- NVIDIA +1.1% in US pre-market after headline beats whilst Q1 gross margins are seen easing.

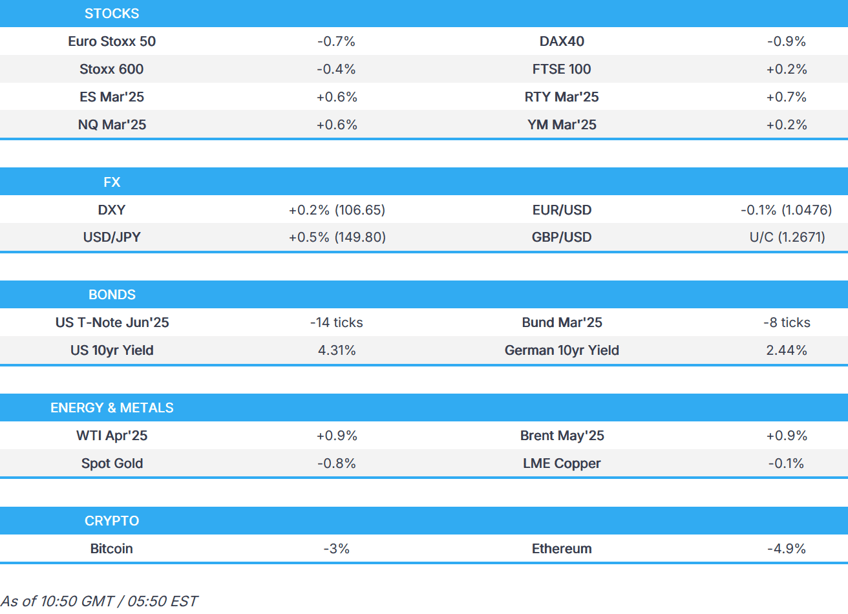

- European bourses on the backfoot with sentiment hit in Europe amid Trump’s EU tariff threats; US futures gain.

- Pick-up in US yields provides reprieve for USD, USD/JPY eyes a test of 150.

- Crude trims recent losses but metals pressured by a firmer Dollar.

- Looking ahead, US Durable Goods, GDP 2nd Estimate (Q4), Core PCE Prices (Q4), Jobless Claims, Japanese Tokyo CPI, Retail Sales, ECB Minutes, Speakers include Fed’s Barkin, Schmid, Barr, Bowman, Hammack & Harker, Earnings from Vistra Energy, Norwegian Cruise Line, Dell.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- Mexico’s Deputy Foreign Trade Minister said Mexico is working with US officials to reach an agreement on tariffs before the deadline and US officials are recognising Mexico’s efforts in addressing illegal drugs and migration.

- US President Trump will hold a press conference with UK PM Starmer on Thursday at 14:00EST/19:00GMT.

- India is reportedly considering tariff reductions on cars and chemicals ahead of Trump's looming tariff deadline, according to Bloomberg

NVIDIA

- Q4 revenue topped estimates, as Data Centre revenue surged, driven by AI chip demand, though the rate of expansion is slowing. And while Q1 sales guidance was above expectations, gross margins are seen easing in Q1, leading to shares slipping about 1.5% by the end of the extended trading session, with investors left slightly underwhelmed, according to Bloomberg.

- Q4 adj. EPS 0.89 (exp. 0.83), Q4 revenue USD 39.33bln (exp. 37.61bln). Q4 Data Centre revenue +93% Y/Y at USD 35.6bln (exp. 34.09bln); Q4 Gaming revenue -14% Y/Y to USD 2.5bln (exp. 3.02bln); Q4 Professional Visualization revenue +10% Y/Y at USD 511mln (exp. 507.6mln); Q4 Automotive revenue USD 570mln (exp. 460.7mln). Q4 R&D expenses +51% y/y to USD 3.71bln (exp. 3.75bln); Q4 adj. operating expenses +53% Y/Y at USD 3.38bln (exp. 3.4bln), Q4 FCF +38% Y/Y at USD 15.52bln.

