Delayed invasions in Gaza (in order to move more US air defense hardware into place) and Russia training for nuclear strikes were not a great background for buying stocks (even after MSFT's earnings, and despite GOOGL's disappointment) and 'strong' housing data didn't help any dovish cases.

No safe-haven bid in bonds as the dollar, gold, and crypto rallied and oil jumped after some early weakness on the nuke sabre-rattling.

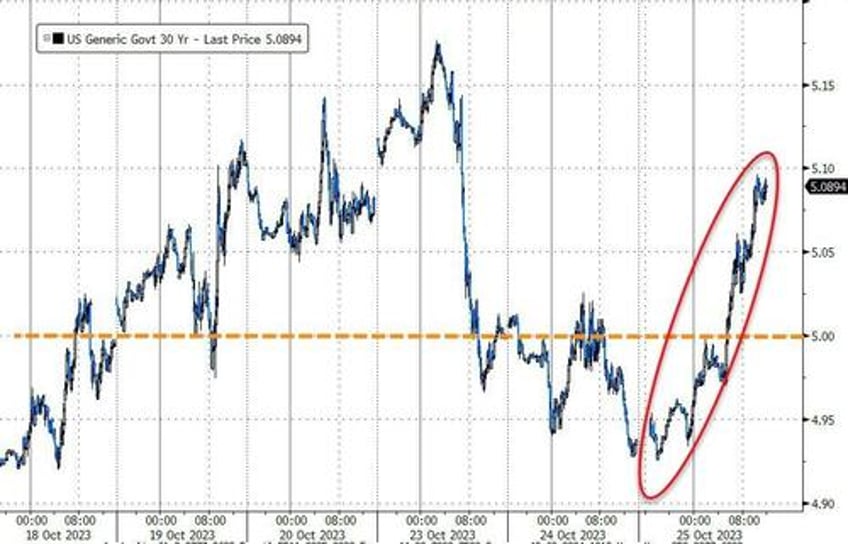

Treasuries puked hard with yields higher across the curve with the long-end significantly underperforming (30Y +15bps, 2Y +5bps). All yields are now higher on the week...

Source: Bloomberg

30Y yield ramped back above 5.00%

Source: Bloomberg

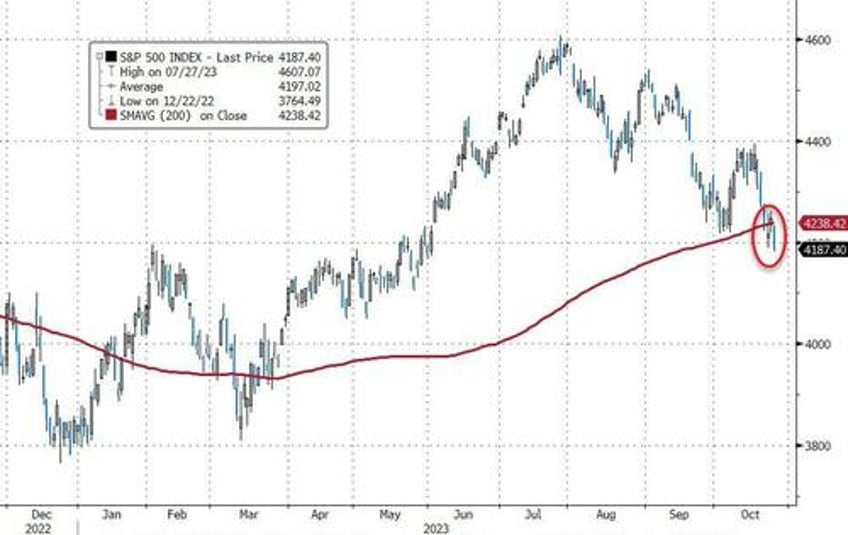

Stocks were nuked as even a better than expected new home sales print (which means homebuilder margins must be getting monkeyhammered) did not help. Higher rates hammered the longest duration equities with Nasdaq the biggest loser. The Dow was the prettiest horse in today's glue factory with S&P and Small Caps ending down around 1-1.5%...

Worst day for Nasdaq since Dec 2022.

As Goldman's Chris Hussey noted, unfortunately for stocks today, the strong housing market is likely contributing to a higher rate environment. Yields on 10-year Treasuries are up 13bp to 4.95%. While yields rose much more steeply a year ago (when 10-year Treasuries rose to 4.2% from 1.4% in 2022), the latest move up in yields is coming alongside a growing assumption that yields are unlikely to return to the ultra-low post-GFC levels that markets enjoyed for over a decade leading up through the pandemic. Today's housing report, for example, is unlikely to provide any reason for the Fed to think that it has raised rates too high. And this higher-for-longer yields environment is weighing on a host of stock valuations.

