Another day, another sentiment survey collapsing into the abyss of Trump-Tariff-driven hell...

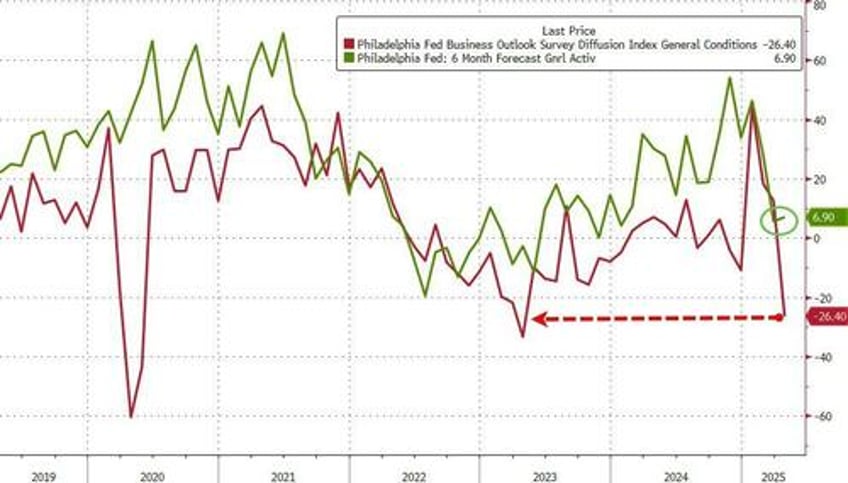

The Philly Fed Manufacturing Business Outlook survey crashed from +12.5 to -26.4 in April (+2.2 exp) - its weakest in two years. However, quietly, the 6-month forward outlook remained positive and actually improved...

The index for new orders also fell sharply, from 8.7 in March to -34.2 this month, its lowest reading since April 2020, and the prices paid index edged up from 48.3 to 51.0, its highest reading since July 2022

Smells a little stagflationary to us.

The future prices paid index climbed to 63.1, and the future prices received index jumped 28 points to 67.7, its highest reading since June 2021.

Finally, the gap between strengthening 'hard' data and collapsing 'soft' data continues to grow...

Will this be a replay of Q2 2024 - when the hard data 'caught down' to soft data? Or Q3 2023 where the sentiment surveys snapped higher as the hard data refused to fold?