- Exec noted that it successfully ramped up Blackwell production massively, and it has been the fastest product ramp in the company’s history; it delivered USD 11bln of Blackwell architecture revenue in Q4. Sees Q1 revenue around USD 43bln +/-2% (exp. 41.56bln), sees Q1 adj. GM at 71% +/- 50bps. Sees Q1 adj. gross margin of 73.5% (exp. 73.5%); gross margins are expected to rebound into the mid-70 later in the FY, being weighed at present by the ramp in Blackwell production.

- CFO said that it expects China shipments to maintain current levels as a percentage of data centre revenue, while Stargate data centres will use Spectrum X ethernet networking; anticipates that its networking unit will resume growth in Q1.

- CEO Huang said that next-gen AI requires 100 times more compute due to advanced reasoning processes, and also noted Nvidia’s China revenue halved due to export controls and competition.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.3%) are in the red (ex-FTSE 100 +0.2%), with sentiment hit amid the latest Trump tariff related commentary on the EU. On the former, the US President said that he will be announcing tariffs on the EU very soon and that the EU can try to retaliate on tariffs, as well as noted that EU tariffs are to be 25% on autos and other things.

- European sectors hold a strong negative bias, and with those in the green only modestly so. Telecoms remains afloat, joined closely by Travel & Leisure and then Energy. Autos is by far the clear underperformer, as the sector reacts to US President Trump’s commentary that EU tariffs are to be 25% on autos and other things.

- US equity futures are firmer across the board, with the RTY outperforming; focus is on the all-important NVIDIA, which is higher by around +1.0% pre-market after its latest earnings report (see above for details).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is a touch higher and attempting to continue its recovery after printing a YTD low on Monday at 106.12 following a recent run of soft economic releases, which have weighed on US yields. On the trade front, US Commerce Secretary Lutnick clarified that if President Trump is satisfied by the March 4th deadline; but global tariffs will still come into effect on April 2nd. Today's docket sees the 2nd release of US GDP, quarterly PCE metrics, durable goods and a busy Fed speaker slate.

- EUR is marginally softer vs. the USD after failing to hold above the 1.05 mark. On Wednesday, EUR/USD was able to match the recent YTD peak at 1.0528 before being dragged lower amid tariff headwinds after US President Trump said he will be announcing tariffs on the EU very soon and noted that EU tariffs are to be 25% on autos and other things. On the ECB, today's account of the January meeting will likely pass with little in the way of fanfare given how stale the release will be viewed by the market. Flash CPI data for Spain leaned marginally hawkish.

- USD/JPY is currently staging somewhat of a bounce after a recent run of losses that have been triggered by softness in US yields; the relatively higher yield environment today is likely playing a factor for today's upside. USD/JPY has ventured as high as 149.96 ahead of 150.00.

- GBP is flat vs. USD and EUR in a week that has been lacking in fresh macro drivers for the UK aside from a pledge to ramp up UK defence spending. Today's docket has UK PM Starmer holding a press conference with US President Trump at 14:00EST/19:00GMT. However, this is not expected to be much of a market mover. Cable currently sits towards the bottom of yesterday's 1.2634-1.2715 range.

- Antipodeans are both gradually declined during APAC hours to their weakest level in almost two weeks amid the flimsy risk environment, while there were muted reactions to the mixed New Zealand business survey and mostly weaker Australian capex data.

- PBoC set USD/CNY mid-point at 7.1740 vs exp. 7.2561 (prev. 7.1732).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are softer, given the constructive US risk tone as NVIDIA results weren’t the near 10% move that options had been implying, though of course it remains to be seen how they will open in today’s session; with tariffs and energy strength also influencing. As it stands, USTs are at the bottom of a 110-14 to 110-26 band. While softer, the benchmark remains comfortably clear of yesterday’s 110-08 base. Ahead, a slew of Fed speak and Q4 GDP & PCE second readings and weekly claims are due.

- Bunds initially held just in the green but has seemingly succumbed to intensifying energy upside in the European morning. Action at the start of the session was, once again, driven by the tariff updates from Trump and remarks from EU officials/member nations on retaliatory measures; which sparked conflicting leads for EGBs given the potential growth headwinds and inflation tailwinds from such measures. As such, Bunds find themselves at the lower-end of a 132.54-132.96 band and now in the red by a handful of ticks. ECB Minutes due later.

