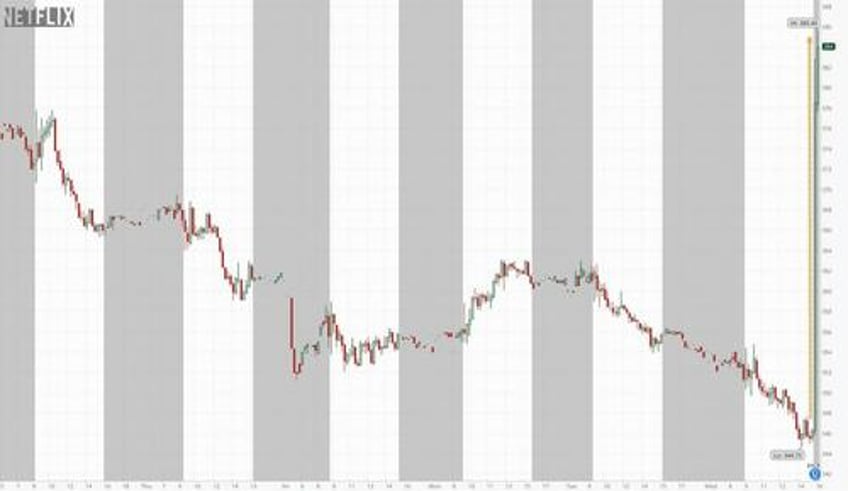

After suffering a historic collapse at the end of 2021, when in the span of five months Netflix lost 75% of its value, the company has enjoyed a solid recovery over the past year when it rose by nearly 200%, from a low of $166 to a recent 52 week high of price of $481, which was the highest since January of 2022, before it lost 28% of its value in the past three months.

Curiously, the solid performance over the past year - which saw the stock down 41% from its pandemic-era all-time closing high of $610.34 on June 30, 2021 but also up 21% YTD vs the 14% increase in the S&P - continued despite several earnings reports that were at best mixed (two quarters ago NFLX not only missed on subs but also slashed guidance, last quarter the company's guidance disappointed despite blowing away subscriber estimates) which brings us to today when the OG video streamer is again trading north of $150N in market cap despite an ongoing Hollywood strike that has mothballed the company's movie and production pipeline for months.

With that in mind, bulls are are hoping for stronger revenue and subscriber growth and guidance than one quarter ago, including more than 6 million new streaming subs at a time when NFLX has cracked down aggressively on password sharing and is navigating a transition from focusing on subscriber growth to maximizing earnings through price hikes and an ad-supported service. It has little choice amid a torrent of competition from some of the world's biggest media companies. Here's what else to expect

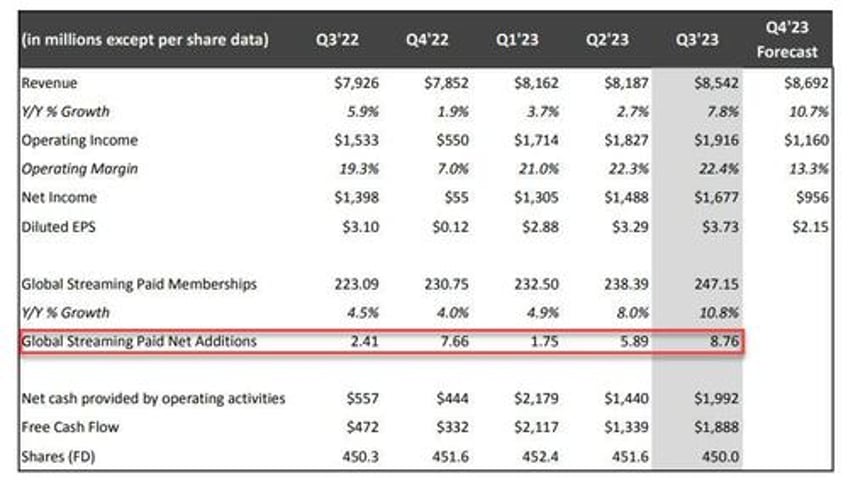

- Earnings: EPS is expected to print $3.49 a share, up from of $3.10 a share last year.

- Revenue: Bloomberg revenue consensus is for $8.53 billion in revenue, up from $7.93 billion a year earlier.

- Stock movement: Netflix shares typically see percentage swings ranging from the high single-digits to the mid-teens after the company posts results.

- Q4 Projections: Revenue estimate $8.76 billion; EPS estimate $2.17; Operating margin estimate 14%

- Full year projections: Free cash flow estimate $5.27 billion; Operating margin estimate 19.8%

What else analysts are watching for:

- "We think Netflix is well-positioned in this murky environment as streamers are shifting strategy, and should be valued as an immensely profitable, slow-growth company," Wedbush analysts said in an Oct. 6 note with an outperform rating and price target of $525. "Even while ads are not yet directly accretive (we think they will be accretive by year-end), the ad-tier should continue to reduce churn and draw new subscribers to the service."

