses, Nasdaq 100 index futures edged higher yet again to record-er highs, putting the tech-heavy index on track for its best year since the dotcom bubble burst, as US equities are set to close out 2023 at all-time highs amid optimism the Powell Fed is poised to boost Biden's re-election campaign by cutting interest rates as soon as March despite sticky inflation, a sturdy labor market with near record low unemployment and an economy which, according to Goldman, is about to ramp up again. As of 7:50am, Nasdaq futures, already at an all time high after soaring a blistering 55% this year, the most since the pre-dot com bubble 1999 - rose another 0.2%, while S&P 500 contracts were little changed after the benchmark edged within just 0.3% of its record high from January 2022. After inexplicably tumbling yesterday, bond yields have reversed some of the sharp move lower, spawned by the relentless slide in the dollar as the market is now convinced the Fed will cut more than 6 times next year to smooth Biden's reelection. Oil extended losses because of continued CTA selling, while bitcoin reversed yesterday's gain.

In premarket trading, cryptocurrency-linked stocks slid as Bitcoin edges lower, following sharp gains on Wednesday that stretched the year’s torrid rallies. Here are some other notable movers:

- Altice USA gains 8.9%, adding to Wednesday’s rally that was spurred by a report billionaire Xavier Niel has interest in buying Altice Portugal, which incidentally is unrelated to Altice USA but year-end squeezes don't bring out the best and brightest.

- CytoSorbents falls 26% after a trial of its medical device missed the primary effectiveness goal.

- Microsoft shares are up 0.3% after Wedbush raised its price target on the software company to $450, maintaining an outperform rating. Analyst Daniel Ives cites the potential of artificial intelligence and the company’s Copilot software.

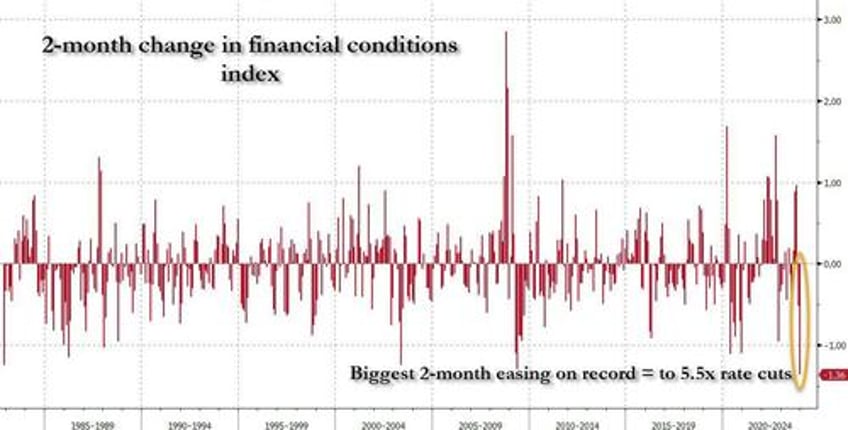

An index of global equities is on pace for its highest close since February 2022, up more than 15% from its October low, reflecting traders’ optimism for interest rate cuts next year. As markets continue to price in a year of seemingly endless easing after Goldman's Financial Conditions Index just experienced its biggest 2-month easing in history...

... many are starting to get cold feet; Mizuho Bank strategist Vishnu Varathan said that expectations of aggressive policy easing are getting front-loaded; with swap markets pricing in about an 84% chance of a cut by March, traders will be watching weekly jobs data later Thursday for further clues on the outlook for rates.

"The ferocity of the bond market rally has really augmented the total returns for investors," said Varathan. "There’s a feeling markets are signaling we’re heading half-way toward easy monetary policy again."

Well, we are: after all Biden's handlers tapped Powell on the shoulder and it's downhill from there... literally.

In Europe, the Stoxx 600 index was little changed after erasing an early advance in thin holiday trading, on track for a gain of more than 12% this year. Oil majors declined as crude prices retreated.

Earlier in the session, gains in Asia were led by Chinese shares, which were headed for their best day in four months, boosted by a rotation into some of 2023’s worst-performing sectors as the dash for trash goes global. Stocks also rallied in Hong Kong, India and Australia. Key stock gauges in India rose for the fifth straight session to fresh record highs, boosted by a risk-on rally across Asia and gains in index heavweights like Reliance Industries. Indian stocks have outrun MSCI’s gauges for Asian and emerging markets stocks this month on the back of heavy inflows from global funds and victory for Prime Minister Narendra Modi’s party in key state elections.

