Trying to break this report down on live TV was quite easy.

Everything pointed to strength.

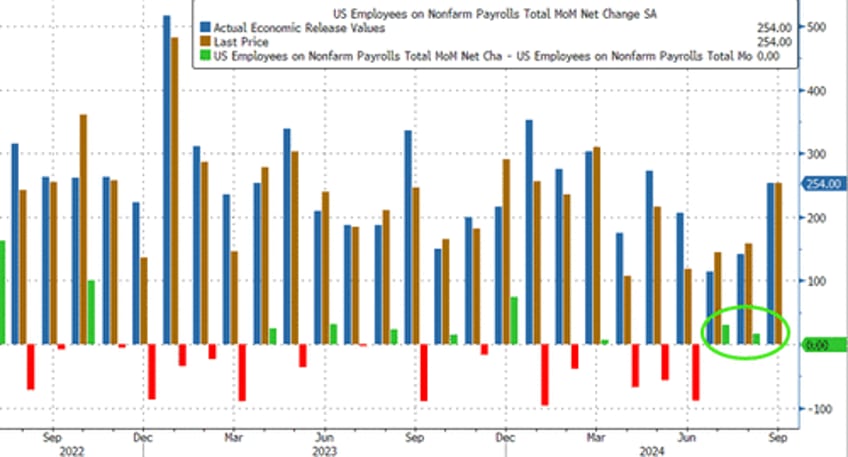

Total jobs great!

The beat was entirely in the private sector, which is where we want to see the jobs created.

UPWARD revisions.

A substantial positive revision is good.

I think it helps confirm my view that the BLS has adjusted their models and aren’t consistently overstating jobs like they were.

I continue to believe seasonal adjustments are off.

Overstating winter jobs and understating summer jobs. This report seems consistent with that.

Upward pressure on wages, and an unemployment number of 4.052% (almost got rounded down to 4%) will give the fed some pause.

Bottom line

Higher yields.

Look for 10s to breach 4% as we head into auctions.

Higher for longer.

Fed cuts should be slower and I continue to think (and the data supports it) that the current neutral rate is well above 3% (economy chugging along on 5% yields for over a year)

I’d fade the initial joy in equity land.