- APAC stocks traded mostly higher as the region resumed the momentum following last Friday's gains on Wall St.

- Israeli PM Netanyahu said Hezbollah will pay heavily for a rocket attack that killed children in the Golan Heights.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.5% after the cash market finished with gains of 1.1% on Friday.

- DXY is softer but holding above the 104 mark, JPY is outmuscling the dollar in choppy trade ahead of this week's BoJ meeting.

- Looking ahead, highlights include Swedish GDP, Retail Sales, US Dallas Fed Manufacturing Business Index, Speech from UK Chancellor Reeves, Earnings from Poste Italiane, Pearson, Entain, Heineken, Philips & McDonald's.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished higher on Friday and Treasuries were ultimately bid across the curve despite the initial two-way price action seen following the PCE data in which the headline readings matched estimates and the core figures were firmer-than-expected but did little to change the Fed narrative, while the attention turned to the upcoming pivotal week packed with major risk events.

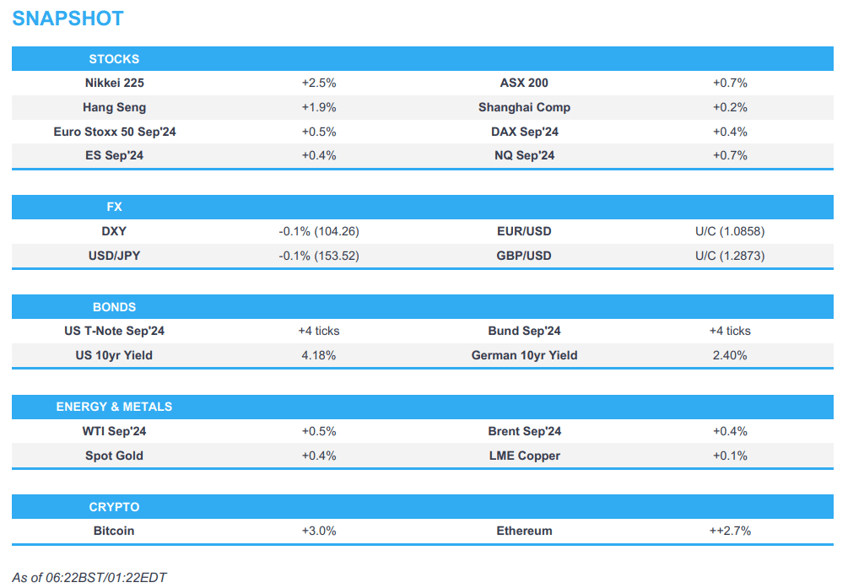

- SPX +1.1% at 5,459, NDX +1.0% at 19,024, DJIA +1.6% at 40,589, RUT +1.7% at 2,260

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Biden plans to unveil a proposal on Monday for dramatically reforming the Supreme Court and is expected to push for a constitutional amendment limiting immunity for presidents and other officeholders, according to Politico.

- Apple and IAM CORE union of retail workers reached a tentative labour agreement, while it was also reported that Apple Intelligence will miss the initial launch of the upcoming iOS 18 overhaul.

APAC TRADE

EQUITIES

- APAC stocks traded mostly higher as the region resumed the momentum following last Friday's gains on Wall St heading into a pivotal week of risk events, while markets also shrugged off the rising Israel-Hezbollah tensions.

- ASX 200 was led higher by early outperformance in tech and telecoms, while all sectors traded in the green.

- Nikkei 225 outperformed and gapped above 38,000 at the open as markets second-guessed whether the BoJ will hike rates.

- Hang Seng and Shanghai Comp. were somewhat varied as the former conformed to the improved global risk sentiment, while the mainland index lagged after stalling just shy of the 2,900 level and failed to benefit from improved industrial profits.

- US equity futures (ES +0.4%, NQ +0.7%) built on recent gains and retested Friday's best levels in a catalyst-light start to a risk-packed week.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.5% after the cash market finished with gains of 1.1% on Friday.

