Oil is up more than $6 from its nadir last week with the latest leg higher helped by the risk-on tone across global markets.

Today’s rally is, as Bloomberg's Alex Longley writes, the latest in a bumper run of intraday price volatility for crude, with average daily swings in August and September being the highest since early this year.

Against that backdrop, money managers had been positioned net short in Brent crude for the first time ever. With the Fed’s interest rate cuts assuaging concerns in financial markets, that left oil prices ripe for a rally.

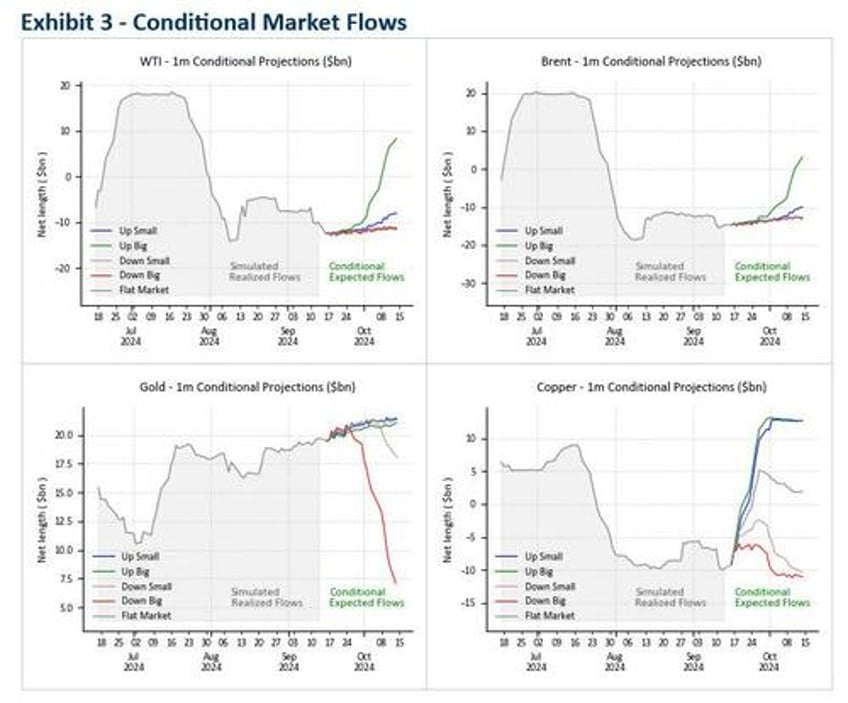

There could be more to come too: as shown in the Goldman charts below, we are rapidly approaching levels where significant CTA buying could appear.

There’s also continued disruption in Libya where output remains far below a million barrels a day and the storage hub of Cushing, where US crude futures are priced, remains at extremely low levels.

WTI Holds Gains As 'Tank Bottoms' Loom After Big Draw At Cushing Hub https://t.co/TuKqsCL8cr

— zerohedge (@zerohedge) September 18, 2024

As Longley concludes, "given oil prices regularly overshoot in either direction, it wouldn’t be a surprise to see this recovery rally gain momentum."