- APAC stocks traded mostly higher as the region took impetus from the rally on Wall St in the aftermath of the soft-leaning US CPI data which boosted Fed rate cut bets and saw money market pricing of cuts for this year return to around pre-NFP levels.

- US official said a Gaza hostage and ceasefire deal was reached and will take effect on 19th January; the deal outlines a six-week initial ceasefire phase that includes a gradual withdrawal of Israeli forces from central Gaza and the return of displaced Palestinians to northern Gaza.

- Fed's Williams (voter) said he doesn’t see higher yields reflecting a big inflation view shift and is not surprised bond yields have risen; Fed's Goolsbee (2025 voter) said he still sees continued progress on inflation.

- BoJ is said to see a good chance of a January rate hike barring a major market rout following Trump's inauguration, according to Bloomberg citing several unnamed people.

- BoE's Taylor said he expects the underlying trend of inflation to remain on track towards the 2% target from now on and his base case on rate cuts is around 100bps this year.

- European equity futures indicate a flat cash market open with Euro Stoxx 50 futures U/C after the cash market gained 1.0% on Wednesday.

- Looking ahead, highlights include UK GDP, US Jobless Claims, Philly Fed Index & Retail Sales, ECB Minutes, NBP Policy Announcement, Treasury Secretary nomination hearing for Scott Bessent, Comments from BoC’s Gravelle, Supply from Spain & US, Earnings from Taylor Wimpey, Whitbread, Wise, Pearson, Richemont, TSMC, UnitedHealth, Bank of America, Morgan Stanley, USB, PNC & Infosys.

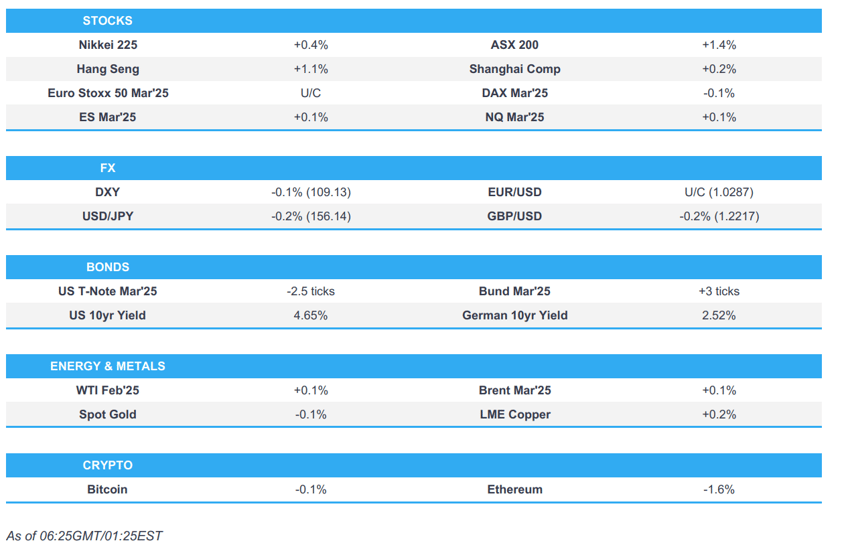

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks and bonds saw hefty bids in response to the soft-leaning US CPI report which resulted in participants boosting rate cut bets with ~40bps of easing now priced through year-end which is back to around pre-NFP levels.

- As such, nearly all sectors were underpinned with notable outperformance in the heavyweight industries such as tech, communications and discretionary, while financials also gained after the big banks kicked off earnings season.

- SPX +1.83% at 5,950, NDX +2.31% at 21,238, DJIA +1.65% at 43,222, RUT +1.99% at 2,263.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Williams (voter) is optimistic about the US productivity outlook and said the wildcard for a neutral rate view is much higher levels of debt, while he noted higher government debt may have lifted the neutral rate estimate. Williams said he doesn’t see higher yields reflecting a big inflation view shift and is not surprised bond yields have risen, while he added that term premia factors are a big part of rising yields and has no prediction when the balance sheet contraction will stop.

- Fed's Goolsbee (2025 voter) said he still sees continued progress on inflation and for the last 6 months, PCE inflation has run close to the 2% target. Furthermore, Goolsbee stated he is optimistic for 2025 regarding a soft landing but also noted a lot of uncertainties.

- Fed Beige Book stated economic activity increased slightly to moderately across the twelve Federal Reserve Districts in late November and December, while consumer spending moved up moderately with most Districts reporting strong holiday sales that exceeded expectations.

- US President Biden said in his farewell address that he wishes the Trump administration success and is concerned about a dangerous concentration of power in the hands of a few wealthy people, while he added that excessive wealth threatens democracy. Biden is also concerned about the tech industrial complex and said Americans are buried in disinformation and free press is crumbling. Furthermore, he said AI needs safeguards and that they must make AI safe and trustworthy, as well as noted that America must lead on AI, not China.