In FX, a gauge of the dollar was on track for a fifth day of declines, as the Bloomberg Dollar Spot Index slumped to a new five-month low as markets continued to look toward Federal Reserve rate cuts next year. USDJPY dropped as much as 0.8% to 140.72 after BOJ Governor Kazuo Ueda hinted that negative rates could be scrapped before the full results of the spring wage negotiations (spoiler alert: they won't be scrapped, if anything Japan will be forced to ease even more). EURUSD rose 0.3% to 1.1138 as the ECB’s Holzmann said there was no guarantee of rate reductions in 2024.

Meanwhile, bonds steadied after Wednesday’s strong rally which saw the two-year Tressury yield fall 11 basis points and Germany’s 10-year yield hitting a fresh 2023 low. That pushed one global measure of the bond market to the cusp of its best two-month rally on record as investors locked in higher yields prior to expected Fed cuts. On Thursday, treasuries dropped with yields rising 2bps across the curve; European government bonds followed Treasuries lower.

Looking at today's US economic calendar we get the November trade balance and inventories and weekly jobless claims data at 8:30am, as well as November pending home sales at 10am. No Fed speakers are scheduled for remainder of year.

Market Snapshot

- S&P 500 futures little changed at 4,834.50

- MXAP up 1.2% to 169.25

- MXAPJ up 1.4% to 528.42

- Nikkei down 0.4% to 33,539.62

- Topix down 0.1% to 2,362.02

- Hang Seng Index up 2.5% to 17,043.53

- Shanghai Composite up 1.4% to 2,954.70

- Sensex up 0.5% to 72,391.85

- Australia S&P/ASX 200 up 0.7% to 7,614.28

- Kospi up 1.6% to 2,655.28

- STOXX Europe 600 little changed at 478.66

- German 10Y yield little changed at 1.92%

- Euro up 0.2% to $1.1131

- Brent futures down 0.7% to $79.07/bbl

- Gold spot down 0.1% to $2,076.28

- US Dollar Index down 0.29% to 100.69

Top Overnight News

- Nearly nine-tenths of the foreign money that flowed into China’s stock market in 2023 has already left, spurred by mounting doubts about Beijing’s willingness to take serious action to boost flagging growth. Since peaking at Rmb235bn ($33bn) in August, net foreign investment in China-listed shares this year has dropped 87 per cent to just Rmb30.7bn. FT

- Japan’s industrial production for Nov isn’t as bad as feared, coming in -0.9% M/M (vs. the Street’s -1.6% forecast). RTRS

- Israel warns it could soon take action along its northern border with Lebanon against Hezbollah as fears grow of a broader conflict. NYT

- During a meeting in Moscow back in March, Russian President Vladimir Putin told his Chinese counterpart Xi Jinping that Russia "will fight for [at least] five years" in Ukraine, sources have revealed. Nikkei

- The US has proposed that working groups from the G7 explore ways to seize $300bn in frozen Russian assets, as the allies rush to agree a plan in time for the second anniversary of Moscow’s full-scale invasion of Ukraine. FT

- American’s border with Mexico is seeing record migrant crossings, overwhelming the ability of US law enforcement to deal with it. NYT

- Dealmaking sank below $3tn for the first time in a decade in 2023, as a cocktail of higher interest rates and escalating geopolitical tension confounded bankers’ hopes that last year’s lull was a one-off. About $2.9tn worth of transactions were struck globally this year, data from the London Stock Exchange Group shows, down 17 per cent from 2022. It was the first time since 2008-09 that the value of deals announced fell more than 10 per cent for two consecutive years, LSEG said. FT

- Professional social networking site LinkedIn has made new inroads into the digital advertising market, with higher demand driving up prices on the platform as brands seek to reallocate spending from Elon Musk’s X. Annual advertising revenues at the Microsoft-owned group rose to nearly $4bn in 2023, up 10.1 per cent year on year, according to estimates from research group Insider Intelligence. It also predicted further growth of 14.1 per cent in 2024. FT

- AAPL won an appeals court ruling temporary pausing an ITC decision that had banned the sale of certain Apple Watch models (the gov’t will rule on Jan 12 whether an Apple software update adequately addresses the ITC patent claim). WSJ

- Aggregate long/short ratio across R2K constituents has declined further to new multi-year lows, suggesting HFs remain skeptical of the price strength since November. GSPB

US Event Calendar

- 08:30: Dec. Initial Jobless Claims, est. 210,000, prior 205,000

- 08:30: Dec. Continuing Claims, est. 1.88m, prior 1.87m

- 08:30: Nov. Advance Goods Trade Balance, est. -$88.9b, prior -$89.8b, revised -$89.6b

- 08:30: Nov. Wholesale Inventories MoM, est. -0.2%, prior -0.4%

- 08:30: Nov. Retail Inventories MoM, est. 0.2%, prior 0%

- 10:00: Nov. Pending Home Sales YoY, prior -6.6%

- 10:00: Nov. Pending Home Sales (MoM), est. 0.9%, prior -1.5%