By Jake Lloyd-Smith, Bloomberg Markets Live reporter and strategist

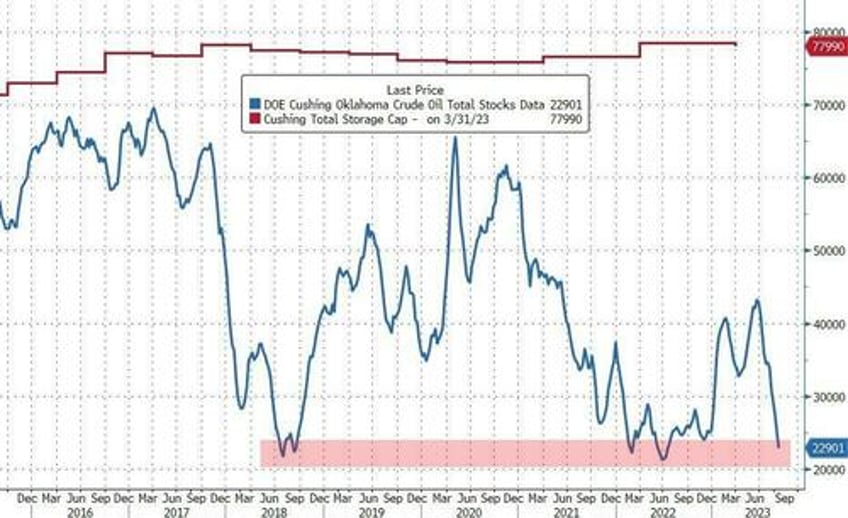

Crude prices will likely get a fresh boost this week, as stockpiles at the key US storage hub in Cushing, Oklahoma, risk collapsing to the lowest level (aka "tank-bottoms") in almost a decade.

Such a move would embolden those aiming for a return of $100 oil by year-end.

Cushing matters. Being the delivery point for the WTI futures contract, the rise and fall of the holdings is among the market’s most closely followed trends. So far in 3Q, inventories have slumped by ~47% to 22.9m barrels. That’s the lowest since July 2022 and that’s not far away from the 2014 lows.

If that comes to pass, it’d highlight the scramble for near-term supplies as the global market tightens up.

Estimates come on Tuesday, followed by the official print the next day.