A recent Falcon Funded study highlights just how steep the price tag is for those hoping to retire at 40 in the U.S.—and how dramatically it varies by state.

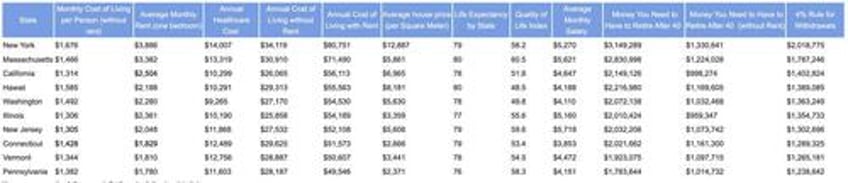

Using the widely cited 4% rule, which assumes a retiree can safely withdraw 4% of savings annually, the analysis factored in monthly living expenses, rent for a one-bedroom apartment, and healthcare costs.

New York tops the list, requiring a staggering $2,018,775 to retire early, largely due to sky-high rent averaging $3,886/month and annual healthcare costs of $14,007, according to a Falcon Funded.

As the study notes, "Retiring at 40 in New York calls for $2,018,775, the highest savings requirement of any state."

Massachusetts ranks second with a needed nest egg of $1,787,246. While also costly—rent sits at $3,382/month—the state boasts the highest quality-of-life index, making it, as the study suggests, “a trade-off between cost and livability.”

California follows in third with $1,402,824 in required savings. High rent ($2,504/month) and moderate healthcare costs contribute to total annual living expenses exceeding $56,000.

Surprisingly, Hawaii comes in just below California despite its reputation for high costs. The lower rent ($2,188/month) keeps its retirement figure at $1,389,085.

The Falcon Funded study said that Washington rounds out the top five at $1,363,249, while Illinois, New Jersey, Connecticut, and Vermont follow close behind, each with required savings between $1.26 million and $1.35 million.

Pennsylvania is the most affordable among the top ten, requiring just $1,238,642 to retire at 40. With rent under $1,800/month and annual living costs below $50,000, it offers the most accessible early retirement option on the list.

Nathan Nolan of Falcon Funded put it bluntly:

“A person aiming to retire at 40 needs to think far beyond lifestyle goals – they need to think geographically. Housing remains the biggest driver, but healthcare and quality of life metrics also shift the savings target dramatically from state to state. Even small differences in monthly expenses can add up to hundreds of thousands in retirement savings over time.”

The message is clear: where you live can either break your early retirement dreams—or make them financially feasible.

You can access the full research findings by following this link.