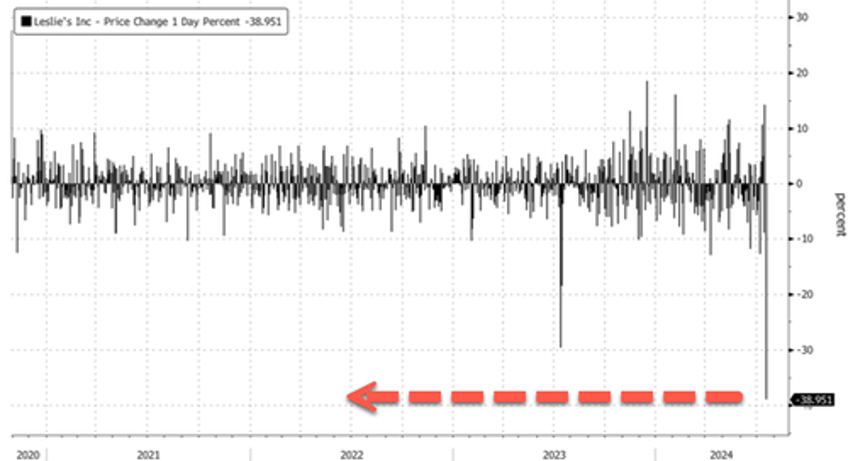

Leslie's shares crashed as much as 38% in the early US cash session after the swimming pool supplies retailer announced preliminary third-quarter results that missed the average analysts tracked by Bloomberg and slashed its full-year forecast on continuing consumer weakness.

Here's a snapshot of the preliminary third-quarter results (courtesy of Bloomberg):

Prelim sales about $570 million, estimate $614.6 million (Bloomberg Consensus)

Prelim adjusted EPS 32c to 33c, estimate 42c

Prelim adjusted Ebitda $108 million to $109 million, estimate $131.2 million

"Considering these preliminary results and expectations for the fourth quarter of fiscal 2024, the Company is revising its full year fiscal 2024 outlook," Leslie's wrote in a statement.

Here's a breakdown of the revised full-year fiscal 2024 outlook:

Sees sales $1.32 billion to $1.35 billion, saw $1.41 billion to $1.47 billion, estimate $1.42 billion (Bloomberg Consensus)

Sees adjusted Ebitda $117 million to $131 million, saw $170 million to $190 million

Sees adjusted EPS 3.0c to 9.0c, saw 25c to 33c, estimate 28c

Mike Egeck, CEO, explained that the "cold and wet spring weather" during the quarter "reduced the number of pool days in non-seasonal markets and delayed the start of pool season in seasonal markets."

This is key:

"We also continued to see weakness in large ticket discretionary categories as persistent inflation and high interest rates pressure pool owners' wallets," Egeck said.

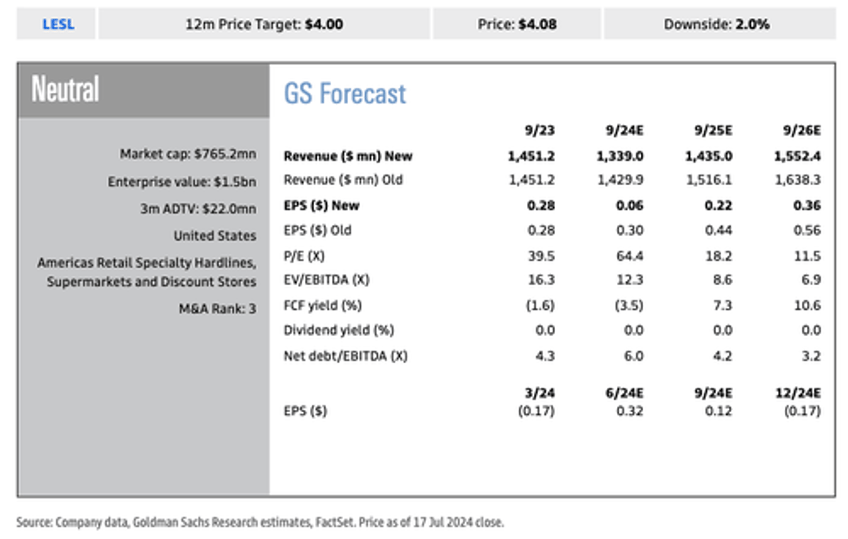

Goldman analyst Kate McShane told clients this morning that after the company's dismal preliminary results, their price target has been cut to $4, down from $5.

