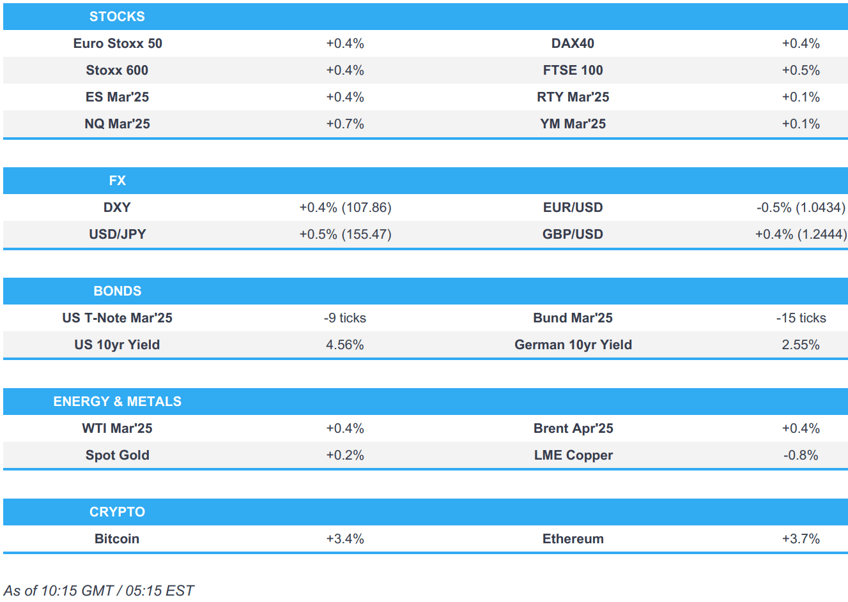

- European bourses are on a firmer footing; NQ outperforms with NVIDIA +5% in pre-market trade.

- USD bounces back following punchy Trump tariff rhetoric; G10s broadly in the red.

- Bonds continue to pullback from Monday's largely tech-driven highs, supply in focus.

- Energy is firmer but base metals are mixed amid tariff threats.

- Looking ahead, US Durable Goods, Richmond Fed Index, NBH Policy Announcement & US Senate Committee, ECB’s Cipollone & Lagarde, Supply from the US, Earnings from LVMH, Boeing, GM, Lockheed Martin, Royal Caribbean, RTX Corporation, Kimberley Clark, Invesco, JetBlue & Starbucks.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- Sentiment has stabilised vs the considerable tech-induced losses seen in the prior session. NVIDIA (+5%) is higher in the pre-market, after sinking as much as 17% on Monday.

- US equity futures are mixed, but with very clear outperformance in the tech-heavy NQ +0.7% as AI-names jump higher in the pre-market, following the tech-rout seen in the prior session; NVDA +5.0%, AVGO +4.0%, MSFT +0.8%.

- In Europe, the Tech sector is found towards the middle of the pack; ASML (+0.8%), BE Semi (+0.3%) are both a little higher, but were initially on the backfoot. SAP (+0.2%) post earnings where the name lifted FY25 guidance.

- European bourses (Stoxx 600 +0.5%) opened the session on a modestly firmer footing, and have generally traded sideways throughout the morning thus far.

- SAP (SAP GY) Q4 Earnings: Beat on Revenue, Net Income, adj. EBIT and Cloud Revenue. Lifts FY25 guidance and expects strong FY Cloud Revenue growth. CEO: Our strong position in data and business AI gives us additional confidence that we will accelerate revenue growth through 2027”.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is bouncing back after being sold yesterday alongside the sell-off in the large cap global tech stocks and failing to act as a safe-haven. The rebound has been bolstered by overnight commentary from US President Trump who pushed back on reports that his administration could impose a gradual 2.5% universal tariff that would increase by 2.5% each month. DXY briefly made its way onto a 108 handle with a current session peak at 108.02.

- EUR is softer vs. the USD and to a lesser extent the GBP. Despite the global risk-aversion yesterday, EUR was actually able to eke out gains vs. the USD. However, this upside has been swiftly reversed on account of the aforementioned inflammatory tariff rhetoric from Trump overnight. EUR/USD is below yesterday's trough at 1.0453 and the 50DMA at 1.0433.