The S&P 500 broke below its 200DMA to its lowest close since May...

After yesterday's big squeeze higher, today saw 'most shorted' stocks clubbed like a baby seal...

And 0-DTE Put-buyers piled on all day (as Call-Deltas remained relatively flat)...

Consumer Discretionary and Tech tankled today as Energy, Staples, and Utes rallied. Bank stocks dumped and pumped...

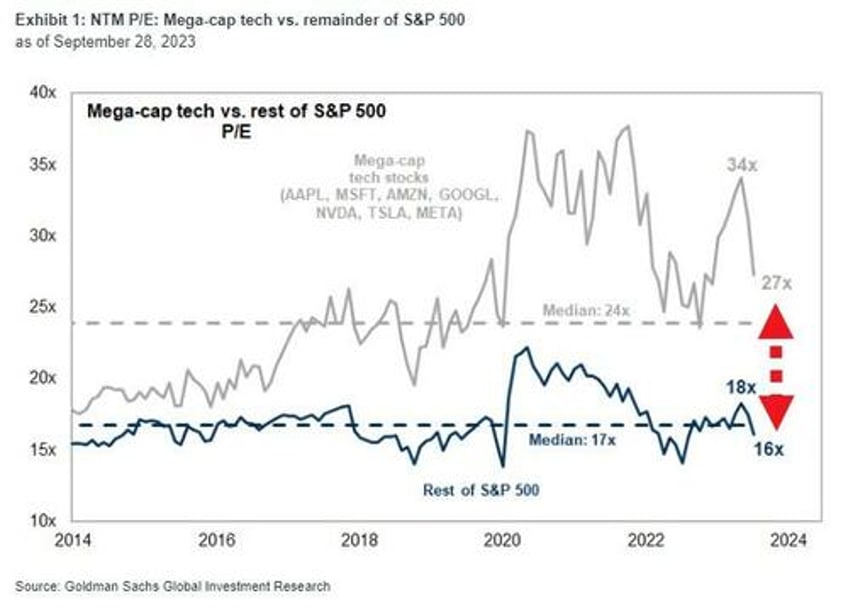

5 of the 7 Mega Cap tech stocks (MSFT, TSLA, META, AMZN, GOOGL) will have reported earnings by the end of this week, and we note that while the group's valuation is well off its high, mega-cap Tech still trades at a significant premium to the other 493 stocks in the S&P 500...

VIX surged back up to a 20 handle...

Oil rallied hard off earlier spike lows to close green as Russian nuke test headlines helped...

...and those same headlines lifted gold (futures) back up towards $2000...

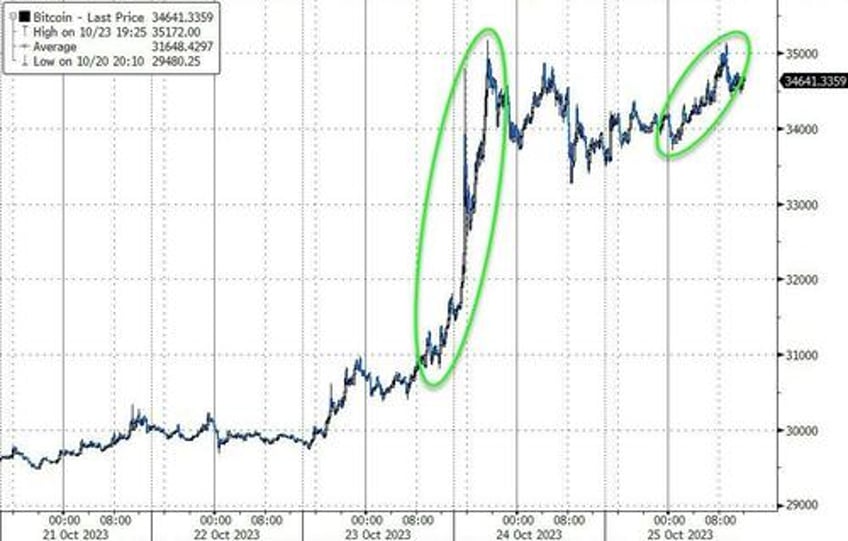

...and Bitcoin back to $35,000...

Source: Bloomberg

And that all happened as the Dollar Index rallied (Loonie and JPY weakness)...

Source: Bloomberg

Finally, we note that USA Sovereign credit risk continues to push higher...

Source: Bloomberg

It seems clear what 'Bidenomics' was really about after all.