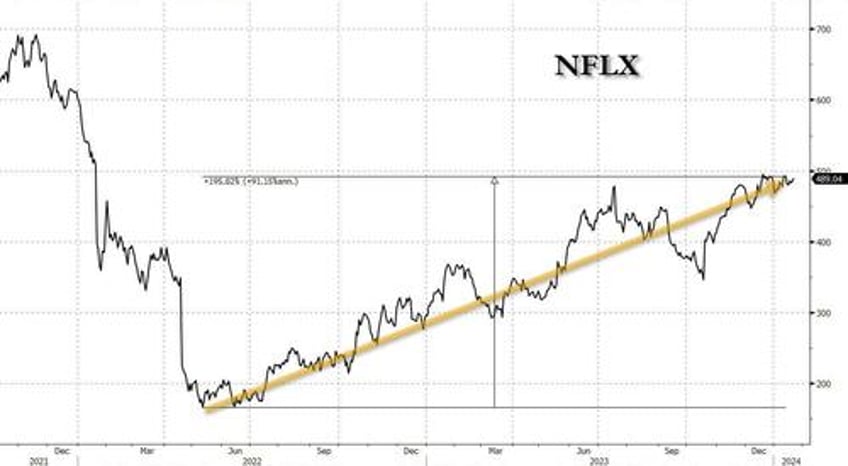

After suffering a historic collapse at the end of 2021, when in the span of five months Netflix lost 75% of its value, the company has enjoyed a solid recovery over the past two year when it rose by nearly 200%, from a low of $166 to a recent 52 week high of price of $493, which in turn recovered from the 25% July to October swoon, and which was the highest price since January of 2022.

With that in mind, bulls are are hoping for continued revenue and subscriber growth following last quarter's blowout results which saw the best subscriber growth since 2020 as well as a fresh round of price increases coming at a time when NFLX had already cracked down aggressively on password sharing and was navigating a transition from focusing on subscriber growth to maximizing earnings through price hikes and an ad-supported service. It has little choice amid a torrent of competition from some of the world's biggest media companies. Here's what else to expect

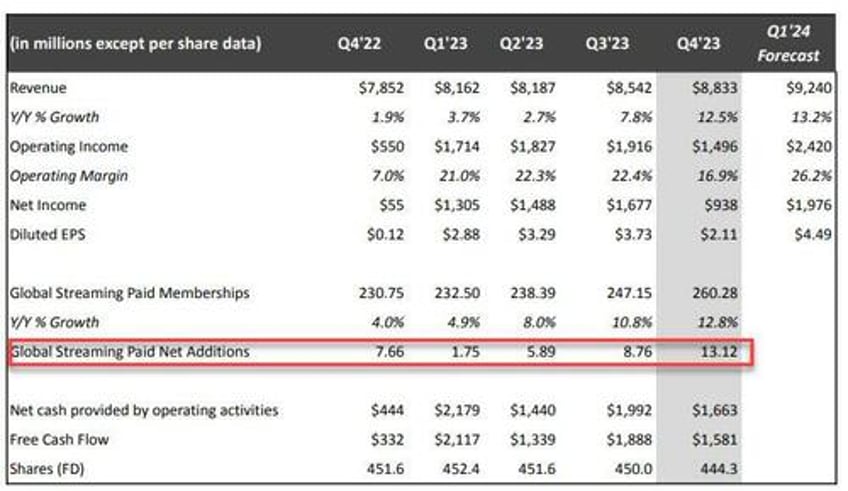

- Earnings: EPS is expected to print $2.19 a share, up from of $0.12 a share last year.

- Revenue: Bloomberg revenue consensus is for $8.71 billion in revenue, up from $7.85 billion a year earlier.

- Stock movement: Netflix shares typically see percentage swings ranging from the high single-digits to the mid-teens after the company posts results.

- Q1/24 Projections: Revenue estimate 9.29$ billion; EPS estimate $4.09; Operating margin estimate %24.1

- Full year projections: Free cash flow estimate $6.03 billion; Operating margin estimate 22.7%

With that in mind, and considering that options were pricing in a 7.7% swing after hours today (similar to the 7.6% swing expected ahead of the company's Q3 earnings results), here is what NFLX reported for its fourth quarter:

- EPS $2.11, missing the estimate $2.19 and well above the 12c a year ago

- EPS includes $239 million non-cash unrealized loss from F/X remeasurement on Euro denominated debt

- Revenue $8.83 billion, +12% y/y, and beating the estimate if $8.71 billion

- Revenue was $0.1B (2%) above the company's October forecast due to favorable F/X movement and stronger than anticipated membership growth.