- Meanwhile, TD Cowen analyst John Blackledge said that he expects paid net additions of 6.5 million subscribers versus a consensus of 6 million, but also sees gradual margin growth in the fourth quarter and beyond. He maintained an outperform rating but trimmed his Netflix price target to $500 from $515 in an Oct. 11 report.

- Wells Fargo said that advertising is “off to a somewhat slow start” with pricing and audience delivery below initial advertiser expectations in the first half. The company recently shook up leadership of its ad sales business. “Investors have said to us, they would like to see a more aggressive push, such as automatically converting Basic subs to Basic with ads.”

With that in mind, and considering that options were pricing in a 7.6% swing after hours today, here is what NFLX reported for its third quarter:

- EPS $3.73, beating estimates of $3.49, and above the $3.10 a year ago

- Revenue $8.54 billion, +7.8% y/y, just barely beating estimates of $8.53 billion

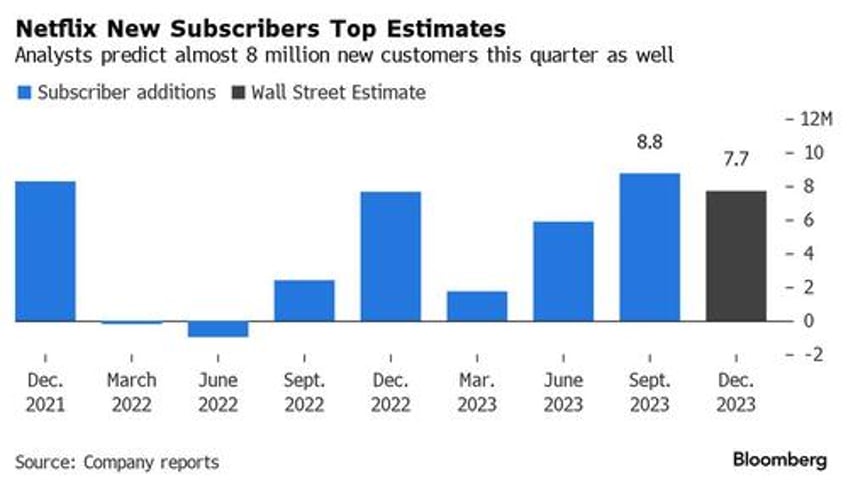

- Streaming paid net change +8.76 million vs. 2.41 million y/y, smashing estimates of +6.20 million

