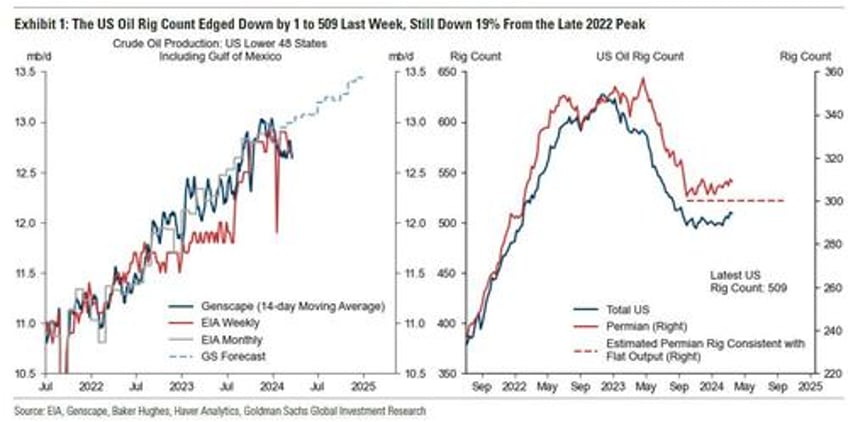

A few weeks ago we looked at the current state of M&A play in the US shale patch, and concludes that with most E&P companies - from small to XXX-large - either set acquire (or be acquired) and/or have opted for an independent future for the near-term, it was only a matter of time before the burst in oil production that defined late 2023 and early 2024, and was meant to window-dress the books of various potential acquisition targets, was about to dry out with a whimper.

The shale turbo boost has peaked with the E&P merger wave over.

— zerohedge (@zerohedge) March 3, 2024

It's all downhill from here pic.twitter.com/UaUGDqlVwE

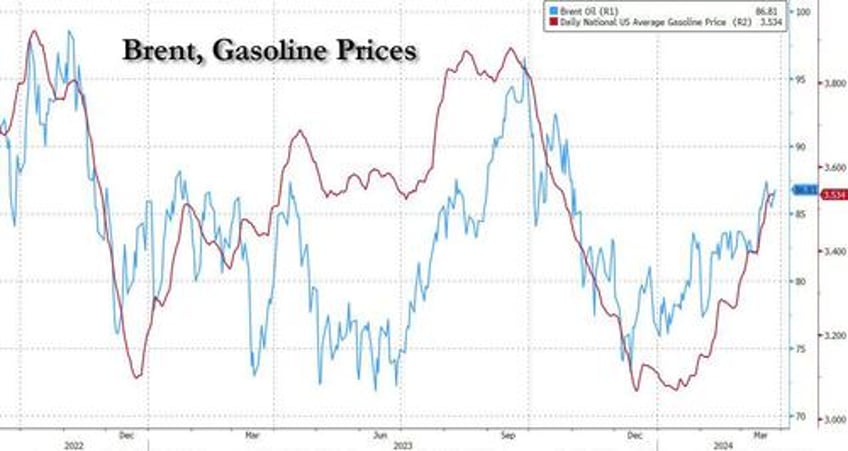

Fast forward three weeks, and what we predicted would happen has happened, along with Brent jumping to a 2024 six-month high on its way to going far higher...

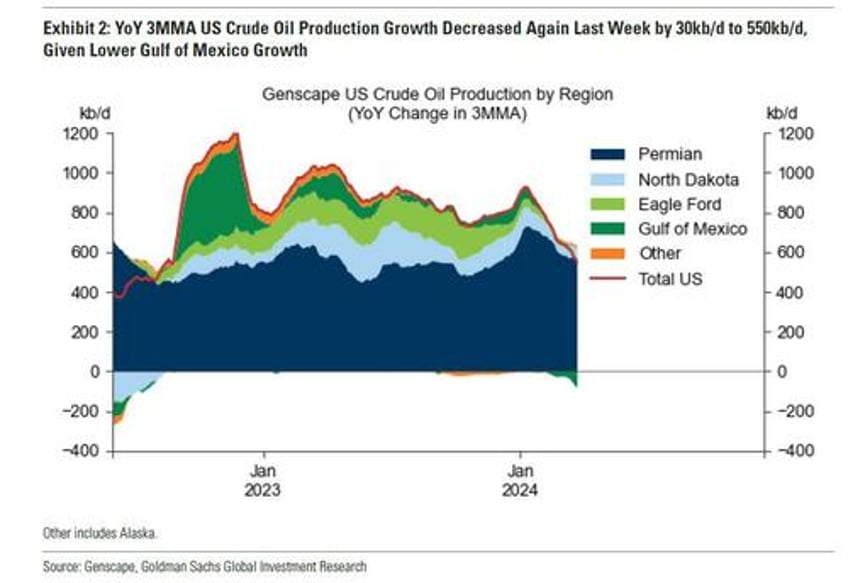

Overnight, in Goldman's weekly Oil Tracker note, the bank's commodity team showed in its "chart of the week" the striking observation that - at a time when everyone and their grandmother is expecting US oil production to keep rising while OPEC+ slashes its own - pipeline implied US L48 crude production has declined nearly 0.4mb/d since December to 12.6mb/d, with a 160kb/d week-on-week drop in Genscape data (14DMA). Furthermore, the 3-month moving average US crude production growth slowed to 550kb/d YoY, with softness in the Gulf of Mexico.

And just like that the biggest bear case brandished around by the oil bears crashed and burns.