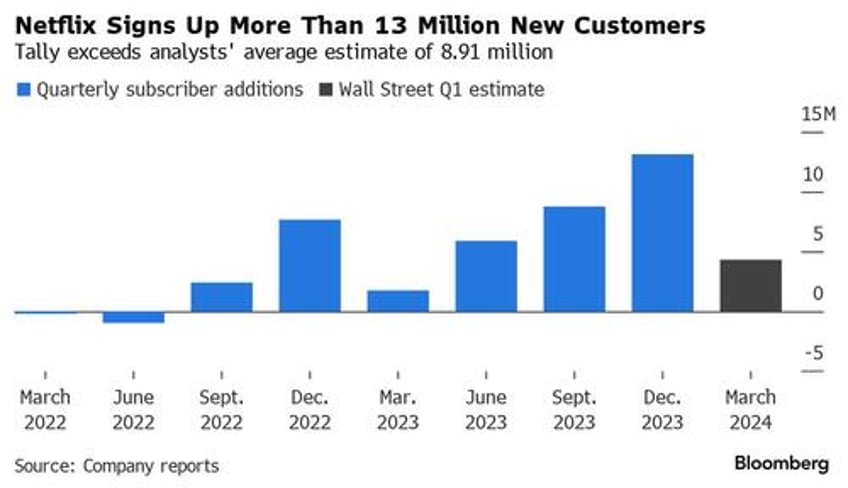

- Streaming paid net change +13.12 million, +71% y/y, and smashing the estimate of +8.91 million; this was the best ever Q4 in company history.

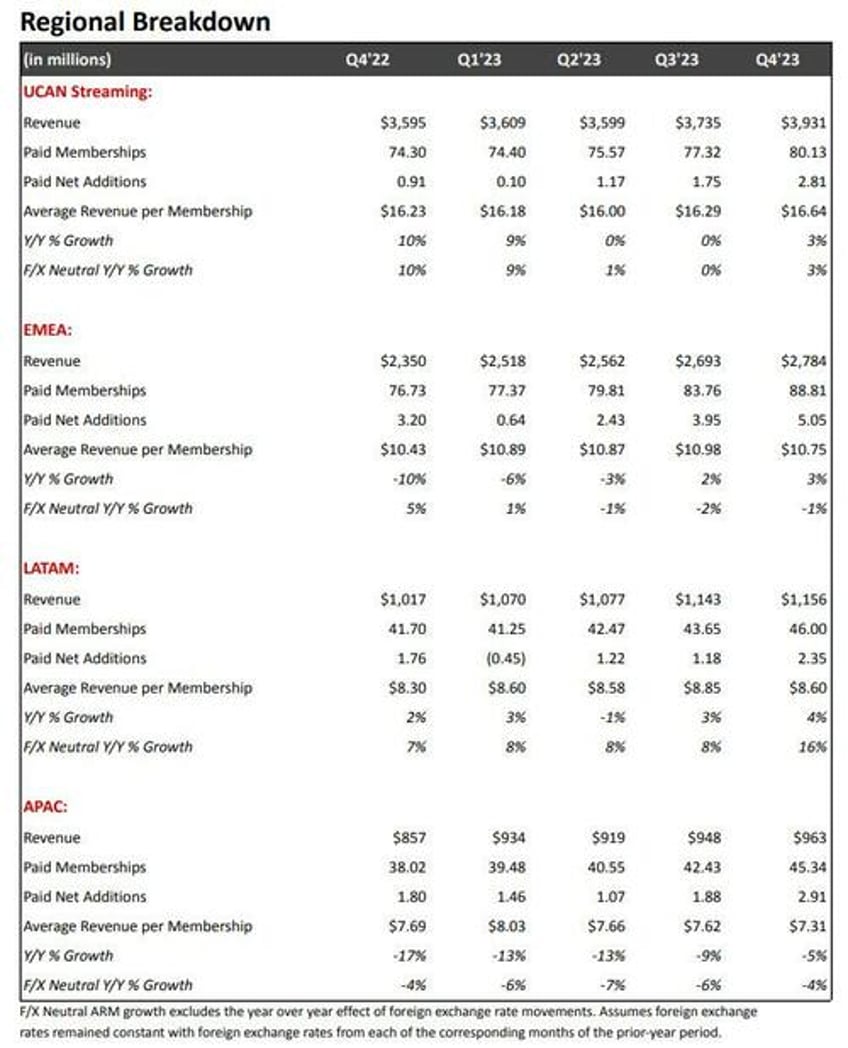

- UCAN streaming paid net change +2.81 million vs. +910,000 y/y, beating estimates of +1.76 million

- EMEA streaming paid net change +5.05 million, +58% y/y, beating estimates of +3.66 million

- LATAM streaming paid net change +2.35 million, +34% y/y, beating estimates of +1.36 million