- US Treasury Secretary Yellen said a duplicative agency doesn't seem like a good step to save money for taxpayers when asked about Trump's plan for an 'external revenue service', while she said Trump's plan to impose new tariffs will raise costs for US goods and services.

- US Treasury Secretary nominee Bessent said in prepared remarks ahead of his Senate testimony that sanctions must be part of a whole government approach, and they must ensure the dollar remains the world's reserve currency. Bessent also stated that the US must secure supply chains vulnerable to strategic competitors and the US must carefully deploy sanctions as part of a government-wide approach to address national security requirements. Furthermore, he said Trump has a generational opportunity to unleash a 'new economic golden age' with more jobs, wealth, and prosperity for Americans.

- US House Speaker Johnson said one bill strategy makes sense, while he added that they will pass the budget and target by late February.

- Outgoing Canadian PM Trudeau said Canada will respond forcefully if the US imposes tariffs but added that they do not even know whether US President-elect Trump will impose tariffs and therefore they don't know what their response would be. Furthermore, reports noted that Canada could impose countermeasures on up to CAD 150bln worth of imports from the US if the Trump administration slaps tariffs on Canadian imports, although Canada won't necessarily impose the countermeasures and would carry out public consultations first, while the proposed Canadian countermeasures would be divided into three groups and Florida orange juice would be targeted immediately.

- Hindenburg Research founder Nate Anderson announced the decision to disband Hindenburg Research.

APAC TRADE

EQUITIES

- APAC stocks traded mostly higher as the region took impetus from the rally on Wall St in the aftermath of the soft-leaning US CPI data which boosted Fed rate cut bets and saw money market pricing of cuts for this year return to around pre-NFP levels.

- ASX 200 advanced at the open with outperformance in tech and financials although miners lagged with Rio Tinto shares indecisive after its quarterly update.

- Nikkei 225 gained but was well off today's best levels amid a firmer currency and the risk of a potential BoJ rate hike next week.

- Hang Seng and Shanghai Comp were choppy and initially boosted after the PBoC continued with its liquidity efforts and with analysts suggesting the PBoC could lower RRR ahead of the Chinese New Year later this month, although the gains in the mainland were then pared amid lingering trade frictions after the US strengthened restrictions on advanced computing semiconductors to prevent diversion to China. Indices then resumed to the upside heading into the European open.

- US equity futures traded little changed but held on to the prior day's post-CPI spoils.

- European equity futures indicate a flat cash market open with Euro Stoxx 50 futures U/C after the cash market gained 1.0% on Wednesday.

FX

- DXY traded rangebound after weakening yesterday on the softer-than-expected Core CPI data which resulted in a brief dip beneath the 109.00 level before recovering off lows, while the latest Fed commentary provided little to shift the dial and participants now await US Retail Sales, Jobless Claims and Philly Fed Index.

- EUR/USD lacked direction with the single currency capped by resistance at the 1.0300 level heading into the ECB Minutes due later.

- GBP/USD was lacklustre after the prior day's whipsawing and failure to sustain a brief return to 1.2300 territory, with monthly UK GDP data eyed next.

- USD/JPY trickled lower amid BoJ rate hike risk with money markets pricing around an 84% chance of a 25bps hike at next week's meeting, while a Bloomberg article also noted the BoJ is said to see a good chance of a January rate hike barring a major market rout following Trump inauguration.

- Antipodeans gradually weakened with AUD/USD on the backfoot despite stronger-than-expected jobs data in which Employment Change for December topped forecasts at 56.3k (exp. 15.0k) although this was influenced by seasonal factors and was solely fuelled by Part-Time employment as Full-Time jobs contracted.

- PBoC set USD/CNY mid-point at 7.1881 vs exp. 7.3247 (prev. 7.1883).

FIXED INCOME

- 10yr UST futures plateaued after surging on the CPI data which boosted Fed rate cut bets with money markets pricing around 40bps of cuts this year.

- Bund futures took a breather after surging above the 131.00 level in tandem with the gains in US counterparts.

- 10yr JGB futures tracked the gains in peers with the help of inline/softer-than-expected PPI and a strong 20yr JGB auction.

COMMODITIES

- Crude futures held on to the prior day's spoil with WTI above USD 80/bbl after recent dollar weakness post-CPI and amid the constructive risk tone.

- US President-elect Trump is to abolish the requirement for some LNG export permit renewals, according to Reuters sources.

- Falling Ukrainian drones triggered a fire at an oil storage facility in Russia's southern Voronezh region although no casualties were reported, according to Reuters citing the regional governor.

- Spot gold remained afloat and tested the USD 2,700/oz level to the upside in the aftermath of the soft-leaning US inflation data.

- Copper futures were mildly underpinned amid the broad constructive mood across global markets.

CRYPTO

- Bitcoin mildly pulled back overnight following the prior day's rally and brief reclaim of the USD 100k status.

NOTABLE ASIA-PAC HEADLINES

- PBoC might cut RRR before the Lunar New Year this month, according to analysts cited by Shanghai Securities News.

