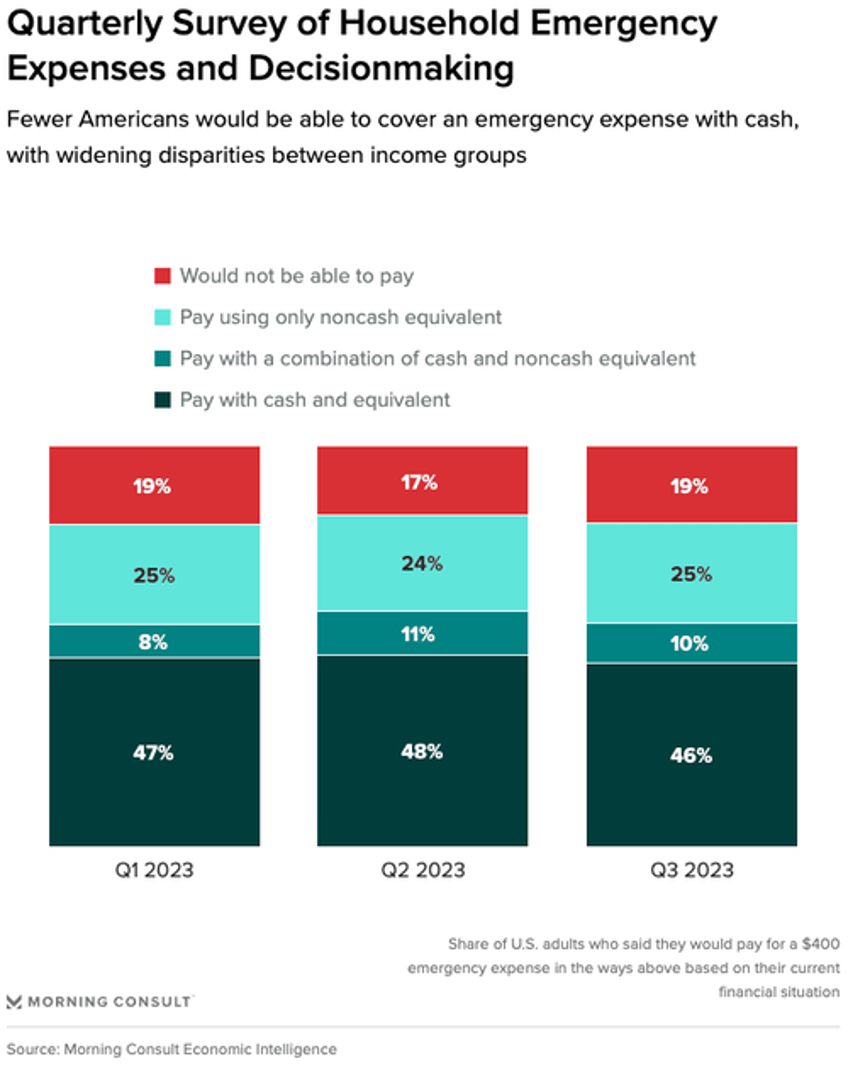

As inflation and economic uncertainty crush American households, only 46% of adults have emergency savings to cover a $400 expense in the third quarter. That is two percentage points lower than survey results from the second quarter, as it appears the financial well-being of consumers is deteriorating.

"The share of U.S. adults who said they would cover a $400 emergency expense with cash or equivalents dropped by 2 percentage points from the previous quarter to 46%, highlighting how cash-strapped many Americans are despite the recent decrease in headline inflation," according to the survey developed by Bloomberg and conducted by intelligence company Morning Consult.

A majority of the 11,000 adults surveyed said they would either need to depend on debt or be unable to cover an emergency expense:

- 35% of respondents said they would need to use at least some debt, steady from the previous quarter,

- while an increasing share, 19%, said they would not be able to pay at all

Morning Consult explained the depressing trend:

"Households are seeing excess savings dwindle with prices still elevated after two years of high inflation, leaving less wiggle room in budgets for unexpected expenses."

... and so much for 'Bidenomics' sparking what the White House has touted as an economic renaissance. Readers know this propaganda from the Biden administration is malarkey (read: here).

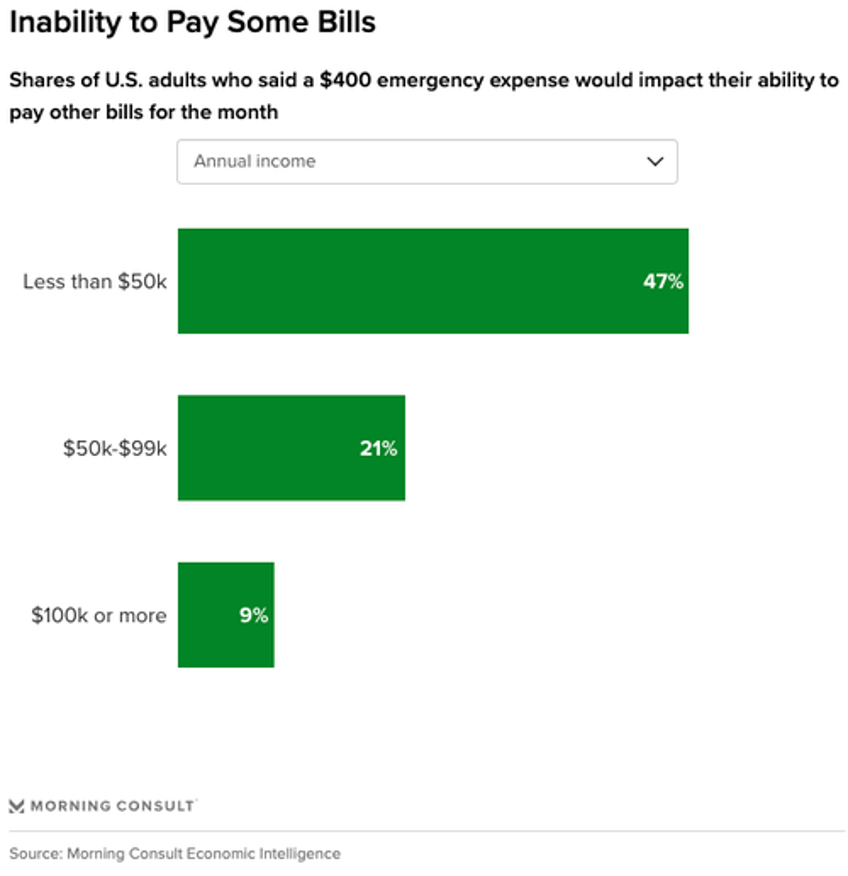

The reality is a $400 emergency expense for the working poor is nearly impossible to pay while borrowing rates are at two-decade highs. Meanwhile, high earners were more than twice as likely as low-income folks to pay the emergency expense with cash or equivalents.

One major problem is that many Americans lack the crucial savings to manage short-term emergencies and build long-term wealth.