- APAC streaming paid net change +2.91 million, +62% y/y, beating estimates of +2.08 million

- Operating margin 16.9% vs. 7% y/y, beating estimate 14.1%

- Operating income $1.50 billion vs. $550 million y/y, beating estimates of $1.2 billion

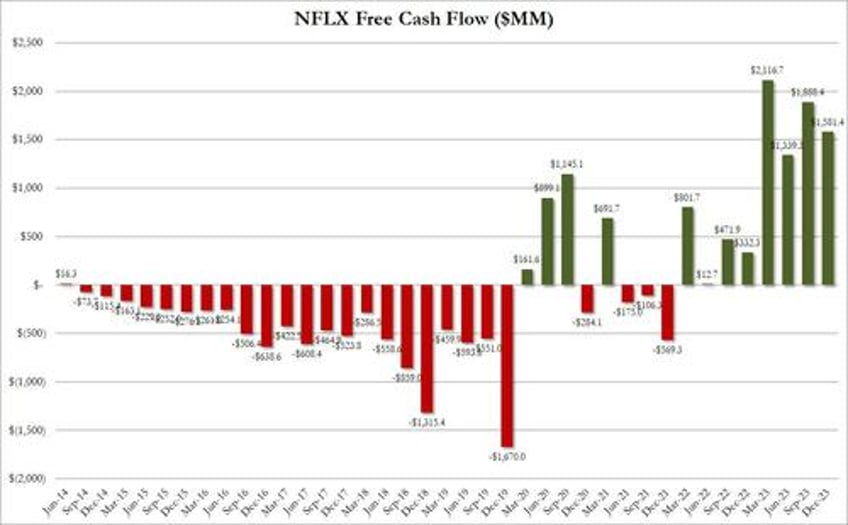

- Free cash flow $1.58 billion vs. $332 million y/y, beating estimates of $1.26 billion

For 2023, NFLX generated $7B of operating income, up 23% year over year. Operating margin for 2023 was 21%, ahead of its 18%-20% beginning-of-year forecast. For the full year, Netflix generated net income of $5.41 billion for all of last year and closed 2023 with $7.1 billion in cash and short-term investments.

And here are the results visually:

Of the above results, what was most impressive is that the company whose content has been consistently spotty, somehow managed to sign up 13.1 million customers in Q4, making it the streaming giant’s best quarter of growth since viewers were stuck at home in the early days of the pandemic. The strong tally exceeded Wall Street’s estimate of 8.91 million and beat projections in every region of the world, with Netflix adding more than 5 million customers in Europe, the Middle East and Africa alone.

And here is the regional detail: for the second consecutive quarter, EMEA (Europe, the Middle East and Africa) accounted for the largest share of Netflix’s growth in the quarter. The company added over 5 million customers in that region, following the 4 million added last quarter. The average amount Netflix makes per customers has increased only modestly in the past year, rising 3%.

The impressive subscriber growth in the final quarter may not continue into 2024, however: Netflix said it won’t add as many customers in the first quarter of 2024 as it did in the final months of 2023, though the tally will exceed the year-ago period’s 1.75 million, to wit:

Similar to prior years, we expect paid net additions to be down sequentially (reflecting typical seasonality as well as some likely pull forward from our strong Q4’23 performance) but to be up versus Q1’23 paid net adds of 1.8M. We expect global ARM to be up year over year on a F/X neutral basis in Q1.

Wall Street expects Netflix to add 4.31 million customers in the quarter. That won’t hurt sales growth, however. Netflix said it will continue to boost revenue at a double-digit rate, in part by raising prices, as it has done for many years now. Indeed, the company forecasts Q1 2024 revenue growth of 13% to $9.24 billion, and includes a three percentage point headwind from F/X on a year over year basis, primarily due to the large decrease in the Argentine peso relative to the US dollar.

The company also expects to continue effectively monetizing the business:

Over the last few years we’ve increased sophistication on our pricing and plans strategy so that we can more effectively capture the value created by our service.

- First, pricing. We seek to provide a range of prices and plans to meet a wide range of needs, including highly competitive starting prices. As we invest in and improve Netflix, we’ll occasionally ask our members to pay a little extra to reflect those improvements, which in turn helps drive the positive flywheel of additional investment to further improve and grow our service.

- Second, ads. Scaling our ads business represents an opportunity to tap into significant new revenue and profit pools over the medium to longer term. In Q4‘23, like the quarter before, our ads membership increased by nearly 70% quarter over quarter, supported by improvements in our offering (e.g., downloads) and the phasing out of our Basic plan for new and rejoining members in our ads markets. The ads plan now accounts for 40% of all Netflix sign-ups in our ads markets and we’re looking to retire our Basic plan in some of our ads countries, starting with Canada and the UK in Q2 and taking it from there. On the advertiser side, we continue to improve the targeting and measurement we offer our customers.

