By Sagarika Jaisinghan, Bloomberg markets live reporter and strategist

Corporate earnings were supposed to be the panacea for global stocks nursing a wipe-out of $8.5 trillion in less than three months. Instead, investors find they’re yet another pain point that have made a year-end rally even more elusive.

The MSCI All-Country World Index is down 3.5% since US banks kicked off the third-quarter reporting season in mid-October, bringing total declines since a July peak to more than 10%. While a surge in US bond yields and the war between Israel and Hamas are partly to blame, US and European earnings also have proved disappointing as companies warned of still-high costs and — crucially — slowing consumer demand.

“Earnings are not providing the spark of excitement that we have seen in some previous quarters,” said Paul de La Baume, investment advisor at BNP Paribas (Suisse) SA. “Investors are becoming much more selective, and it is also a reflection of Big Tech stocks having largely rebounded this year despite reasonably poor macro-outlook globally.”

Expectations were indeed high from the US tech behemoths Meta Platforms Inc, Alphabet Inc., Microsoft Corp., Amazon.com Inc., Tesla Inc., Apple Inc. and Nvidia Corp. — dubbed the “Magnificent Seven” after they led a 45% rally in the Nasdaq 100 this year. UBS Global Wealth Management said the group was estimated to show earnings growth of 30% going into the season, far above the “mid-single digits” expected from the rest of the S&P 500.

But shares of Google parent Alphabet and Facebook owner Meta slumped as they warned of weakness in cloud sales and advertising demand, respectively. Amazon.com is up next, with the fate of a $400 billion rally in its stock resting upon the performance of its cloud business.

In Europe, too, investors have faced a deluge of disappointing earnings as companies ranging from Worldline SA to Unilever Plc and Mercedes-Benz Group AG signaled bleaker consumer demand. The benchmark Stoxx Europe 600 Index is on the verge of erasing its 2023 gain after declining for three straight months.

“Earnings concerns are being heard loud and clear as managements often talk about margin pressures, rising costs and falling demand,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets.

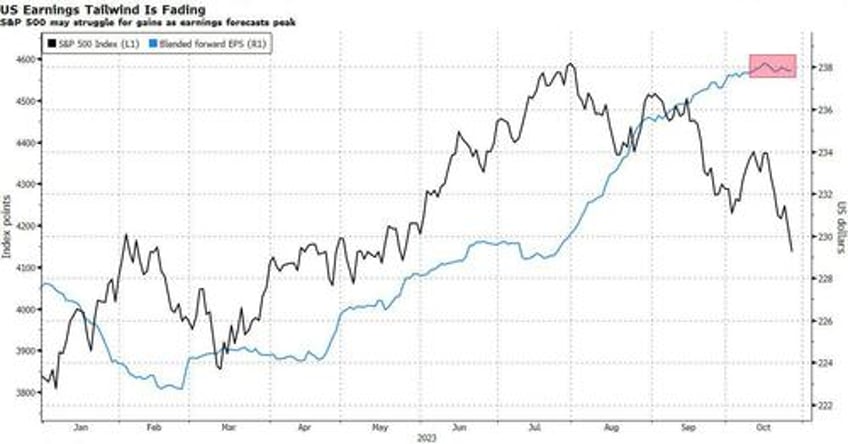

That’s also started to show up in global earnings estimates, with analysts lowering their predictions more than they’ve been raising them for six straight weeks. US profit projections for 2024 are also flat-lining after rising to a near-record earlier this year.

It’s not all bad news. More than 80% of the US companies that reported so far have exceeded expectations, UBS Wealth said. And data compiled by Bloomberg Intelligence show Corporate America is set to end a profit recession sooner than expected, with earnings-per-share on a pace to rise 0.4% for the third quarter. Going into the earnings season, analysts had estimated a decline of 1.2%.

But as a US bond yield at 5% reduces the appeal of riskier equities and concern lingers about a possible recession, market participants are finding value in other asset classes, reducing the odds of a year-end rally in stocks.

“We consider bonds as our preferred asset class, while US equities are rated least preferred,” said Mark Haefele, chief investment officer at UBS Wealth.