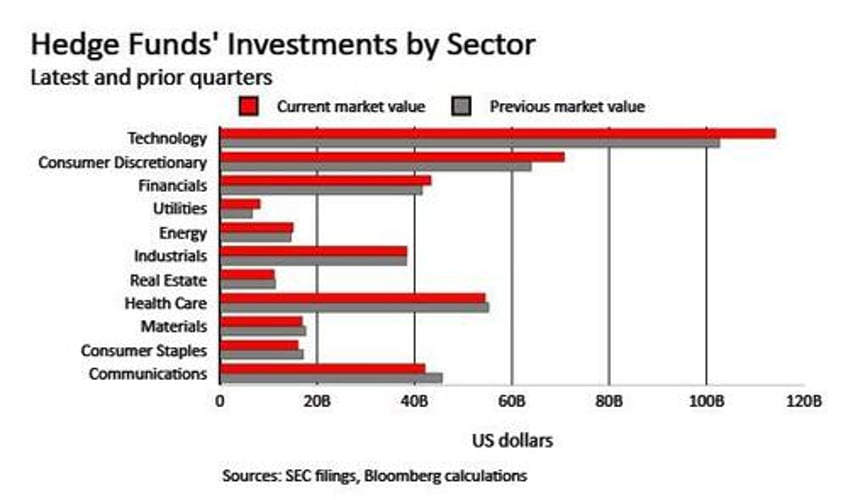

It wasn't just Warren Buffett slashing his Apple stake by more than half: in the second quarter a veritable who is who of the hedge fund community were dumping tech exposure (just as we said at the time, but without knowing names, see "Hedge Funds Dumping Record Amounts Of Tech Stocks To Retail Investors" from June 26).

According to the latest 13F filed by the smart money, besides Buffett, some of the luminaries who trimmed their holdings in “Magnificent Seven” stocks ahead of the late July rout were George Soros and Stanley Druckenmiller.

Soros Fund Management sold some of its stake in Alphabet totaling $58 million, and about $15 million of Amazon.com, according to regulatory filings for the three months ended in June.

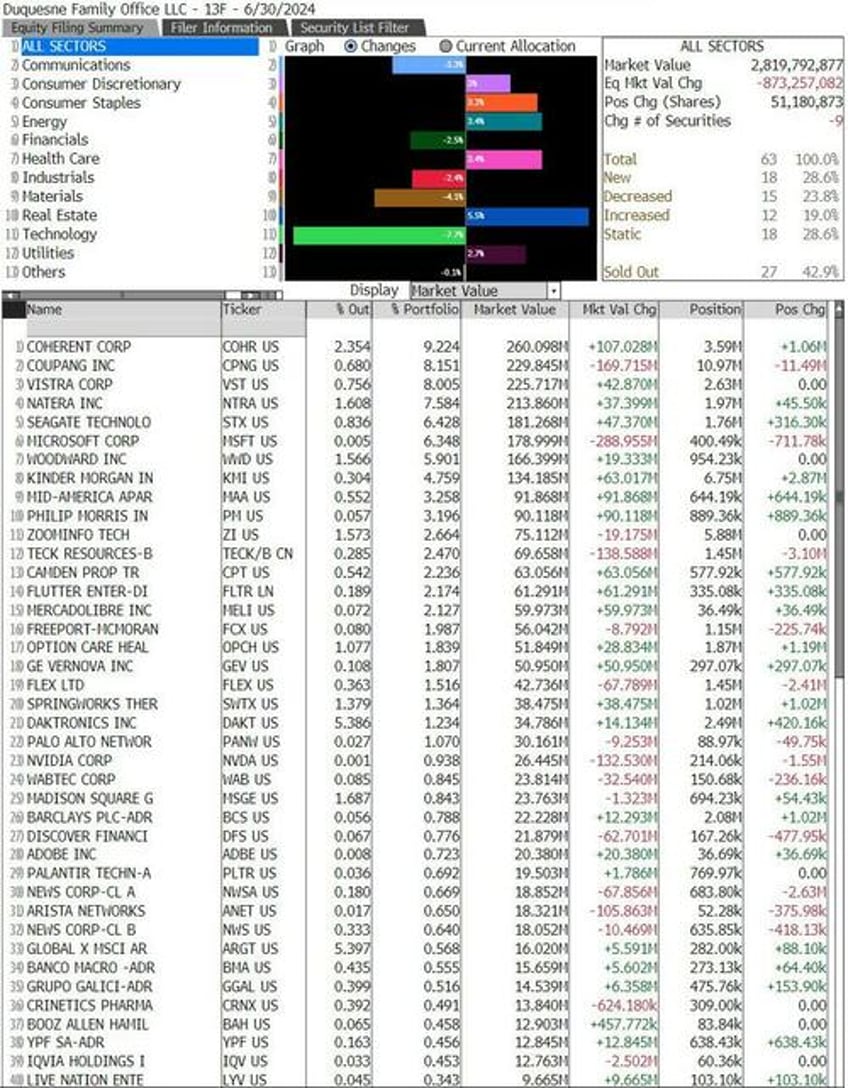

Perhaps not too surprisingly, former Soros disciple, Stanley Druckenmiller, was also among investors paring stakes in AI leader Nvidia. His Duquesne Family Office sold more than 1.5 million shares, filings show.

