By Benjamin Picton of Rabobank

We're going to build a (tariff) wall...

Crude oil prices spiked on Friday evening following news that OPEC+ and Russia will extend production cuts through to June of this year. Brent closed 2% higher at $83.55/bbl, which means that prices have now risen by more than $6/bbl since the start of the year. Gold also caught a bid on Friday night to close the week at $2,082/ounce. This followed weaker than expected ISM survey data out on the United States that saw 2-year yields fall 9bps to 4.53% and the S&P500 hit fresh all-time-highs. Meanwhile, the Bitcoin surge continues apace after prices for ‘digital gold’ finished the week slightly above $62,500.

Judging from the price action last week, the everything rally remains resilient to the effects of monetary tightening. Have we sprung a monetary leak somewhere that is providing mysterious liquidity into markets? Or is this all just a huge lag effect as the Covid-era torrents of easy money continue to wash through the economy and the US deficit remains close to 6.5% of GDP?

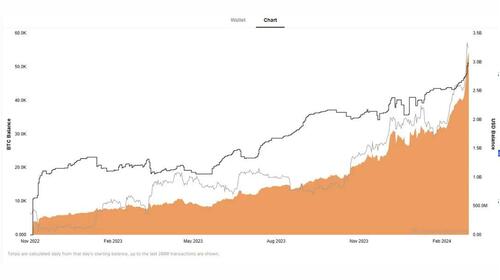

Whatever the case, some of the moves are very interesting. News has emerged of a crypto whale dubbed ‘Mr 100’ who has been quietly accumulating a $3.1bn stash of Bitcoin. Decrypt.co reports that the mysterious whale is unlikely to be US-domiciled, and unlikely to be one of the new Bitcoin ETF operators since those have already disclosed their blockchain addresses. Could a central bank somewhere be buying crypto assets?

There is plenty on the calendar this week for markets to digest, but of particular interest is the National Party Congress of the Chinese Communist Party. The meeting begins on Tuesday and will include an updated growth target for the Chinese economy. Last year’s ‘modest’ 5% target was exceeded by two-tenths of a percentage point after helpful base effects and data revisions helped the economy over the line. The speculation is that the CCP will again set 5% as the official goal, although our own China watcher, Teeuwe Mevissen, expects growth of just 4.6% in the Middle Kingdom this year.

In the United States we have the non-farm payrolls report at the end of the week, but on a longer view the possibility of universal tariffs will have much more structural bearing on who produces what and where, and for how much, and to be sold to who. This Daily last week canvased the possibility of outright bans on Chinese auto imports into the United States as the Biden White House attempts to outbid Donald Trump on America First protectionism. Trump’s threats of 10% universal tariffs, with tariffs of 60% or more on Chinese goods, would be certainly be a big structural change that, in our view, could reignite inflation. It also (by design) poses risks to the Chinese growth model.

With real-estate and infrastructure investment already reeling from heavy debt loads, a loss of confidence and Xi Xinping’s Common Prosperity initiatives to rein-in speculation on house prices, the China model will be even more reliant on production and exports. It’s worth asking the question whether that can still work in a world where the world’s biggest market is potentially slapping a 60% tax on your exports. Of course, Chinese goods could flow into other markets like Europe, but if the Trump tariffs are enacted it would take all of 5 minutes before European leaders follow suit in an effort to protect their own sputtering industry from Chinese competition.

So where does this leave China? The worst case would be massive oversupply, deflation and economic depression as China fails to escape the Middle Income Trap. The alternative might be economic reorganization away from a production-led economy toward a more balanced growth model that emphasises internal consumption. Such a reorganization would also start to address one of the major (but not the only) impediment to the adoption of CNY as a reserve currency: China’s enormous trade surplus, but it would stand at odds with Xi Xinping thought that sees consumerism as decadent and production as virtuous. That’s a vicious circle to square, but if it is to ever happen, we should expect to see early signs this week.

This week will be important for other reasons. We are now one week out from the date at which the Fed will cease issuing new loans under the BTFP program. Regular readers will remember that this was the liquidity facility put in place during the mini banking crisis last year. Under the terms of the program, the Fed accepts collateral from the banking system while paying out the par value (!) of the securities in cash. Questions remain over what will happen to US regional banks with a large share of commercial real estate loans on the balance sheet (many due for refinance shortly!) once the banking system can no longer pretend that those loans are not underwater.

It may be the case that the Fed had hoped that they would be cutting rates by now and the capitalisation rates on commercial real estate would look less bad as a result. Unfortunately, last week’s PCE data did little too further the case for imminent cuts. PCE rose by 0.3% in January, but if you move the decimal a couple of places it becomes obvious how close we came to a 0.4% reading instead. One Swallow does not make a summer, but the January PCE result marks a substantial acceleration compared to December, November and October. That’s despite being helped by lower fuel prices that are unlikely to be replicated in February. The +0.4% core reading was the highest since January of last year, and the +0.6% services ex housing and energy reading was the highest since December of 2021.

In Europe last week the inflation story was similar. Eurozone preliminary CPI for February rose at the fastest pace since April last year. It was up 0.6% m-o-m, which translates to a 2.6% y-o-y figure. That was a little below the 2.8% figure for January but higher than the consensus estimate of 2.5%. The core reading printed at 3.1% versus an analyst consensus of 2.9%. So the direction is right, but progress is slow, and as our Head of Macro Research, Elwin de Groot, pointed out in a piece last week, the Red Sea shipping disruptions could pose a substantial upside risk to Eurozone price pressures.

So, for the moment at least we have encountered a bump in the road back to low and stable inflation. Central banks ought to be cognizant of the risks in cutting rates while loads of asset classes are already making new highs every other day, and the spectre of geopolitics looms as a potential spoiler for markets that think only in terms of free-flowing trade and capital. In a world of rapid change, the ability to think outside accepted paradigms is becoming more and more important.