- JPY has given back the bulk of yesterday's gains vs. the USD that were triggered by the sell-off in global large-cap tech stocks. However, this move has been tempered during today's session in the wake of the broadly stronger USD, which has been bolstered by inflammatory tariff rhetoric from US President Trump. USD/JPY is currently tucked within yesterday's 153.71-156.24 range.

- GBP is softer vs. the USD but firmer vs. the EUR. Fresh macro drivers for the UK are light aside from the BRC Shop Price Index for January showing a 0.7% Y/Y decline vs. prev. 1.0%. Cable matched the bottom-end of yesterday's 1.2426-1.2524 range.

- Another session of losses for the antipodes after suffering yesterday alongside the tech sell-off. This time around, the broader recovery in the USD is acting as a drag.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Overall, USTs are pulling back this morning as tech/market sentiment looks set to attempt a slight recovery from the substantial pressure seen on Monday, with NVDA higher by around 5% in pre-market trade. Supply the scheduled point of focus for the session ahead. Follows on from mixed auctions on Monday where the 2yr tap was a soft auction but was followed by the 5yr which experienced a much better reception. Today, USD 44bln of 7yr Notes are on offer after a 2yr FRN sale. As it stands, USTs are softer to the tune of c. 10 ticks at a 108-25+ low.

- Bunds are pulling back in tandem with the above though magnitudes are slightly more contained today on account of Bunds, relatively speaking, paring more of Monday’s upside in that session than USTs managed to do. No reaction to the latest ECB Bank Lending Survey or Germany’s BDI Industry Association forecasting a domestic output contraction in 2025. Bunds at a 131.42 base vs Monday’s 132.14 high, as such Bunds are back to within touching distance of Monday’s 131.38 opening level/trough.

- Gilts are echoing the above, at a 92.13 trough vs Monday’s 92.68 peak. A low which brings Gilts comfortably below the week’s 92.32 open and at an incremental fresh low for the week.

- UK DMO announces gilt tender for up to GBP 1.5bln of their 0.125% 2026 conventional gilt on Jan 30th.

- Netherlands sells EUR 2.45bln vs exp. EUR 2-2.5bln 2.50% 2030 DSL; average yield 2.493% (prev. 2.481%)

- UK sells GBP 1.5bln 1.125% 2035 I/L Gilt Auction: b/c 3.12x and real yield 1.128%.

- Italy sells EUR 3bln vs exp. EUR 2.75-3.0bln 2.55% 2027 BTP & EUR 2-2.5bln 1.50% 2029 & 1.80% 2036 BTP€i.

- Click for a detailed summary

COMMODITIES

- The crude complex is a little firmer and ultimately taking a breather from yesterday's losses, whilst prices could also be underpinned to an extent from reports that protesters at Libya's Es Sidra port prevent tankers from loading, according to engineers cited by Reuters. Brent Apr resides in a USD 76.12-76.90/bbl parameter.

- Mixed/flat trade across precious metals as prices take a breather from yesterday's volatility and with newsflow somewhat light during European hours awaiting any impulse from Wall Street. Spot gold currently resides in a USD 2,734.81-2,745.30/oz range.

- Mixed trade across metals amid an overall cautious tone in the market and with Trump tariff threats continuing to cap gains. Adding to bearish sentiment, US President Trump is reportedly set to impose tariffs on steel, aluminium, and copper imports. 3M LME copper resides in a USD 9,016.00-9,115.50/t range

- Russia's Kremlin says Russia is interested in the continuation of gas transit via Ukraine.

- Saudi's Energy Minister met with Iraqi and Libyan counterparts and discussed efforts to support stability in energy markets, according to the Saudi state news agency.

- Petrobras CEO told Brazilian President Lula that the company will readjust diesel prices with the readjustment expected to occur in the next weeks.

- Slovakian Foreign Minister said they welcome the European Commission statement on gas supplies through Ukraine and see Ukraine's willingness to discuss transit of non-Russian gas as a return to a solution they have proposed, such as Azeri gas.

- Protesters at Libya's Es Sidra port prevent tanker from loading, according to engineers cited by Reuters. Protestors have halted oil loading operations at Libya's Ras Lanuf port, according to Reuters sources.

- India is set to invest nearly USD 2bln to develop the critical minerals sector, according to Reuters sources

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Shop Price Index YY (Jan) -0.7% (Prev. -1.0%)

NOTABLE EUROPEAN HEADLINES

- ECB Euro area bank lending survey: Credit standards tightened for firms in the fourth quarter of 2024, driven by higher perceived risks and lower risk tolerance. Credit standards remained unchanged for loans to households for house purchase but continued to tighten for consumer credit. Housing loan demand continued to rebound strongly, while demand for firm loans remained weak.

