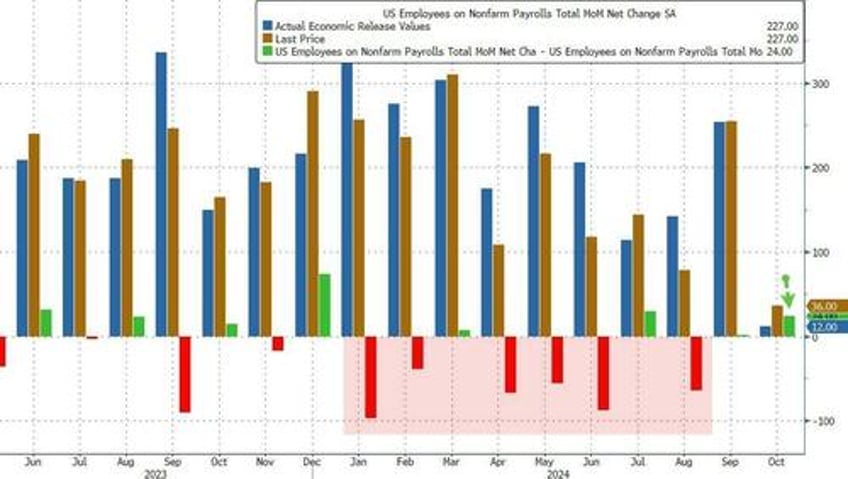

After the October hurricane-driven debacle which sent last month's payrolls print to the lowest in years, at just 12K, traders were expecting a solid bounce today, with many whispering a print that would come above the consensus estimate of 220K... and they were right: moments ago the BLS reported that in November, payrolls growth surged to 227K, the second highest print since March (after the upward September revision).

Unlike previous month, most of which had all seen downward revision, the previous two months were revised higher, September was revised up by 32,000, from +223,000 to +255,000, and the change for October was revised up by 24,000, from +12,000 to +36,000. With these revisions, employment in September and October combined is 56,000 higher than previously reported.

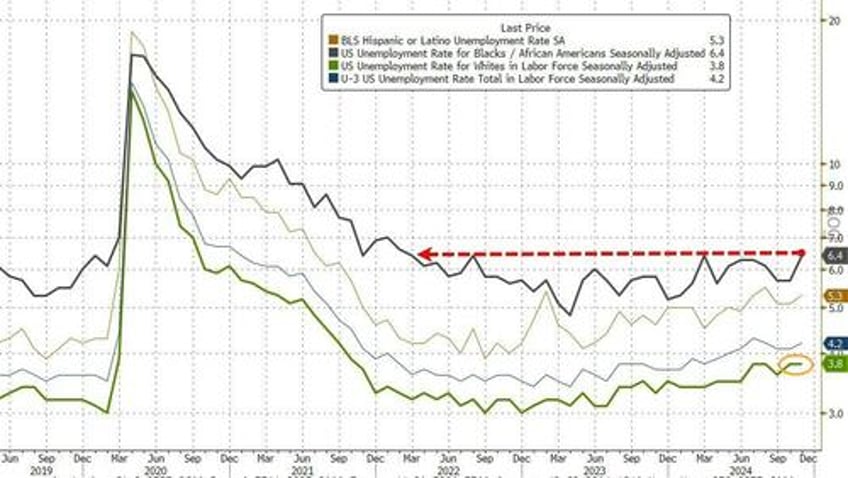

Those looking for a clear indication whether the Fed will keep cutting or halt its easing cycle in two weeks, will have to wait because the rest of the jobs report was mixed: on one hand, unemployment rose from 4.1% to 4.2%, and above the 4.1% estimate (with Black unemployment at 6.4% rising in November, while the jobless rates for adult men (3.9 percent), adult women (3.9 percent), teenagers (13.2 percent), Whites (3.8 percent), Asians (3.8 percent), and Hispanics (5.3 percent) showed little or no change over the month)...