Which is not to say that US shale production is about to crater to 0 and oil will hit $200 overnight: as Goldman writes in the report, other key trends of the week were mixed, with lower Russia production on the bullish side, but softness in Goldman's China demand nowcast and the crude basis, and the sharp rise in positioning on the bearish side.

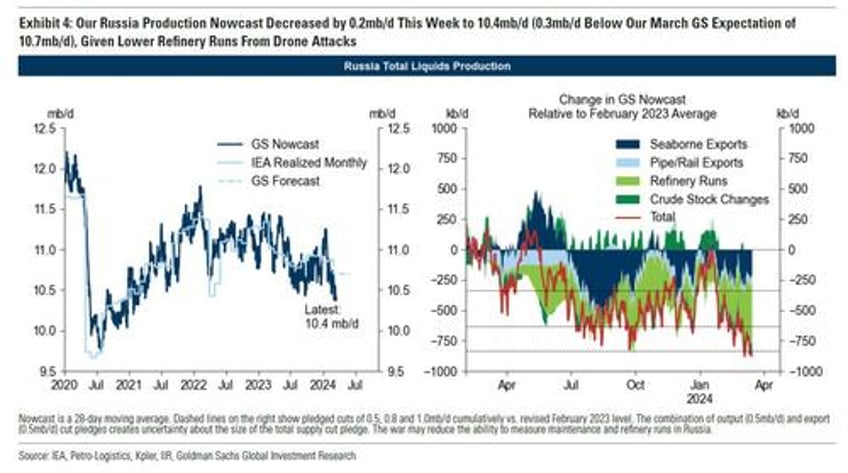

Before we turn on China, let's first take a closer look at what's taking place in Russia; Here Goldman notes that the bank's Russian liquids production nowcast slipped by 0.2mb/d this week to 10.4mb/d on lower refinery runs following drone attacks that continued over the weekend.

- Russian refinery runs decreased by 0.3mb/d since the first string of drone attacks on Russian refineries in January.

- Russian production is now roughly in line with the pledged cuts of 1mb/d from February 2023 average.

Speaking of the plunge in Russian refinery runs, last week we learned that none other than Joe Biden himself slammed Ukraine for daring to attack the heart of Russian oil infrastructure as the guaranteed outcome are much higher gas and oil prices, which make it less likely the Fed will be able to cut rates, and thus ensure that Biden's already abysmal approval rating will slide even further. No wonder the FT said that the "White House had grown increasingly frustrated by brazen Ukrainian drone attacks that have struck oil refineries, terminals, depots and storage facilities across western Russia, hurting its oil production capacity." An NSC spokesperson told the FT that "we do not encourage or enable attacks inside of Russia."

Translation: we encourage them not to attack Russian refineries.

But wait, there's more: not only did Rosneft halt the primary unite at its Kuibyshev oil refinery in Samara after the latest Ukraine drone attack, but sensing that Biden is suddenly extremely vulnerable to further Russian production cuts, Reuters reported this morning that Russia's government has ordered companies to reduce oil output in the second quarter.

While the stated reason is to ensure they meet a production target of 9 million barrels per day (bpd) by the end of June in line with its pledges to OPEC+, three industry sources said on Monday, Russia never before made a big stink about cheating on its OPEC+ promises, until now. Why? Because suddenly every incremental dollar in oil costs means Biden's approval rating drops by (at least) 1%.

And just like that, the fate of Biden's re-election is now in the hands of the two things he hates the most: US shale companies and Vladimir Putin... as is the price of oil and gas, and expect both to keep rising for the foreseeable future crushing any last hope Biden may have had of being re-elected.

Going back to the Goldman report, the bank next turns to China where it says that its oil demand nowcast remained soft week at 15.7mb/d, and adds that "the risks to our forecast of a 350kb/d deficit in Q2 are balanced as the misses in our US supply nowcast and our China demand nowcasts are roughly offsetting."

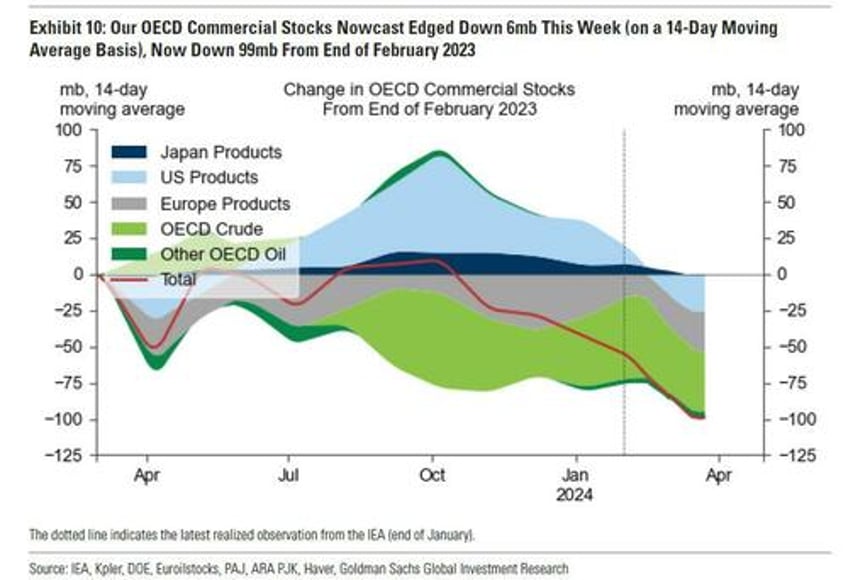

Finally, Goldman's OECD total oil landed commercial stocks nowcast — the key variable in the bank's crude pricing framework — remains about 19mb below its March expectations at 2,723mb.

More in the full Goldman note available to pro subscribers.