FX

- DXY weakened after losing ground to its major peers including a firmer yen although it remains above the 104.00 level as participants await the looming major global risk events.

- EUR/USD eked slight gains in quiet trade with the single currency lacking notable drivers.

- GBP/USD nurses some of last week's losses ahead of comments from Chancellor Reeves who will reveal the state of the UK's finances which is seen to pave the way for spending cuts and tax increases.

- USD/JPY swung between gains and losses as market participants brace for the BoJ's upcoming key announcement.

- Antipodeans kept afloat owing to the constructive mood but with gains capped amid a light calendar and weaker CNY fix.

- PBoC set USD/CNY mid-point at 7.1316 vs exp. 7.2522 (prev. 7.1270).

FIXED INCOME

- 10-year UST futures were higher in a resumption of Friday's upward momentum following recent data releases and amid softer yields, while participants await the FOMC announcement mid-week and a slew of data culminating with NFP on Friday.

- Bund futures held on to recent spoils in uneventful trade amid light pertinent catalysts.

- 10-year JGB futures climbed back above the 143.00 level ahead of the BoJ's pivotal 2-day meeting which concludes on Wednesday where the central bank will unveil its taper plans and decide whether to hike rates, while the BoJ were also present in the market today for over JPY 1.1tln of JGBs.

COMMODITIES

- Crude futures failed to sustain the early momentum from the heightened Israel-Hezbollah tensions.

- Venezuelan President Maduro won a third term, according to the electoral authority. US Secretary of State Blinken said the US applauds the Venezuelan people for their participation in the election despite significant challenges and deep concerns about the process, while he added it is vitally important that every vote is counted fairly and transparently. Furthermore, he said the US calls for electoral authorities in Venezuela to publish detailed tabulation of votes to ensure transparency and accountability.

- Iraq’s June oil exports averaged 3.4mln bpd, according to the Oil Ministry.

- Ukraine said it struck an oil depot in Russia’s Kursk region.

- Spot gold advanced at the open to test the psychological USD 2,400/oz level where it met resistance and gave back a majority of its gains ahead of major central bank policy announcements and this week's key data releases.

- Copper futures kept afloat but with upside capped as geopolitical risks lingered and the major risk events loom.

CRYPTO

- Bitcoin gained overnight and climbed back above USD 69,000 amid the mostly positive risk environment.

- US Republican presidential candidate Trump said he wants crypto to be mined and made in America, while he will create a strategic national Bitcoin stockpile if elected and it will be his policy to keep 100% of all Bitcoin the US holds in the future if he is elected.

NOTABLE ASIA-PAC HEADLINES

- Italian Premier Meloni said Italy is to sign a three-year action plan with China to experiment with new forms of cooperation, according to ANSA.

- China Evergrande New Energy Vehicle said some creditors of two subsidiaries applied to the court for their bankruptcy reorganisation, while it said the matter has a major impact on the Co. and its units’ production and operating activities.

DATA RECAP

- Chinese Industrial Profits YY (Jun) 3.6% (Prev. 0.7%)

- Chinese Industrial Profits YTD YY (Jun) 3.5% (Prev. 3.4%)

GEOPOLITICAL

MIDDLE EAST

- A dozen were killed including children and more were injured by a rocket that hit a football pitch in Golan, according to Israeli Channel 13.

- Israeli PM Netanyahu said Hezbollah will pay heavily for the rocket attack that killed children, while the PM’s office later announced that the cabinet authorised the PM and Defence Minister to determine the type and response to the Hezbollah attack. It was also reported that Israel’s Foreign Minister said they are approaching the moment of an all-out war against Hezbollah and Lebanon.

- Israeli military spokesperson said they are preparing a response against Hezbollah, while the Israeli military later said it struck Hezbollah targets deep inside Lebanese territory and in southern Lebanon.

- Hezbollah announced it was on high alert and cleared some key sites in east and south Lebanon in case of possible Israeli escalation, according to two securities sources cited by Reuters.