- German economy output forecast to fall by 0.1% in 2025, according to BDI, while global economy expected to grow by 3.2%; must assume a leading role in Brussels with ambitions economic policy agenda.

- German Regulator BaFin says property markets correction among top risks in 2025; other top risks include financial market corrections and corporate loan defaults

- UK PM Starmer has reportedly requested that the relinking of the UK and EU emissions trading scheme is on the agenda for spring talks, via FT citing EU officials.

NOTABLE US HEADLINES

- DeepSeek says an issue has been identified, fix is being implemented.

- US President Trump said he will work with Congress on a plan to secure the borders and that they need a massive increase in funding for border security, while he will work with Congress on tax cuts and must permanently extend tax cuts previously passed under the Trump administration. Trump reiterated "drill baby drill" and said he will give fast approval to anyone building a plant for electric generation. Trump also stated that tariffs will be placed on computer chips in the near future and he will place tariffs on producers of pharmaceuticals, while he added that steel and other industries will be considered for tariffs and tariffs will also be placed on aluminium and copper. Furthermore, he said if you want to stop placing the tariffs, companies need to build plants in the US and it is good that companies in China have come up with a faster method of artificial intelligence whereby Chinese startup DeepSeek should be a wake-up call.

- US President Trump said he wants universal tariffs much larger than 2.5% and has a tariff level in mind but had not set it yet, which followed an earlier report in FT that Treasury Secretary Bessent is pushing for a gradual 2.5% universal tariffs plan in which the 2.5% levy would move higher by the same amount each month.

- US Senate voted 68-29 to confirm Scott Bessent as Treasury Secretary.

GEOPOLITICS

MIDDLE EAST

- US Secretary of State Rubio had a call with Jordan's King Abdullah and discussed the implementation of a ceasefire in Gaza, the release of hostages and a pathway for stability in the region.

- "Iranian foreign minister told Sky News: If Iran's nuclear facilities are attacked, it will be answered "immediately and decisively"", according to Sky News Arabia.

- "Hamas: Mediators have begun the process of taking the pulse of the two sides to start the second phase of the agreement", according to Al Arabiya.

OTHER

- US President Trump to sign an order to begin the process of creating the next generation of missile defence, while the order will call for the creation of an 'Iron Dome' for the US.

- UK Foreign Secretary Lammy and US Secretary of State Rubio spoke on the phone and said the UK and US will work together in alignment to address the situation in the Middle East, Russia’s war in Ukraine and challenges posed by China.

CRYPTO

- Bitcoin is back on a firmer footing, after yesterday's tech-induced weakness; currently trading around USD 103k.

APAC TRADE

- APAC stocks were mixed amid holiday-thinned conditions on Chinese New Year's Eve and after the recent US tech sell-off.

- ASX 200 traded rangebound on return from the long weekend as gains in the consumer, healthcare, telecoms and financial sectors offset the losses in real estate, utilities, tech and miners, while improved Business surveys did little to spur demand.

- Nikkei 225 extended on the recent selling but was off worst levels amid a weaker currency and softer Services PPI data.

- Hang Seng kept afloat but with upside capped amid the absence of mainland participants and Stock Connect flows, while markets in Hong Kong closed early ahead of Chinese New Year celebrations.

NOTABLE ASIA-PAC HEADLINES

- US President Trump said they will have a lot of people bidding on TikTok and don't want China involved in TikTok, while he confirmed Microsoft (MSFT) is in talks on TikTok and said he would like a bidding war over TikTok.

- US federal maritime official said the US is not without options in addressing the growing presence of China and Chinese companies in Panama, while the US seeks to increase support for American companies in Panama and throughout the Americas, ensuring Chinese companies are not the sole bidders on contracts.

- Japan's government nominated Waseda University professor Junko Koeda as BoJ Board Member to replace Board Member Adachi whose term ends on 25th March 2025.

DATA RECAP

- Japanese Services PPI (Dec) 2.90% vs Exp. 3.20% (Prev. 3.00%)

- Australian NAB Business Confidence (Dec) -2.0 (Prev. -3.0); Conditions (Dec) 6.0 (Prev. 2.0)