Following yesterday's reported re-ignition in consumer price inflation (despite people seemingly being exuberant that it was 'as expected' - we don't remember The Fed's mandate being stable prices in line with consensus expectations?), this morning's producer prices were expected to accelerate further also to +2.6% YoY from +2.4% YoY.

But it didn't...

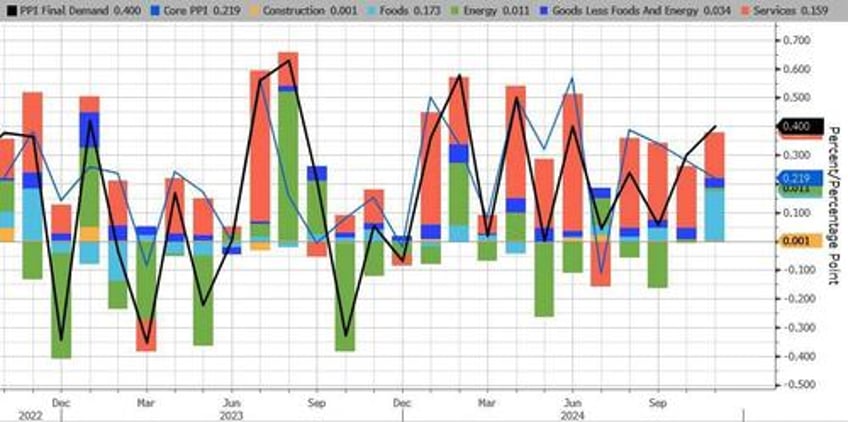

Headline PPI surged 0.4% MoM (+0.2% MoM exp) - biggest MoM jump since June - which lifted the YoY rise in producer prices to +3.0% - far above expectations and the highest since Feb 2023...

Source: Bloomberg

Headline PPI's big jump was driven by food costs (rising at their fastest since Nov 2022)...

Source: Bloomberg

Core PPI (ex-food and energy) rose 0.2% MoM as expected but the YoY core PPI jumped dramatically to +3.4% YoY - also the hottest since Feb 2023...

Source: Bloomberg

Does that look like an inflationary backdrop that needs a rate-cut next week?

Developing...