With a combination of high interest rates and a slow return to office towers, the commercial real estate sector faces further declines as the new year begins. One of the most significant challenges facing office tower owners will be either repaying the full value of the loan or finding an institution, such as a regional bank, willing to offer refinancing.

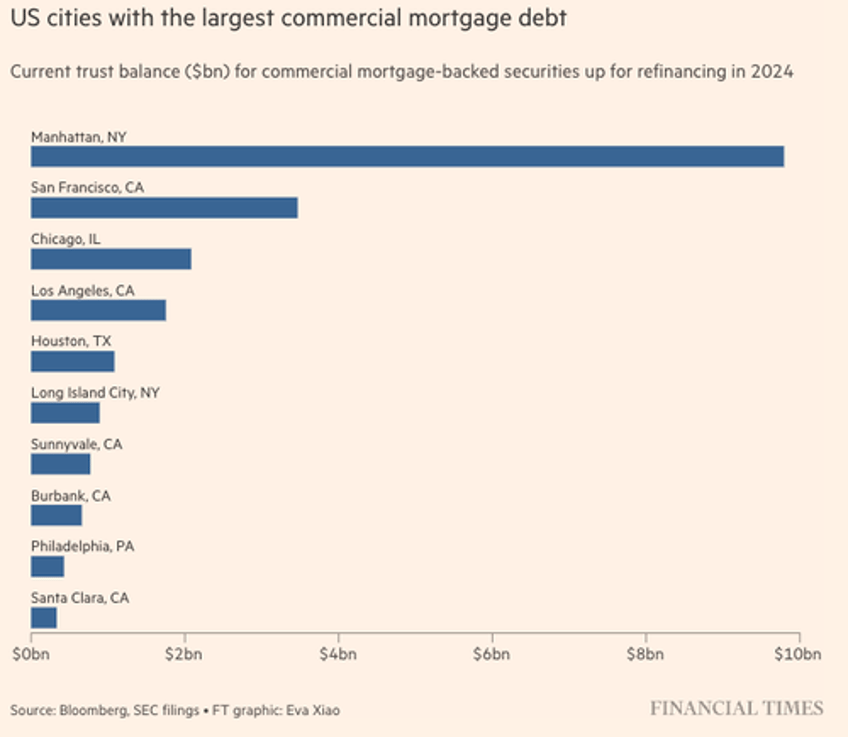

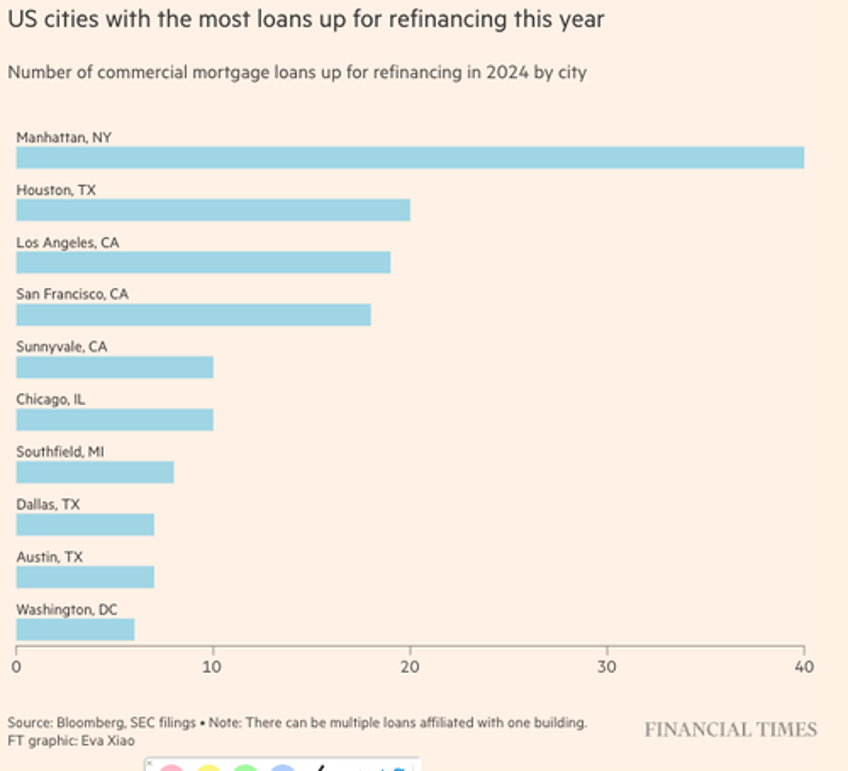

According to a new report by the Financial Times, which references data from the Mortgage Bankers Association, $117 billion in CRE office debt needs to be repaid or refinanced this year. Much of this debt is concentrated in major cities such as Manhattan, San Francisco, Chicago, and Los Angeles.

"It's going to be a very difficult environment to be getting loans from the institutions that typically give these loans. That's the bottom line, "Andrew Metrick, the Janet L. Yellen Professor of Finance and Management and director of the Yale Program on Financial Stability, recently said at the Alumni Real Estate Association Conference.

The challenging environment can be attributed to several factors, including regional bank stress due to the collapse of Silicon Valley Bank, First Republic, and Signature Bank, among others, in the first half of 2023. The situation worsens for building owners because regional and community banks make up most of the CRE lending space. Additionally, the Federal Reserve's most aggressive interest rate hiking cycle in decades has significantly increased the cost of borrowing.

Moody's Analytics estimates about 605 office towers with mortgages will need financing this year. Of that, about 224 will have trouble refinancing - either because the property values have plunged and there is too much debt or perhaps a high vacancy rate.

Meanwhile, stress is emerging as new Trepp data shows delinquencies on office loans financed by commercial mortgaged-backed securities topped 6% at the end of November, up from 1.7% a year earlier.

Even with the low default rates, the potential losses on these loans are in the billions of dollars. A recent study by a group of US economists found that 40% of office loans on bank balance sheets were valued less than the loan amount, posing a risk for regional banks.

"People should realize that regional banks are still very much exposed to the troubles in commercial real estate," said Leo Huang, head of commercial real estate at Ellington Management.

Over the next three to four years, about two-thirds of the CRE space will require refinancing. With property values plunging and significantly higher interest rates, default rates will likely continue surging, causing even more trouble for exposed regional banks.

CRE office turmoil is far from over.