It's now officially the "most important stock on planet earth", and thus everyone was watching what Nvidia would report after the close, with option markets expecting a 10% swing (a $200 billion delta) after hours. And while many were hoping that the company to continue its relentless meltup ways, Goldman's trading desk was less euphoric with TMT specialist Peter Callahan warning overnight that there is "plenty of tactical debate whether this print will be a local top or a ‘break-out’ moment for the stock and for the A.I. trade (from my seat, feels like consensus is learning more towards the former).

In retrospect he may have been right because even though NVDA reported stellar Q4 results, they may not have been stellar enough and the stock is now sliding after hours.

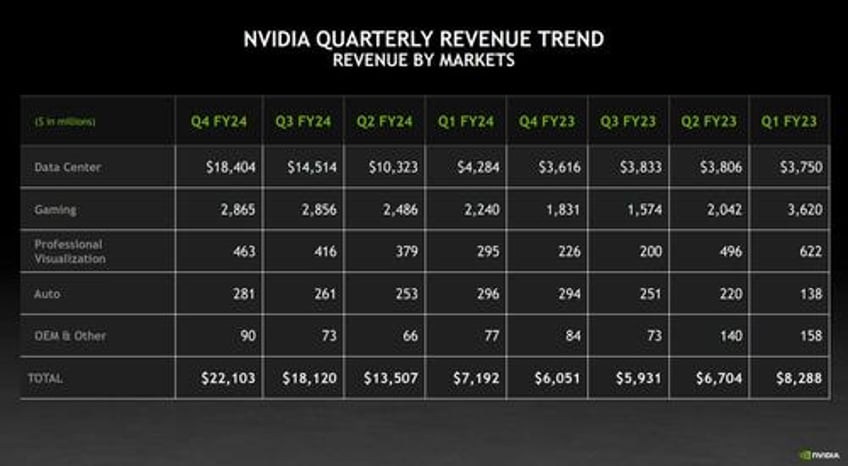

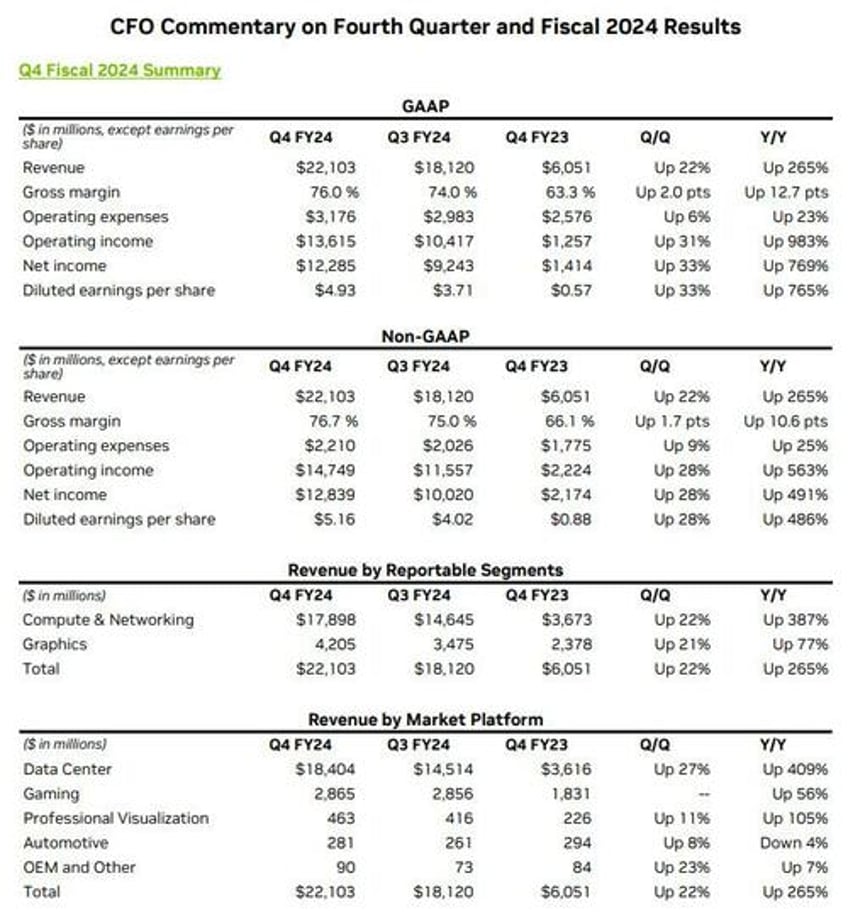

Here is what NVDA reported for Q4 earnings:

- Adjusted EPS $5.16, smashing estimates of $4.53

- Revenue $22.10 billion, up 265% from $6.05 billion y/y, and beating the estimate $20.41 billion

- Data center revenue $18.4 billion, up 409% from $3.62 billion y/y, beating estimates of $17.21 billion

- Gaming revenue $2.9 billion, up 58% y/y from $1.8 billion, and beating estimates of $2.72 billion

- Professional Visualization revenue $463 million, up 11% from $226 million y/y, and beating the estimate of $435.5 million

- Automotive revenue $281 million, down 4.4% from $294 million, and also beating estimates of $272.1 million

Some more details on the revenue breakdown

- Data Center revenue for the fourth quarter was a record, up 409% from a year ago and up 27% sequentially. These increases reflect higher shipments of the NVIDIA Hopper GPU computing platform used for the training and inference of large language models, recommendation engines, and generative AI applications, along with InfiniBand end-to-end solutions. Data Center revenue for fiscal year 2024 was up 217%. In the fourth quarter, large cloud providers represented more than half of our Data Center revenue, supporting both internal workloads and external customers. Strong demand was driven by enterprise software and consumer internet applications, and multiple industry verticals including automotive, financial services, and healthcare. Customers across industry verticals access NVIDIA AI infrastructure both through the cloud and on-premises. Data Center sales to China declined significantly in the fourth quarter due to U.S. government licensing requirements. Data Center compute revenue was up 488% from a year ago and up 27% sequentially in the fourth quarter; it was up 244% in the fiscal year. Networking revenue was up 217% from a year ago and up 28% sequentially in the fourth quarter; it was up 133% in the fiscal year

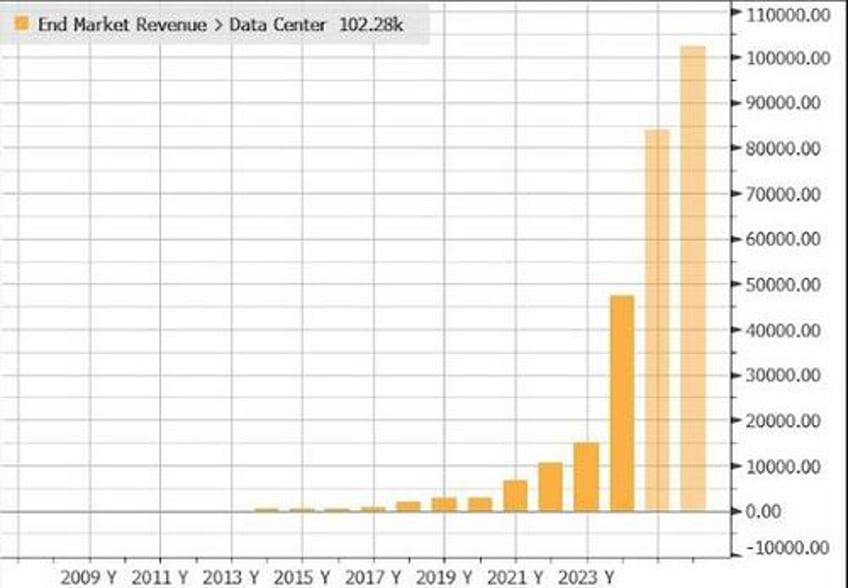

The chart below shows all you need to know about the company's main revenue driver

- Gaming revenue was up 56% from a year ago and flat sequentially. Fiscal year revenue was up 15%. The year-on-year increases for the quarter and fiscal year reflect higher sell-in to partners following the normalization of channel inventory levels and growing demand. The launch of our GeForce RTX 40 SUPER Series family of GPUs also contributed to revenue in the quarter.