- BoJ Governor Ueda reiterated they will raise the policy rate this year if economic and price conditions continue to improve, while he added how to proceed with monetary policy adjustment will depend on economic, price, and financial conditions at the time. Ueda also commented that the new US administration's policy outlook and domestic wage negotiations are key factors in the policy decision, as well as repeated that they will debate at next week's meeting whether to hike rates.

- BoJ is said to see a good chance of a January rate hike barring a major market rout following Trump's inauguration, according to Bloomberg citing several unnamed people.

- Reuters poll showed nearly two-thirds of 32 economists expect the BoJ to hike rates at next week's meeting with 59 of 61 expecting the key rate to be at 0.50% by end-March, while two-thirds of 21 economists expect Japanese authorities to intervene in FX if yen weakens to 165 vs the dollar and the Japan rate of pay increase in labour talks this year is seen at 4.75% (prev. 4.70% in December poll).

- BoK maintained its base rate at 3.0% (exp. 25bps cut) with the decision not unanimous as board member Shin dissented and wanted a cut, while it announced to expand the cap on the temporary special loan for small to medium businesses to KRW 14tln. BoK said it will determine the timing and pace of any further base rate cuts to mitigate downside risks to economic growth, as well as noted that South Korean consumption weakened, construction investment has been sluggish and economic growth is to slow. BoK Governor Rhee said the need for further cuts is higher now that downside risks to economic growth have heightened and all board members said a rate cut would be necessary but took consideration of dollar-won FX rates fluctuating due to political turmoil. Rhee also stated that six board members said they are open to rate cuts in the three-month ahead window, while Rhee noted it would be appropriate to wait until domestic political turmoil stabilises, and some certainty comes from the new US administration before changing policies. Furthermore, Rhee said Thursday's rate decision was not because dollar-won rates are at a certain level, but because political uncertainties have been impacting the FX rates.

DATA RECAP

- Japanese Corp Goods Price MM (Dec) 0.3% vs. Exp. 0.4% (Prev. 0.3%)

- Japanese Corp Goods Price YY (Dec) 3.8% vs. Exp. 3.8% (Prev. 3.7%, Rev. 3.8%)

- Australian Employment (Dec) 56.3k vs. Exp. 15.0k (Prev. 35.6k)

- Australian Full Time Employment (Dec) -23.7k (Prev. 52.6k)

- Australian Unemployment Rate (Dec) 4.0% vs. Exp. 4.0% (Prev. 3.9%)

- Australian Participation Rate (Dec) 67.1% vs. Exp. 67.0% (Prev. 67.0%)

GEOPOLITICS

MIDDLE EAST

- US official said a Gaza hostage and ceasefire deal was reached, while US President-elect Trump commented on Truth Social that they have a deal for hostages in the Middle East and they will be released shortly. Furthermore, Qatar’s PM also stated that a ceasefire deal in Gaza has been reached and will take effect on 19th January.

- Israel-Hamas deal outlines a six-week initial ceasefire phase that includes a gradual withdrawal of Israeli forces from central Gaza and the return of displaced Palestinians to northern Gaza. Hamas will release 33 Israeli hostages, including all women, children and men over 50, while the total number of Palestinians released will depend on the hostages released and could be between 990-1,650. Furthermore, negotiations over the second phase of the agreement will start by the 16th day of phase one and is expected to include the release of all remaining hostages.

- Israeli PM Netanyahu thanked US President-elect Trump for help in the Gaza deal and they agreed to meet in Washington soon, while he also spoke with US President Biden and thanked him for help in the hostages deal. However, it was separately reported that Israeli PM Netanyahu's office said they are working on the final details of a Gaza agreement, according to AP. Yedioth Ahronoth also reported that the Israeli negotiating team will remain in Doha to complete talks, according to Asharq News.

- Israel reportedly conducted violent raids on Gaza City, according to Al Arabiya.

RUSSIA-UKRAINE

- Ukrainian President Zelensky sees a higher likelihood for the war to end in 2025.

- UK and Ukraine are to sign a historic partnership as UK PM Starmer travels to Ukraine to meet President Zelensky, according to Downing Street.

- Russian Defence Ministry said it successfully hit a large underground gas storage area in Stryi in western Ukraine, while it added that attacks on energy infrastructure were responses to Ukrainian strikes using Western weapons on the Krasnodar region and TurkStream pipeline.

EU/UK

NOTABLE HEADLINES

- BoE's Taylor said his view is the risks around inflation have shifted in the last 12 months and that inflation moderated faster than expected in 2024, while he would expect the underlying trend of inflation to remain on track towards the 2% target from now on and his base case on rate cuts is around 100bps this year. Taylor also stated that a rise in gilt yields does not make things easier and that it is a headwind for the economy.

- ECB's Centeno said the interest rate will continue on a trajectory ideally towards values close to 2%.

DATA RECAP

- UK RICS House Price Balance (Dec) 28% vs. Exp. 28% (Prev. 25%)