- Gilts opened essentially unchanged but have also succumbed to intensifying energy action; currently trade at the low-end of a modest 92.99-93.33 band. Traders await the meeting between Trump and UK PM Starmer (19:00 GMT) today for any signs of a deal or exemptions from some or all of the touted measures. Supply from the UK was robust enough, though the sub-3x cover may have disappointed some, in the first conventional auction for the 2040 line after two well-received syndications.

- UK sells GBP 3.25bln 4.375% 2040 Gilt: b/c 2.89x, tail 0.6bps, average yield 4.836%.

- Italy sells EUR 6.75bln vs exp. EUR 5.75-6.75bln 2.95% 2030, 3.65% 2035 BTP & EUR 2.75bln vs exp. 2.5-2.75bln 2033 CCTeu.

- Click for a detailed summary

COMMODITIES

- Crude is on a firmer footing, paring back some of the pressure seen in the prior session after mixed inventories data. Newsflow in the European morning has been light with attention on tariff rhetoric after US President Trump's commentary on Wednesday in which he noted they will be announcing tariffs on the EU very soon. Brent May in a USD 72.10-72.80/bbl range at the time of writing.

- Subdued sentiment was seen in precious metals and as spot gold trickled lower amid a firmer dollar and eventually dipped under yesterday's trough beneath the USD 2,900/oz level. Spot gold resides in a current USD 2,877.17-2,920.81/oz range after dipping under support at 2,890.86/oz.

- Base metals trade mixed amid the tentative mood across markets and with upside capped by tariff rhetoric. Overnight action saw copper futures subdued after wiping out this week's gains. 3M LME copper resides in a USD 9,410.00-9,461.00/t range thus far after dipping sub-9,500/t yesterday.

- US Secretary of State Rubio said he is providing foreign policy guidance to revoke all Biden-era oil and gas licenses that have funded Venezuela’s Maduro regime.

- Indian Mines Minister says they decided to explore lithium in Jammu and Kashmir, with clarity expected by May; looking at Congo and Tanzania for critical minerals.

- Click for a detailed summary

NOTABLE DATA RECAP

- French Producer Prices MM (Jan) 0.7% (Prev. 1.0%, Rev. 0.9%)

- Swiss GDP YY (Q4) 1.5% vs. Exp. 1.6% (Prev. 2.0%, Rev. 1.9%); GDP QQ (Q4) 0.2% vs. Exp. 0.2% (Prev. 0.4%)

- Spanish HICP Flash YY (Feb) 2.9% vs. Exp. 2.8% (Prev. 2.9%); HICP Flash MM (Feb) 0.4% vs. Exp. 0.40% (Prev. -0.10%); CPI MM Flash NSA (Feb) 0.4% vs. Exp. 0.30% (Prev. 0.20%); CPI YY Flash NSA (Feb) 3.0% vs. Exp. 3.00% (Prev. 2.90%)

- EU Loans to Households (Jan) 1.3% (Prev. 1.1%); Loans to Non-Fin (Jan) 2.0% (Prev. 1.5%); Money-M3 Annual Growth (Jan) 3.6% vs. Exp. 3.8% (Prev. 3.5%)

- Italian Consumer Confidence (Feb) 98.8 vs. Exp. 98.4 (Prev. 98.2); Manufacturing Business Confidence (Feb) 87.0 vs. Exp. 87.0 (Prev. 86.8, Rev. 86.8)

- EU Selling Price Expec (Feb) 9.8 (Prev. 8.7, Rev. 8.8); Economic Sentiment (Feb) 96.3 vs. Exp. 96.0 (Prev. 95.2, Rev. 95.3); Consumer Confid. Final (Feb) -13.6 vs. Exp. -13.6 (Prev. -13.6); Industrial Sentiment (Feb) -11.4 vs. Exp. -12.0 (Prev. -12.9, Rev. -12.7); Cons Infl Expec (Feb) 21.1 (Prev. 20.2); Services Sentiment (Feb) 6.2 vs. Exp. 6.8 (Prev. 6.6, Rev. 6.7); Business Climate (Feb) -0.74 (Prev. -0.94, Rev. -0.92)

NOTABLE EUROPEAN HEADLINES

- French President Macron and incoming German Chancellor Merz agree to "open a new chapter in Franco-German relations", according to Reuters sources.