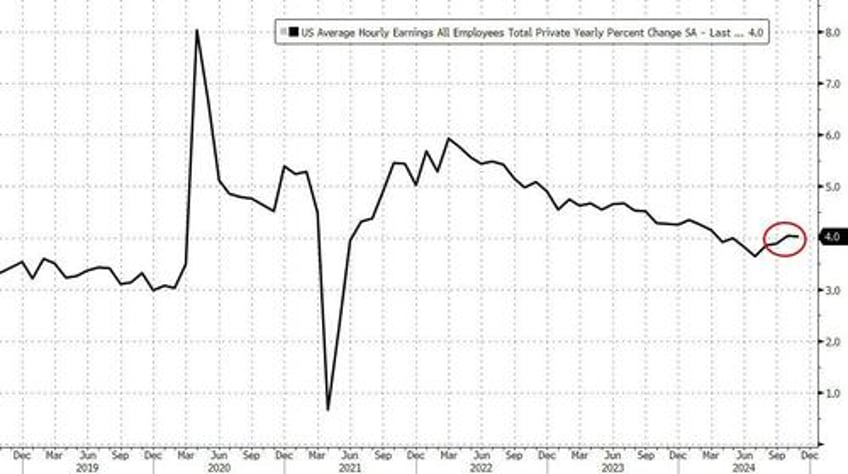

...but hourly earnings also rose, rising 0.4% MoM in November, above the 0.3% estimate, with annual wage growth flat at 4.0%, also above the 3.9% estimate, both indicating that wage growth pressures remain.

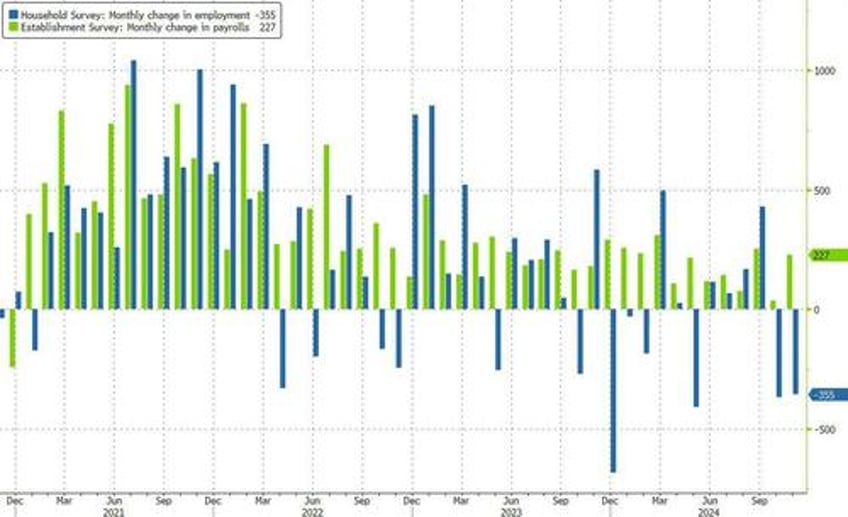

We should note that while the Establishment report gain of 227K payrolls was solid, the Household survey indicated a much bigger weakness, with the number of people employed tumbling by 355K to 161.141 million.

Taking a closer look at the report we find the following:

- The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.7 million in November. This measure is up from 1.2 million a year earlier. In November, the long-term unemployed accounted for 23.2 percent of all unemployed people.

- The labor force participation rate, at 62.5 percent, changed little in November and has remained in a narrow range of 62.5 percent to 62.7 percent since December 2023. The employment-population ratio, at 59.8 percent, also changed little over the month but is down by 0.6 percentage point over the year.

- The number of people employed part time for economic reasons changed little at 4.5 million in November. This measure is up from 4.0 million a year earlier.

- The number of people not in the labor force who currently want a job, at 5.5 million, changed little in November. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force, at 1.6 million, was unchanged in November. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey.

- The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, changed little at 396,000 in November.

d

Developing.