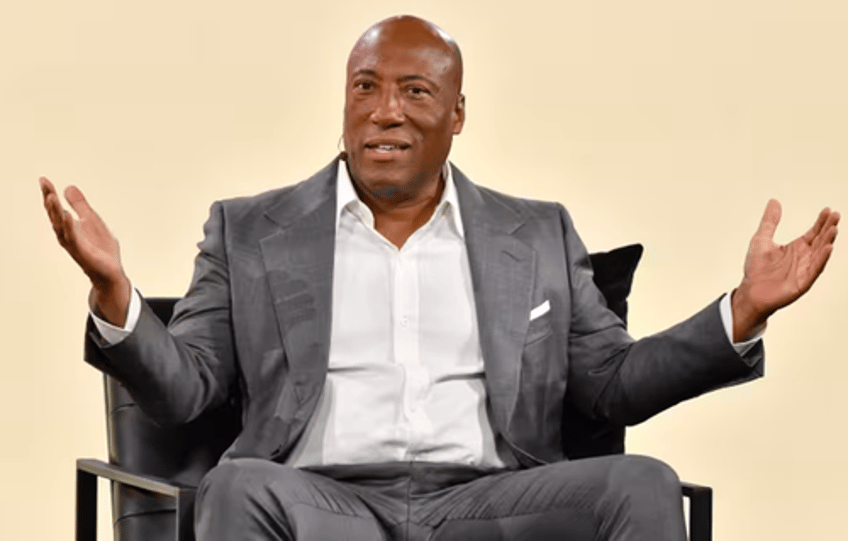

Paramount Global Class B shares rocketed higher in premarket trading after a report from Bloomberg specified media mogul Byron Allen offered $14.3 billion to purchase all of Paramount Global's outstanding shares.

The report, citing "people familiar with the terms," said Allen offered $28.58 for each voting shares of Paramount, a 50% premium versus non-voting shares. Including debt, the deal's total value is worth about $30 billion.

Around 0700 ET, Paramount's non-voting shares jumped 17% and soared as high as 22% earlier this morning. If the gains hold into the cash session, this would be the largest intraday move for the stock since March 2020.

Bloomberg confirmed with Allen's firm, Allen Media Group, that the centimillionaire (near billionaire) made an offer:

"This $30 billion offer, which includes debt and equity, is the best solution for all of the Paramount Global shareholders, and the bid should be taken seriously and pursued," Allen's company said in the statement.

People familiar with the deal said Allen plans to sell the Paramount film studio, real estate, and other intellectual property. He wants to keep TV channels, including the Paramount+ streaming service, but the people did not explain why.

Paramount owns major brands, including CBS, Showtime Networks, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, Paramount+, and Pluto TV.

Bloomberg noted Allen "sent Walt Disney Co. Chief Executive Officer Bob Iger a text offering $10 billion, albeit tentatively, for Disney's flagship ABC broadcast network as well as the FX and National Geographic cable channels. Iger, who had previously suggested he'd considered offers, later said he didn't want to sell."

It's unclear what Allen's precise plan is. He seems to be focusing on either media entertainment outlets or news stations. The coincidence of his offer with the beginning of the presidential election cycle might hint at his intentions.