- French Armed Forces Minister, regarding US tariffs, says EU needs to react in the firmest manner possible as soon as possible.

- Austrian Coalition Government programme says we seek to avoid an EU excessive deficit procedure by achieving savings of more than EUR 6.3bln this year and EUR 8.7bln next year.

NOTABLE US HEADLINES

- US President Trump issued an executive order to implement DOGE's government efficiency initiative which deals with federal spending on contracts, grants, and loans, according to the White House.

- US President Trump has assured House and Senate Republicans he intends to open up his stockpile of campaign reserves to defend the party’s slim majorities in both chambers next year, a White House official with knowledge of the conversations told CNN.

- US Senate Majority Leader Thune told Punchbowl "I’m not exactly sure where the 8% number or argument is coming from", in relation to Pentagon spending cuts.

GEOPOLITICS

MIDDLE EAST

- "Negotiations for the passage of the second phase will take place next week in Cairo or Doha", according to Al Jazeera

- The bodies of four Israeli hostages have been transferred to Israel and a Hamas source stated that 97 Palestinian prisoners have been transferred to Egypt. Hamas also said it adheres to the Gaza ceasefire agreement and is ready for discussions on the second phase, while it added suggested the release of the remaining hostages depends on commitment to the ceasefire terms.

UKRAINE/RUSSIA

- Russia's Kremlin says they think the process with the US can move forward with political will, welcome the fact that US President Trump is "willing to listen", no one expects quick and easy solutions with the US. No substantiative discussion yet on cooperation between Russian and US companies. Don't want to see global trade wars. Everything needs to be resolved in stages. Focused on trade with the BRICS.

- European Council President Costa says member states must be prepared for a potential European contribution to the security guarantees for Ukraine and President Zelensky has been invited to the March 6th leaders summit.

CRYPTO

- Bitcoin is back on a weaker footing, now down to USD 86.2k; Ethereum is also lower and holds just above USD 2.3k.

APAC TRADE

- APAC stocks followed suit to the mixed performance stateside for most of the session after tariff-related confusion and NVIDIA's earnings.

- ASX 200 edged mild gains amid outperformance in Consumer Staples following earnings from supermarket heavyweight Coles but with the upside limited amid losses in tech and after disappointing capex data.

- Nikkei 225 swung between gains and losses amid a quiet calendar and choppy currency, while Seven & I Holdings was the worst performer after the founding family's management buyout fell through.

- Hang Seng and Shanghai Comp were initially pressured as trade frictions remain in the spotlight with US Commerce Secretary Lutnick recently commenting that China is his biggest concern and that they will prevent Chinese vehicles from entering the US market, while it was also reported that China is putting the breaks on US stock listings for domestic companies.

NOTABLE ASIA-PAC HEADLINES

- Chinese Commerce Ministry, on possible US trade deal, says China's MOFCOM has been maintaining communication with US counterparts.

- Thai government engages in preliminary talks with automakers regarding potential car trade-in and scrappage initiative, according to Reuters sources.

- China set to boost financial support for EV charging facilities, according to Bloomberg.

- Chinas Financial Regulator encourages banks and insurers to enhance medium-to-long term lending support to tech innovation and equipment upgrades in sectors including steel, nonferrous metals, and petrochemicals.

- MediaTek (2454 TT) FY24 (TWD): Net profit 106.4bln (exp. 115.05bln), Co. is to pay cash dividend of TWD 40bln or TWD 25/shr.

DATA RECAP

- Australian Capital Expenditure (Q4) -0.2% vs. Exp. 0.8% (Prev. 1.1%)

- Australian Private Capital Expenditure for 2025-26 (AUD)(Estimate 1) 148.0B

- Australian Private Capital Expenditure for 2024-25 (AUD)(Estimate 5) 183.4B (Prev. 178.2B)

- New Zealand ANZ Business Confidence (Feb) 58.4 (Prev. 54.4)

- New Zealand ANZ Activity Outlook (Feb) 45.1 (Prev. 45.8)