"LESL management pre-announced its Q3 results AMC on 7/17 as a result of wetter weather and ongoing weakness in demand for big ticket items. We have lowered our FY24, FY25 and FY26 EPS estimates as a result. Our target price is now $4 (down from $5)," McShane said.

She said, "We remain Neutral on LESL as the company works through a normalization of demand post COVID."

Here's a breakdown of McShane's report to clients:

Q3 preannouncement details - The Company expects preliminary sales for the fiscal third quarter of approximately $570 million (compared to FactSet consensus of $598mn). Gross profit is expected to be $228 to $229 million (compared to FactSet consensus of $245mn) and gross margin is expected to be approximately 40%. Net income is expected to be $56 to $58 million. Adjusted EBITDA is expected to be $108 to $109 million, adjusted net income is expected to be $59 to $60 million, and adjusted diluted earnings per share are expected to be $0.32 to $0.33 (compared to FactSet consensus of $0.39).

Full year guidance revised - The Company is also revising its full year fiscal 2024 outlook. Sales are now expected to be $1,321 to $1,347 million (down 7.4% at the mid point from original guidance), with gross profit now expected to be $483 to $499 million. Adjusted EBITDA is expected to be $117 to $131 million (down from original guidance of $170-$190m), and adjusted diluted earnings per share are expected to be $0.03 to $0.09 (down from original guidance of ($0.25-$0.33). The company expects to end the fiscal year with approximately 20% less inventory than at fiscal 2023 year-end and is expected to have more cash on hand at the end of the fiscal year compared to the end of fiscal 2023 (FY 23 cash was $55.4M).

Highlights of Q3; some data points showing signs of improvement - The guide for Q3 implies a SSS of ~-7%; a sequential improvement on both a one and two year stack basis (Q2 SSS was down 12.1%) driven by weaker equipment and larger ticket discretionary sales. However, sales trends improved throughout the quarter with June SSS ending -2%. Encouragingly, the company highlighted MSD growth in chemical sales in June (significantly improved from the down MSD growth in chemicals last quarter). Although trends improved in June, the company revised full year sales guidance at the mid point assumes Q3 trends continue through Q4, implying some conservatism, in our view.

She included upside and downside risks in her forecast:

Upside risks include better-than-expected demand, particularly for discretionary products; stronger margins, driven by stronger sales and leverage; favorable weather, contributing to stronger seasonal demand; stable and/or better-than-expected chemicals pricing; and a more significant reduction in leverage.

Downside risks include potentially sustained demand headwinds; if chemical price deflation is more than anticipated; promotional risk; lower-than-expected customer growth and retention; lower growth prospects if residential pools decrease in popularity; and execution risks.

Besides Goldman, here's what other Wall Street analysts are saying about the preliminary third-quarter results:

Piper Sandler (neutral)

- Analysts Peter Keith and Alexia Morgan say Leslie's seems to be "experiencing pressure from numerous angles," noting that each of the company's categories is trending toward y/y declines in 3Q and weak traffic in the residential channel

- PT cut to $3 from $6

Jefferies (hold)

- "Unfavorable weather continues to overshadow ongoing company efficiencies, as a cold and wet spring delayed the start to pool season '24 and weighed on F'3Q results," analyst Jonathan Matuszewski writes

- Notes weather improved in June along with the company's performance; updated guidance assumes 3Q trends remain steady in 4Q

- PT cut to $3.50 from $4

The gloomy outlook for swimming pool supply demand caused the company's shares to crash 38%.

Shares stumbled to a record low in New York.

This comes weeks after the world's largest wholesale distributor of swimming pools and related outdoor living products, Pool Corp., warned about "dampening discretionary spending" that only signals a broader consumer downturn.