- Third, monetizing sharing. We believe we've successfully addressed account sharing, ensuring that when people enjoy Netflix they pay for the service too. Features like Transfer Profile and Extra Member were much requested, and many millions of our members are now taking advantage of them. At this stage, paid sharing is our normal course of business — creating a much bigger base from which we can grow and enabling us to more effectively penetrate the near term addressable market of ~500M connected TV households (excluding China and Russia), which should increase over time as broadband penetration rises

Netflix rebounded from a rocky 2022 by posting one of its strongest years of customer growth ever, buoyed by a crackdown on password sharing, the introduction of a cheaper advertising-supported option and a strong slate of programs. Hit shows of the latest quarter included the post-apocalyptic thriller Leave the World Behind and a documentary about soccer great David Beckham.

When Netflix lost customers in the first half of 2022, management responded by taking steps it had long resisted. The company introduced advertising, and forced customers to stop sharing passwords. The ad-supported tier got off to a slow start, but has begun to gather momentum. The company said earlier this month it now has more than 23 million people using the tier.

While Netflix still makes almost all of its money from people who pay to watch streaming video on-demand, that will change in the years ahead as the company has invested millions in video games and this week took another step in a new direction by striking a deal to stream live wrestling every week starting next year. Here is an excerpt from the company's 2024 perspective:

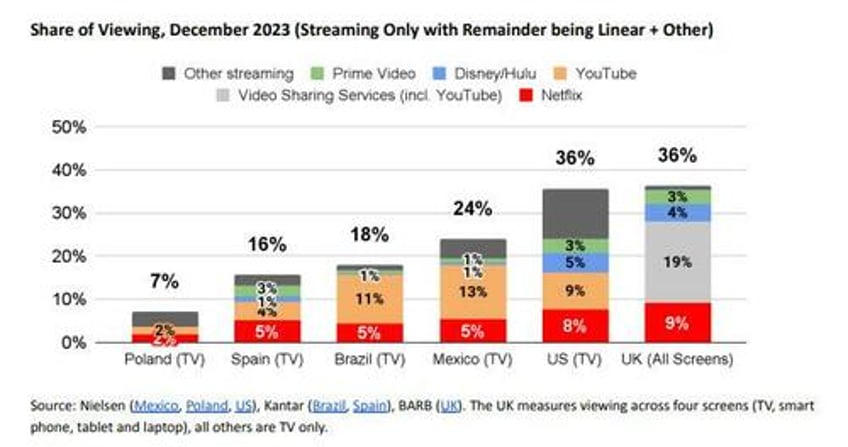

If we continue to execute well and drive continuous improvement — with a better slate, easier discovery and more fandom — while establishing ourselves in new areas like advertising and games, we believe we have a lot more room to grow. It’s a $600B+ opportunity revenue market across pay TV, film, games and branded advertising — and today Netflix accounts for only roughly 5% of that addressable market. And our share of TV viewing is still less than 10% in every country. But it all starts with the consumer. Because when we delight our members, we can drive more engagement, revenue and profit than the competition — creating an increasingly valuable entertainment company (for our members, content creators and shareholders) that will strengthen and grow over time.

Netflix’s strong performance stands in sharp contrast to many of its competitors in Hollywood, which operate shrinking cable networks and unprofitable streaming services.

Going back to the company's results, free cash flow for Q4 was $1.6B compared with $332 million in the prior year period. This was the third highest FCF quarter on record but was largely as a result of the lack of cash spending due to the recently concluded Hollywood strike. For the full year 2023, net cash provided by operating activities was $7.3B vs. $2.0B in 2022 while FCF totaled $6.9B compared to $1.6B in 2022. This included approximately $1B in delayed spending due to the WGA and SAG-AFTRA strikes. Over the past four years, Netflix has generated $12B in net cash provided by operating activities and over $10B in positive FCF.

The company noted that the strikes will cause some lumpiness in its year to year FCF progression. For the full year 2024, NFLX expects FCF of approximately $6B, and continues to expect 2024 cash spend on content of up to $17B. In Q4’23, the company repurchased 5.5M shares for $2.5B and it has $8.4B remaining under the current buyback authorization. The compaany has $400M in senior notes maturing in Q1 of this year and it plans to pay that down with cash on hand

In any case, while the company's Q1 guidance was a little nebulous, the market was more than happy with the surge in Q4 subs and the full year cash flow guidance, and sent the stock some 6% higher, roughly what the options market had priced in, and solidly above $500 per share, the highest level since exactly two years ago when NFLX price plunged from $700 to $200 in the span of 6 months.