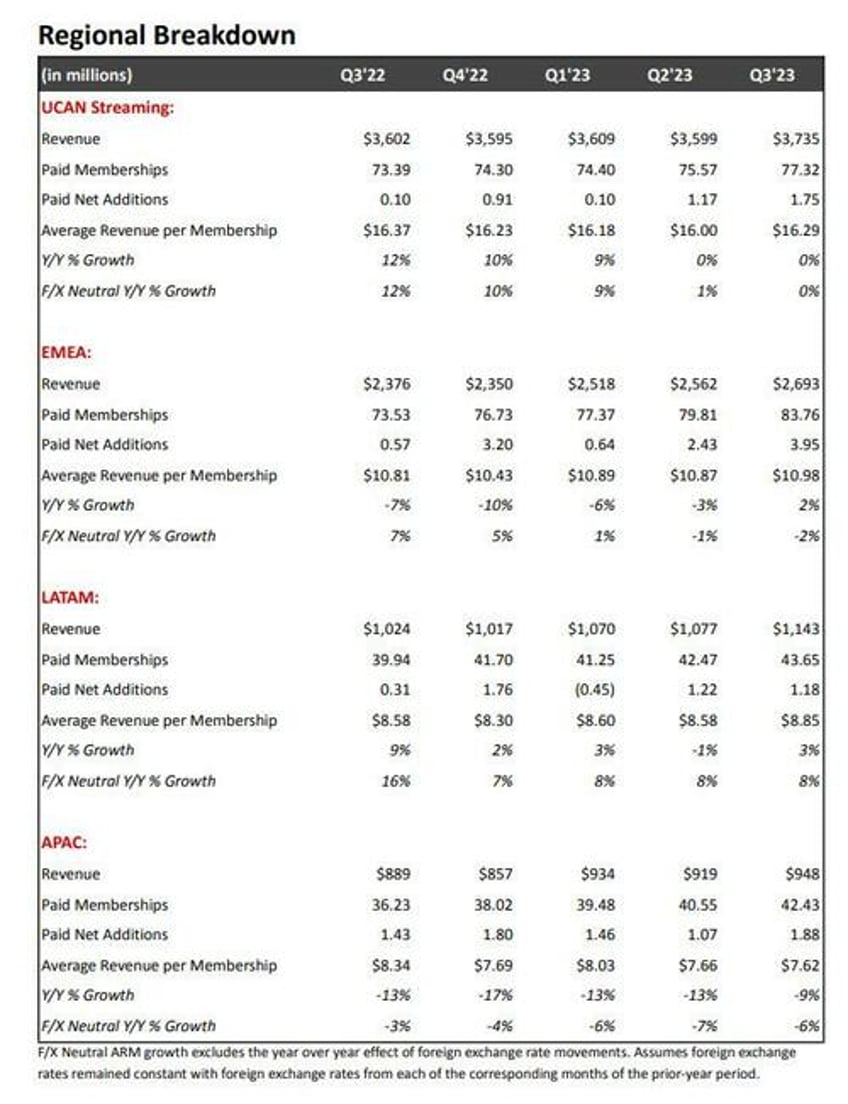

- UCAN streaming paid net change +1.75 million vs. +100K y/y, beating estimate 1.22 million

- EMEA streaming paid net change +3.95 million vs. +570K y/y, beating estimate +2.22 million

- LATAM streaming paid net change +1.18 million vs. +310,000 y/y, beating estimate 1.15 million

- APAC streaming paid net change +1.88 million, +31% y/y, beating estimate +1.41 million

- Streaming paid memberships 247.15 million, +11% y/y, beating estimate 244.41 million

- Operating margin 22.4% vs. 19.3% y/y, beating estimate 22.1%

- Operating income $1.92 billion, +25% y/y, beating estimate $1.9 billion

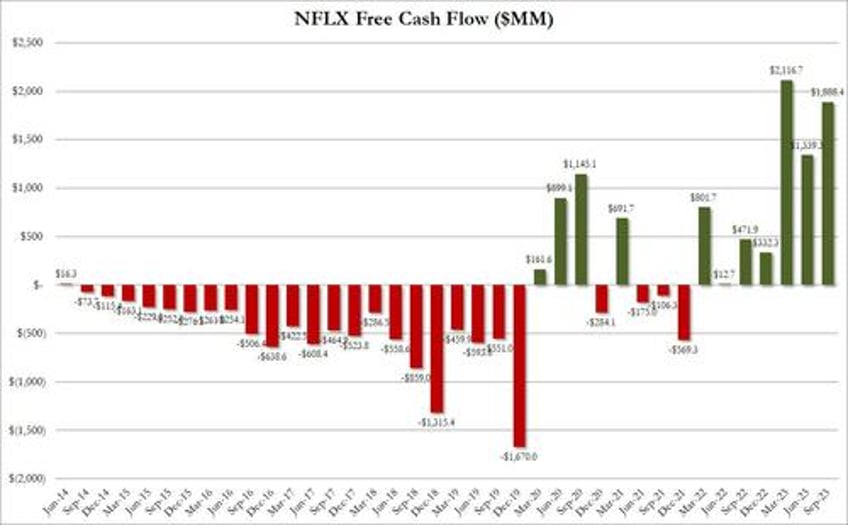

- Free cash flow $1.89 billion vs. $472 million y/y, beating estimate $1.27 billion

The results visually:

The number of new subs added was the strongest since Q2 2020, the peak of the covid lockdowns. Netflix is now on track to add more than 20 million customers this year, a big jump from fewer than 9 million in 2022.

Cracking down on password sharing has been one of the major initiatives at Netflix, which is trying to revive growth after a sluggish year or two. The company also rolled out an advertising-supported version of its streaming services in 12 markets. About 30% of new customers in those markets opted for ads last quarter, the company said.

And here is the regional detail: EMEA (Europe, the Middle East and Africa) accounted for the largest share of Netflix’s growth in the third quarter. The company added almost 4 million customers in that region. The average amount Netflix makes per customers hasn’t changed much in the past year.

The company credited a strong programming slate and its crackdown on password sharing, to wit:

Revenue growth in Q3 reflected a 9% year-over-year increase in average paid memberships (8.8M paid net additions vs. 2.4M in Q3’22) due to the roll out of paid sharing, strong, steady programming and the ongoing expansion of

streaming globally. ARM decreased 1% year-over-year both on a reported and F/X neutral basis, in-line with our expectations. This was due to a number of factors, including a higher percentage of membership growth from lower ARM countries, limited price increases over the past 18 months, and some shift in plan mix.Q3’23 operating income totaled $1.9B vs. $1.5B last year (up 25% year over year), slightly above our guidance forecast due to the revenue upside and timing of content and other spending. As a result, we delivered an operating margin of 22.4% (vs 22.2% forecast), up three percentage points vs. the year ago quarter. EPS in Q3 was $3.73 vs. $3.10 and included a $173M million non-cash unrealized gain from F/X remeasurement on our Euro denominated debt, which is recognized below operating income in “interest and other income

Netflix also said that adoption of its ads-funded plan continues to grow — with ads plan membership up almost 70% quarter-over-quarter — and 30% of sign ups in our ads countries are, on average, to our ads plan, with more work to do to scale this business.