- US Secretary of State Blinken said every indication is that the rocket that hit Golan Heights was from Hezbollah and the US stands with Israel’s right to defend its citizens from terrorist attacks, while he added that a ceasefire in Gaza would be an opportunity to bring lasting calm to the blue line between Israel and Lebanon.

- US asked Lebanon’s government to restrain Hezbollah, while Hezbollah asked the US to urge restraint from Israel, according to Lebanon’s Foreign Minister who warned a significant attack by Israel would lead to a regional war.

- US is highly concerned that the Golan Heights attack could lead to an all-out war between Israel and Hezbollah, according to Axios. It was also reported that the White House said it has been in continuous contact with Israeli and Lebanese counterparts since the attack that killed a number of children playing football and it is working on a diplomatic solution that would end attacks on the Israeli-Lebanon border.

- UN officials urged maximum restraint on the Lebanon-Israel front and warned exchanges of fire on the Lebanon-Israel border could engulf the region in catastrophe beyond belief.

- Iran’s Foreign Ministry spokesperson warned Israel about any new ‘adventure’ in Lebanon regarding the Golan Heights incident. In other news, Iran's Supreme Leader endorsed reformist Pezeshkianas president, according to FT.

OTHER

- Russian President Putin said Russia took note of US and German plans to deploy long-range missiles in Germany and noted that important Russian facilities will be in range of those US systems, while he warned that Russia will take similar actions to deploy and will no longer adhere to its unilateral INF moratorium if the US goes ahead with such plans.

- Russia’s Defence Ministry said its forces have taken two villages in Ukraine’s Donetsk region.

- US State Department senior official said Secretary of State Blinken and Chinese Foreign Minister Wang Yi had an extended conversation about Taiwan and Blinken raised concerns over China’s recent provocative actions regarding Taiwan including the simulated blockade around Taiwanese President Lai’s inauguration. Blinken raised human rights issues including Tibet, Hong Kong and Taiwan, while they agreed to keep making progress on military-to-military ties.

- US and Japan expressed concern Russia will undermine regional stability by giving North Korea WMD and missile technology, while they are concerned about the rapid expansion of China’s nuclear arsenal and will advance talks on a high-priority effort to expand co-production of defence equipment including air-to-air missiles and enhanced patriot air defence interceptors. Furthermore, the US reiterated its commitment to defend Japan with conventional and nuclear forces, while they condemned Russia’s procurement of North Korean weapons.

- South Korean Foreign Minister Cho stressed the importance of freedom of navigation and flight in the South China Sea at the ASEAN meeting, while he added peace and stability in the Taiwan Strait are just as important as the South China Sea.

- ASEAN communiqué said they strongly condemn violence against civilians in Myanmar and call for an immediate cessation, while they underlined the importance of a serious engagement and cessation of hostilities in Ukraine, as well as expressed concern over the dire humanitarian situation and alarming casualties in Gaza. Furthermore, they said North Korean missile tests are worrisome developments and urged UNSC resolution compliance, while they also affirmed the need to cease actions in the South China Sea that can complicate and escalate disputes.

- Russian Foreign Minister Lavrov expressed concern over the US-South Korean nuclear operations plan, according to Yonhap.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves is to accuse the former Conservative government on Monday of committing to billions of pounds of spending that has not been properly budgeted for, according to Reuters. The Telegraph reports that Reeves will attempt to fill the "black hole" by selling off land and building sites, whilst also banning the use of non-essential consultants. CityAM notes that the Treasury has refused to deny rumours it is planning to hike capital gains tax today.

- UK ports are to demand compensation if post-Brexit trade barriers with the EU are reduced after they were forced to spend millions of pounds building border-control facilities, according to FT.

- Trade between the UK and Germany is starting to recover from the post-Brexit decline, according to FT citing official figures which showed that the UK was Germany's ninth-largest trading partner during most of H1.

- ECB's Schnabel said on Friday that services inflation is showing that the last mile in the inflation fight is especially difficult, according to Faz. Schnabel also said some data was not quite in line with the projections and that a first cut doesn't automatically lead to a series.