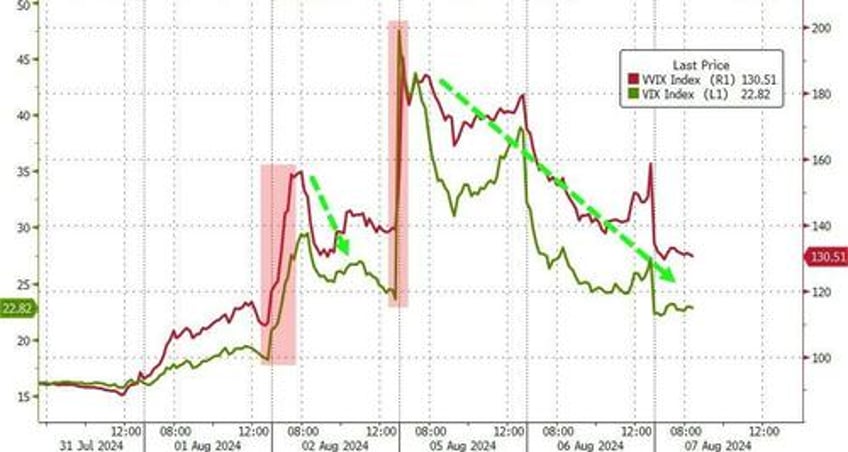

Remarkably, and despite having absolutely cratered off the peak 'vol extremes' into a strong reset the last two days, US Equities Vol metrics continue to price-in a still abnormally large distribution of outcomes for the market path from here (relative to recently placid standards of the past year), signaling ongoing pockets of strain for those (both Buyside and Dealer / Market Maker) who have been covering various “Short Vol / Short Gamma / Short Skew / Short Crash” -positions through the forced risk-management unwind of the past few sessions.

Perversely, this was perpetuated after years of back-tested market conditioning which trained investors to “Sell the Vol rips, buy the Spot dips”...