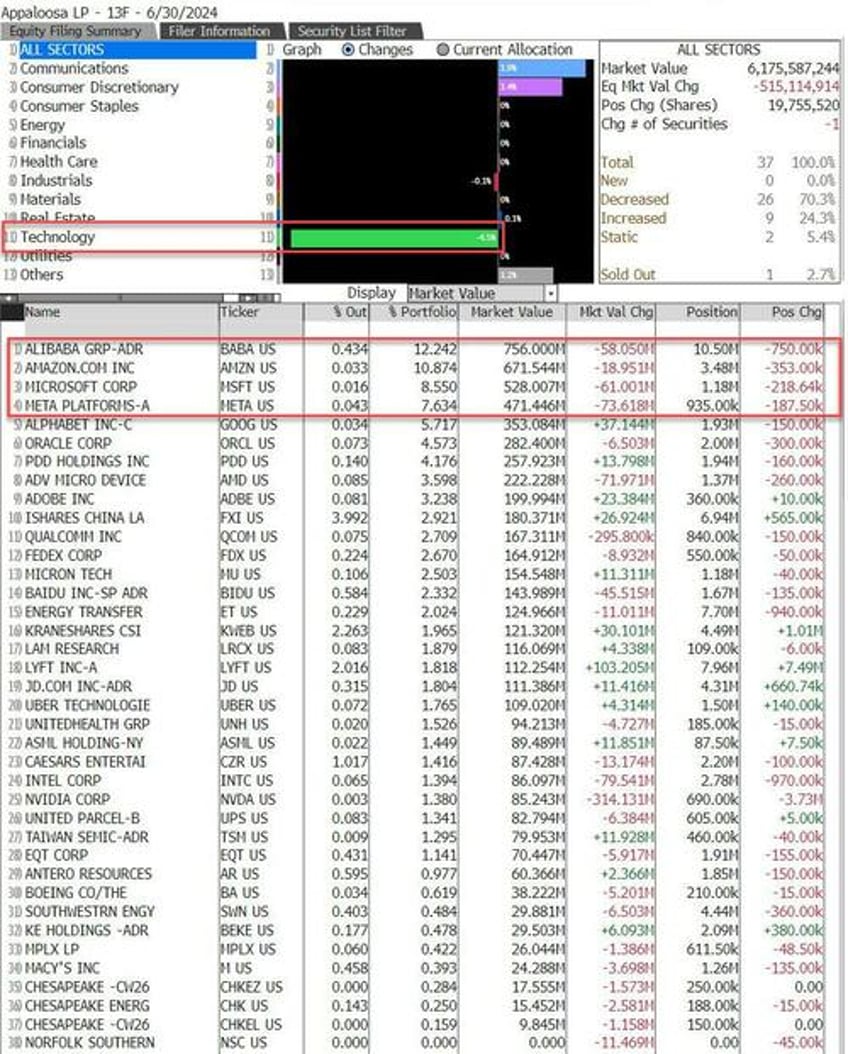

Elsewhere, billionaire David Tepper’s Appaloosa Management cut its holdings of Amazon, Microsoft and Meta, three of its largest positions, continuing similar cuts reported at the end of March.