The successful rollout of paid sharing, which lets customers purchase additional access for friends or family, has emboldened Netflix to raise prices in some of its biggest markets. Starting Wednesday, Netflix is increasing the cost of its most expensive plan in the US by $3 to $23 and its basic plan by $2 to $12, while keeping two other plans the same. It’s taking similar steps in the UK and France, two other large markets.

While the current quarter was stellar, the company's Q4 guidance was curiously on the weak side, coming below consensus for both revenue, EPS and margins:

- Sees revenue $8.69 billion, estimate $8.76 billion

- Sees EPS $2.15, estimate $2.17

- Sees operating margin 13.3%, estimate 14%

The company said subscriber additions would be similar to the just-ended quarter, plus or minus a few million. Some more details from the company:

- For Q4’23 Netflix forecasts revenue of $8.7B, up 11% year-over-year, or 12% on an F/X neutral basis. For the fourth quarter, the company expects paid net additions will be similar to Q3’23 (+/- a few million). Global ARM in Q4 is expected to be roughly flat year-over-year, primarily due to limited price increases over the last eighteen months. In addition, over the past few months the US dollar strengthened versus other currencies, representing a roughly $200M expected drag on Q4 revenue and ARM.

- In terms of profitability,

And here is full 2023: thank you striking workers:

- Sees free cash flow $6.5 billion, saw at least $5 billion, and above the estimate $5.27 billion: "We now expect FY23 free cash flow to be approximately $6.5B (+/- a few hundred million dollars), up from our prior forecast of at least $5B, and vs. $1.6B in 2022. This includes ~$1B in lower-than-planned cash content spend in 2023 due to the WGA and SAG-AFTRA strikes. As a result, we expect 2023 cash content spend of around $13B and, assuming the SAG-AFTRA strike is resolved in the near future, we are currently expecting cash content spend of up to ~$17B in 2024. As we said last quarter, the strikes will create some lumpiness in FCF over the 2023/2024 period, but we still plan to deliver very substantial positive FCF in 2024."

- Sees operating margin 20%, saw 18% to 20%, estimate 19.8%: Netflix is updating its FY23 operating margin guidance forecast to 20%, the high end of the prior 18% to 20% forecast (based on F/X rates as of 1/1/23). This would mean that the operating margin would increase approximately two percentage points from our 18% operating margin in FY22. Assuming no material swing in F/X rates, the company currently expect an operating margin in FY24 of 22% to 23%.

Yet we find it odd for the 2nd consecutive quarter that while the Hollywood strike is boosting free cash flow, it has no adverse impact on revenue...

Netflix has returned to growth as many of its peers struggled to figure out their streaming operations. Walt Disney Co., Warner Bros Discovery Inc. and Paramount Global have all cut costs and fired staff to improve their financial performance. They have spent billions of dollars to fund new streaming services that can replace their declining linear TV networks. But most of the newer streaming services lose money.

“We’ve shown that with discipline and a focus on the long term, you can build a strong, sustainable streaming business,” the company said in a letter to shareholders.

Going back to the company's results, free cash flow in Q3’23 amounted to a whopping $1.9B compared with $472MM in the year ago quarter; this was the second highest FCF quarter on record but was largely as a result of the lack of cash spending due to the ongoing Hollywood strike.

NFLX finished Q3 with gross debt of $14B (in-line with the company's $10B-$15B targeted range) and cash and short term investments of $8B, leaving net debt at $6.5BN. During the quarter, NFLX repurchased 6M shares for $2.5BN. Since the inception of this authorization, NFLX has bought back $4.1B. In September, the board increased an additional $10BN stock repurchase authorization on top of the $1B remaining under the prior authorization.

Netflix has returned to growth as many of its peers struggled to figure out their streaming operations. Disney, Discovery and Paramount have all cut costs and fired staff to improve their financial performance. They have spent billions of dollars to fund new streaming services that can replace their declining linear TV networks. But most of the newer streaming services lose money.

And while the company's Q4 guidance was just a touch on the light side, the market was more than happy with the surge in Q3 subs and the full year cash flow guidance, and sent the stock, which is up 17T this year, 11% higher after hours; however when factoring the 2.7% drop during the regular session, most calls and puts will expire worthless: the market was pricing in a +/-8% change today and that may be precisely what it will get.