- Professional Visualization revenue was up 105% from a year ago and up 11% sequentially. Fiscal year revenue was up 1%. The year-on-year increase for the quarter primarily reflects higher sell-in to partners following normalization of channel inventory levels. The sequential increase was primarily due to the ramp of desktop workstations based on the Ada Lovelace GPU architecture.

- Automotive revenue was down 4% from a year ago and up 8% sequentially. Fiscal year revenue was up 21%. The sequential increase was driven by self-driving platforms. The year-on-year decrease for the quarter was driven by AI Cockpit, offset by an increase in self-driving platforms. The year-on-year increase for the fiscal year primarily reflected growth in self-driving platforms.

Going down the line:

- Adjusted gross margin 76.7% vs. 66.1% y/y, beating estimates of 75.4%

- R&D expenses $2.47 billion, +26% y/y, beating estimates of $2.43 billion

- Adjusted operating expenses $2.21 billion, +25% y/y, below the estimate of $2.23 billion

- Adjusted operating income $14.75 billion vs. $2.22 billion y/y, beating estimates of $13.14 billion

- Free cash flow $11.22 billion vs. $1.74 billion y/y, also beating estimates of $10.82 billion

Gross Margin:

- GAAP and non-GAAP gross margins for the fourth quarter increased significantly from a year ago and sequentially on strong Data Center revenue growth primarily driven by our Hopper GPU computing platform. Our gross margins in the fourth quarter also benefited from favorable component costs

Expenses:

- Non-GAAP operating expenses for the fourth quarter were up 25% from a year ago and up 9% sequentially. The year-on-year increase was driven by growth in employees and compensation increases. The sequential increase reflected higher compute and infrastructure investments.

- Fiscal year non-GAAP operating expenses were up 13% from a year ago, reflecting growth in employees and compensation increases.

The financial results in a nutshell:

Commenting on the results, CEO Jensen Huang said that “accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations." He added that “our Data Center platform is powered by increasingly diverse drivers — demand for data processing, training and inference from large cloud-service providers and GPU-specialized ones, as well as from enterprise software and consumer internet companies. Vertical industries — led by auto, financial services and healthcare — are now at a multibillion-dollar level.

“NVIDIA RTX, introduced less than six years ago, is now a massive PC platform for generative AI, enjoyed by 100 million gamers and creators. The year ahead will bring major new product cycles with exceptional innovations to help propel our industry forward. Come join us at next month’s GTC, where we and our rich ecosystem will reveal the exciting future ahead."

And while the Q4 results were stellar, it was once again the company's guidance that blew away investors - even if it did take algos a few minutes to process it - and send the stock sharply higher after hours.

- Revenue is expected to be $24.00 billion, plus or minus 2%, Est. $21.9BN

- GAAP and non-GAAP gross margins are expected to be 71.5% and 72.5%, missing the estimate of 75.5%

- GAAP and non-GAAP operating expenses are expected to be approximately $2.95 billion and $2.00 billion, vs est of $2.4 billion

- GAAP and non-GAAP tax rates are expected to be 14.5%, plus or minus 1%, excluding any discrete items.

- GAAP and non-GAAP operating expenses are expected to be approximately $2.95 billion and $2.00 billion, respectively.

Unlike two quarters ago, when the company announced a $25BN stock buybacks, there was no such kicker this time, although judging by the market's reaction the company probably won't be need to repurchase shares any time soon. NVDA reported that at the end of the year, cash and cash equivalents were $26.0 billion, up from $13.3 billion a year ago and $18.3 billion a quarter ago. The increases primarily reflect higher revenue partially offset by taxes paid and stock repurchases.

In response to the stunning earnings, NVDA stock first dumped - perhaps as the company's guidance missed the whisper number of $25 billion and also disappointed on the gross margin guidance, but then reversed all losses and ended up spiking about 9% after hours. But since option straddles were pricing in a 10% move in either direction, tomorrow a whole lot of put and call buyers will be left very disappointed when they see the value of their options vaporize.