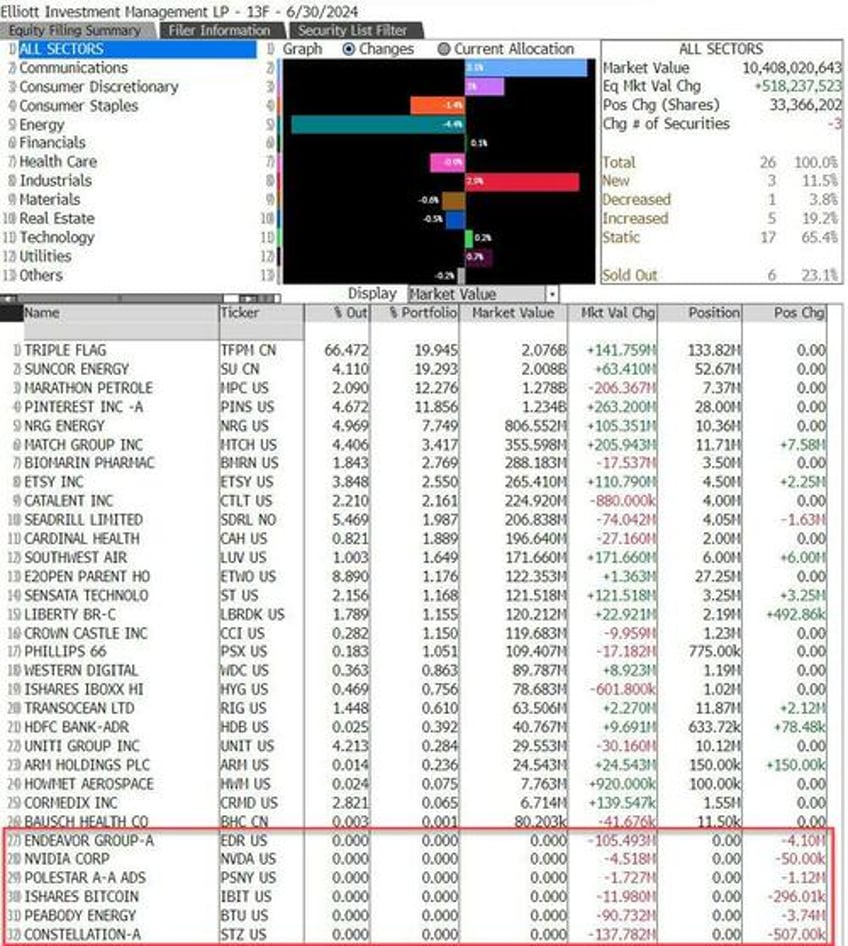

Paul Singer, a prominent AI skeptic who recently slammed the AI space, echoing the deeply pessimistic take of Goldman's head of research, sold off his holdings in Nvidia. He also liquidated its holdings in Constellation Brands, Peabody Energy and the Bitcoin ETF IBIT.

David Bonderman’s Wildcat Capital Management also sold out of his Meta position, dumping shares worth $24 million in the quarter.

As Bloomberg notes, and as our readers were mostly aware, the latest 13F show how investors captured the benefits of the run-up before the benign economic outlook took a gloomier turn, with the Nasdaq 100 slumping 14% in the four-week period beginning July 10. The “Magnificent Seven” had been emblematic of the rally, reflected in the Bloomberg Magnificent 7 Price Return Index, which rose 17% in both the first and second quarters.

Speaking in a CNBC interview in May, Druckenmiller suggested the artificial intelligence boom may be “over-hyped” in the short term.

Yet it wasn't all selling: while Buffett was dumping Apple, others such as Janus and Third Point were buying; in total the stock attracted an aggregated net buy of more than 8.5 million shares from hedge funds, which of course is a far cry from the 400 million shares dumped by Buffett.

Several hedge funds also added to their holdings in other AI-related companies like Taiwan Semi and Amazon, where holdings were increased or initiated by 166 investors, the biggest tally... and likely to result in even more disappointment because after last week's rout, Amazn, which recently hit an all time high, is back to where it was in the summer of 2021.

At the same time, hedge funds sold shares Nvidia as they took their profit from the frenetic rally. Microsoft was cut or reduced by 140 investors, the biggest such reduction.

Here are some other notable moves:

- Soros sold out of its $108 million position in American National Insurance, and $67 million in Aramark.

- Elliott Management added new stakes in Southwest Airlines, with 6.00M shares, and Arm Holdings, worth 150K shares. He also beefed up position in Match Group to 11.7M shares from 4.13M shares, Etsy to 4.50M from 2.25M, and Transocean to 11.9M from 9.75M.

- Druckenmiller’s Duquesne reported a new position in Mid-America Apartment Communities, a real estate investment trust that acquires multi-family apartments, worth $92 million and in cigarette maker Philip Morris International Inc. of $90 million.

- Druckenmiller’s Duquesne reported a new position in Mid-America Apartment Communities, a real estate investment trust that acquires multi-family apartments, worth $92 million and in cigarette maker Philip Morris International Inc. of $90 million.

- Iconiq Capital, the investment firm which manages money for Meta CEO Mark Zuckerberg, sold $2.5 million in Apple.

- Kemnay Advisory Services, a family office that helps manage the fortune of duty-free-shopping billionaire Alan Parker, cut its holdings of Nvidia, Apple, Microsoft, Meta, Alphabet and Amazon.

- As reported last night, Warren Buffett added stakes in cosmetics chain Ulta Beauty Inc. and aerospace company Heico Corp, while liquidating Snowflake and Paramount.

- Michael Burry’s Scion Asset Management continued to boost its stake in China’s tech giant Alibaba Group Holding Ltd., while slashing his overall equity portfolio in half, according to data compiled by Bloomberg.

- Trian sold 29.69 million shares in Walt Disney, the biggest reduction by the investor group; Twin Tree Management LP sold 512,934 shares

- Tairen Capital added 2.8 million shares in Apple, the largest increase; Renaissance Technologies LLC added 1.31 million shares

- Reverence Capital Partners LP added 23.2 million shares in New York Community Bancorp, the largest increase; Renaissance Technologies LLC added 1.25 million shares

According to a Bloomberg analysis of the latest 13F filings from 674 hedge funds, their combined holdings amounted to $443.46 billion, compared with $427.22 billion held by the same funds three months earlier.