By Bas van Geffen, Senior Macro Strategist at Rabobank

Yesterday, we discussed one potential chain reaction that could result from a further escalation of the Israel-Hamas war. But the conflict could spark more subtle chain reactions elsewhere too.

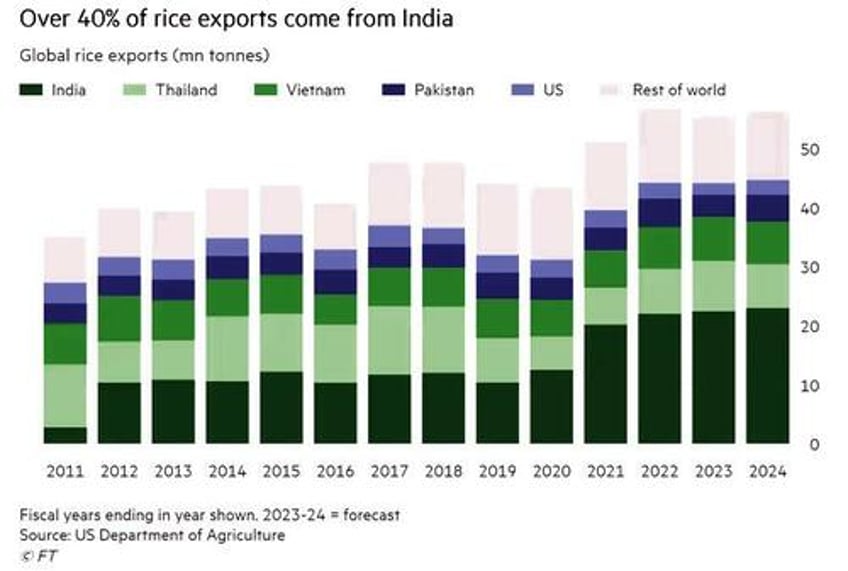

The Financial Times reported yesterday that rice is becoming unaffordable in various countries that rely heavily on the grain. The cause is an export ban in India, which accounts for 40% of global exports, that has been in effect since September last year. These restrictions originally targeted specific types of rice, but they have since been expanded. And variants that aren’t subject to the export ban yet, now come with a minimum sale price or tariffs.

Some are hoping that a better-than-expected harvest may lead to an easing of these restrictions. But fears that El Niño could lead to poor yields next year may make the Indian government reluctant to lift the export controls. As the FT notes, food prices are a key point for Prime Minister Modi into the upcoming election cycle. This sparks concerns that we could see a repeat of the 2008 rice crisis, and potential unrest in countries that rely heavily on imports of the staple.

The potential for another rice crisis should not be seen in a vacuum: the odds that this repeats are, to some degree, tied to the developments in the Middle East – and more particularly to the risks of another shock to global energy prices. Higher energy prices would first and foremost give the Indian government yet another reason to maintain the export ban, in order to limit the impact on households’ finances. However, that would deal a double blow to consumers in rice importing countries, who will then have to face both higher energy and higher food costs – with weaker currencies likely only adding insult to injury.

While the Middle East is in turmoil, legislation in the US Congress is frozen as the Republicans are still trying to agree on a candidate for the House Speakership. The remaining candidate, Jim Jordan, dropped out on Friday after he lost a third vote for support. In fact, he lost more Republican backing in each subsequent round of voting. On Friday, only 194 Republicans supported him and 25 defected. Since Republicans only have a small 221-212 majority in the House of Representatives, Jordan could afford to lose only 4 votes from his own party. All Democrats are voting in favor of their leader Hakeem Jeffries.

With Jim Jordan out of the race, nine Republicans jumped into it this weekend. After presenting themselves on Monday, Republicans are expected to take an internal vote on Tuesday. Subsequently, the winner will have to run against the Democratic Minority Leader in a vote on the House floor. The best known Republican candidates are Tom Emmer, Kevin Hern, Byron Donalds and Pete Sessions. Emmer is the Majority Whip, the number three House Republican in case there is a Republican House Speaker. His candidacy is endorsed by ousted House Speaker McCarthy. Hern leads the conservative Republican Study Group and considered entering the earlier race between Scalise and Jordan after McCarthy was deposed. However, in order to speed up the process he decided to stay out it. Donalds is a first time Congressman, with ties to Donald Trump. And Sessions has been in Congress since 1996. Other candidates are Mike Johnson, Jack Bergman, Austin Scott, Dan Meuser and Gary Palmer. As long as there is no House Speaker, urgent legislation on support for Israel and Ukraine, and avoiding a government shutdown after November 17, cannot proceed.

Meanwhile, the Bank of Japan still seems to pretending that things can go back to normal. The central bank announced another unscheduled bond buying operation today, after 10-year JGB yields surpassed 0.85%. This is the fifth unscheduled operation since Governor Ueda announced a softening of the bounds of the BoJ’s yield curve control policy. The intervention comes days after Nikkei reported that policymakers may implement further changes to the policy – possibly widening the tolerance band for yields even further – as early as next week.

Policymakers maintain that the earlier tweaks to the policy were merely for operational efficiency and should not be seen as policy tightening – even though they effectively allowed yields to rise. And, indeed, the timing of reported upcoming changes to YCC is remarkable: last week the national CPI print came in stronger than expected, and today’s PMI report indicated that price pressures remain elevated. Even if policymakers were to maintain a similar narrative next time, the optics are certainly against them.

The BoJ is walking on eggshells as it carefully removes itself from the bond market. The Japanese central bank is far from the only one facing difficulties withdrawing its support measures. As the ECB explores ways to shrink its balance sheet, higher yields are already causing some concern about potential debt sustainability issues. Although Eurozone spreads are still lower than they have been in the past, they are now measured against a much higher Bund yield. So when looking at outright levels, Italian BTP yields have already traded above 5% last week.

Likewise, removal of Fed stimulus is now occurring at a time when markets have to absorb increased Treasury issuance. US Treasury yields also briefly breached the 5%-level yesterday, before some key market players announced that they believe the rout was overdone and that they had closed their short positions.