After a mixed (to hotter than expected) CPI, this morning's Producer Prices also surprised to the upside with headline PPI rose 0.2% MoM (vs +0.1% MoM exp). This did push the YoY PPI down to +1.7% (the lowest since Feb)...

Source: Bloomberg

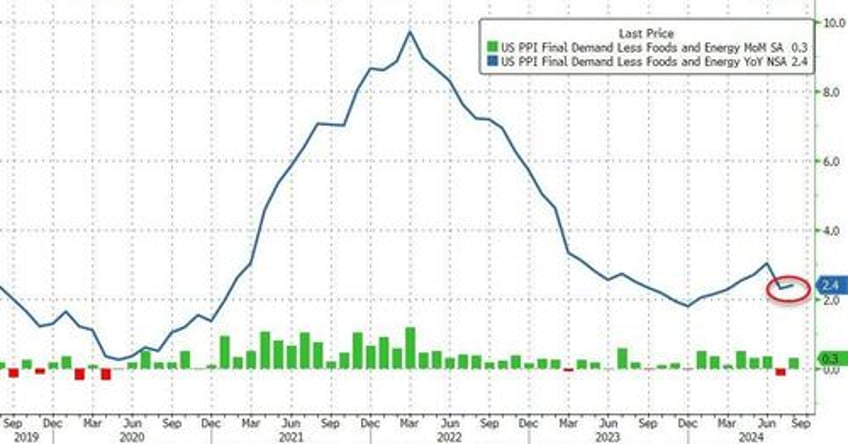

Core PPI rose 0.3% MoM (also hotter than expected) with YoY core PPI re-accelerating...

Source: Bloomberg

Final demand services:

Prices for final demand services rose 0.4 percent in August after declining 0.3 percent in July. Nearly 60 percent of the increase is attributable to a 0.3-percent advance in the index for final demand services less trade, transportation, and warehousing.

Product detail:

- A 4.8-percent rise in the index for guestroom rental was a major factor in the August advance in prices for final demand services.

- The indexes for machinery and vehicle wholesaling, automotive fuels and lubricants retailing, residential real estate loans (partial), professional and commercial equipment wholesaling, and furniture retailing also moved higher.

- Conversely, prices for airline passenger services fell 0.8 percent.

- The indexes for food and alcohol retailing and for membership dues, admissions, and recreational facility use fees (partial) also decreased.

Final demand goods:

Prices for final demand goods were unchanged in August after rising 0.6 percent in July. In August, the indexes for final demand goods less foods and energy and for final demand foods advanced 0.2 percent and 0.1 percent, respectively. In contrast, prices for final demand energy fell 0.9 percent.

Product detail:

In August, the index for non-electronic cigarettes increased 2.3 percent.

Prices for chicken eggs, gasoline, diesel fuel, and drugs and pharmaceuticals also moved up.

Conversely, the index for jet fuel decreased 10.5 percent. Prices for meats; electric power; hay, hayseeds, and oilseeds; and nonferrous scrap also declined

Not a pretty picture for a dovish Fed to defend.

Developing...